Today I tell you what acceptable rents are and what you should consider when renting a place in Switzerland. tl;dr: Never ever spend more than 30% of your net salary otherwise you’re being ripped off.

Basic recommendations

There are some simple rules when it comes to renting a place in Switzerland:

- One Third: Never spend more than 33% of your net income (after 2nd Pillar and AHV/IV contributions) on your apartment. Not even if you can live right next to the city center.

- City center premium: Obviously the closer in the city center the apartment is located the more expensive it is. However think twice if a 2.5 room apartment with 50sqm for 2000+ CHF is a good deal (hint: it’s not!). The more outside of the city centers you go the more affordable flats should become.

- The room thing: In Switzerland we count rooms in apartments, that includes living rooms and bed rooms and office rooms but excludes bathrooms. A 2 room apartment will have 2 bed rooms and a bath room. An additional 0.5 rooms is added when one can eat in the kitchen (e.g. open space) or if a room is exceptionally big. A loft with one big room and a bathroom would be considered a 1.5 room apartment. We do NOT count bed rooms like the US (e.g. a 2 bed room apartment in the US in Switzerland would be a 3 or 3.5 room apartment). Also popular is the livable/usable space which is stated as square meters (often m² or sqm).

- How big?: Depends a bit on you, general rule of thumb can be 50sqm per person in the household. With kids needing a bit less space (but their own room ideally).

- Price per sqm: Anything below 20 CHF per sqm can be considered cheap. Anything above 25 CHF is rather expensive. Also consider the canton and the tax implications (e.g. Zug -> low tax, high rents / Zurich -> high tax, high rents).

Examples from Mr. Cheese

I lived in 3 apartments so far outside from my parents house:

The old block apartment (2010 – 2014)

My first own apartment was a 70sqm, 3 room apartment in Lucerne. It was located in a row apartment building (Reihenmehrfamilienhaus) with 3 identical buildings next to each other. The building was from the 70ies and it had rather old floors (loud ones…) but the kitchen and the bathroom were freshly renovated. The starting rent was 1300 CHF including side costs. It was 20mins walk away from the Lucerne main station and 5 mins away from a smaller Migros store and a bus station. Over the years I did get several rent reductions due to the reduction of the reference interest rate and at the end in 2014 I think I paid around 1220 CHF (incl. side costs). Since it was located right next to one of the telecom company distribution buildings it also was one of the first apartments to get FTTH. I was one of the first people in Switzerland who got 1 GBit/s internet! But I get side tracked.

The apartment also came with a cellar space and a roof storage area (another 20sqm not counted to the 70sqm).

Downsides of the apartment were certainly the somewhat thin walls and noisy floors. I also had upstairs neighbors who liked to let kids play with marbles on the floor… please don’t. I also had one case of mold mostly due to me not venting the apartment enough in the winter. And right when I moved in one of the radiators was leaking, however that was replaced quickly.

The newly built Minergie apartment (2014 – 2017)

No picture/floorplan of this one unfortunately 🙁

My second apartment was a 164sqm, 5.5 room apartment in Central Switzerland (Obwalden). It was located in a freshly built neighborhood and we were the first tenants to move in. It was huuuuuge, I moved there with my girlfriend of that time and we used the extra rooms as: dedicated office room (one for me, one for her) and a guest room. Plus a spacious living/diningroom and the kitchen combined (see the 0.5 added? 😉 ). It came also with 2 parking spots and was all in all 3000 CHF (incl. side costs). It was built according to the Swiss Minergie standard which mandates that a building has to be very well insulated and it had an active air flow system. It also had a huge cellar room of around 30sqm and a 65sqm balcony on which we hosted several great barbeques.

The active air flow system was a bit of a down side to be honest as it made the air in Winter very very dry giving me some regular nose bleeding. Also the insulation according to the Minergie standard caused the apartment to get very very warm in Summer. When there were high temperatures outside for several days the apartment temperature wouldn’t fall under 28°C anymore. Which makes sleeping rather difficult.

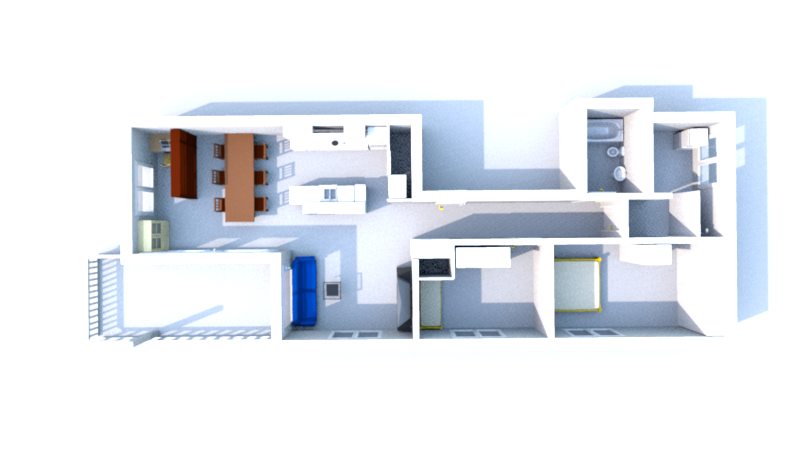

My current owned newly built apartment (2017 – )

My current apartment is a 110sqm, 3.5 room apartment in the canton of Zug. Purchased for 850’000 CHF in 2017. I already somewhat excessively wrote about it in the “7 things I wished I knew before I bought/built my apartment and 6 things I would do again” post. An apartment with the same floor plan next door was rented out for 2800 CHF in 2018 (including one parking spot). The same apartment would today probably go for around 3000 CHF (incl. side costs), especially mine since it’s a Smart Home and has a somewhat high build out standard (e.g. rain shower, 1GBit/s network in every room etc.).

I actually just (in January 2021) re-evaluated the apartment for a mortgage extension and banks estimate it pessimistically at 1.1M CHF. And I effectively currently pay 976 CHF (incl. side costs & parking spot).

Conclusions

Try to be mindful when getting an apartment in Switzerland. They are usually rather expensive to rent. Keep in mind the sqm and the room counting and maybe learn from my lessons regarding old vs. new apartments. Ask yourself how many rooms and sqm you need? In todays world where Homeoffice is mandated by the Swiss government maybe an extra room is worth more than it costs.

And you, how much do you pay for your Swiss apartment? Let me know in the comments below. I hope this post was helpful and prevented you from over-insuring yourself.

Nice write up! As for the 33% rule I’d based that on income after 2nd pillar, social security *and* income tax. Otherwise there’s really not much left after paying your rent.

I remember the struggle finding an apartment with 3-3.5 rooms for under 2000CHF/month when I moved to Basel in 2019. Fortunately after a lot of searching we found one with 3.5 room and about 85 square meter plus balcony and clear for 1870CHF/month. Now I’m thinking of moving out of Basel to save both on rent and income tax. Haven’t made up my mind yet (I’m a city person) but considering my FIRE goals it’s probably the right thing to do.

That’s a good point, I assumed an Expat would be taxed at source so the net salary would be automatically be w/o the income tax. Yes moving to more rural areas can often improve the value for the money in terms of rent but can also have additional cost for needed transportation etc. like everything always a trade-off.

On a search for an apartment(4.5/5.5) in ZUG area (where my wife works), it is being a pain. There is no much offer rent or buy…

I agree, I think I recently have seen about 8 offers in the whole canton. Mostly beyond 3000.- Fr. (Or 1.5M+ when buying). Usually the time around March, July, September is better as more people change apartments then.

you say that the effective mortgage rate is 976 CHF, how much of this is for shared costs of common areas of the building?

I think this could be a bad surprise when buying.

Great blog btw 😉

There’s quarterly side costs for maintenance etc. of 1330.- CHF.