Welcome to the Portfolio update of April 2020. What a shitty month. Corona crisis in full motion. Me working from home since the 2nd of March and a Net Worth loss of 16k CHF.

Let’s see how the the P2P Portfolio performed.

What should I say, fucking Coronavirus. My employer allowed everyone voluntary WFH (work from home) since the beginning of March, then made it mandatory together with the school closures and the lockdown-light in Switzerland. It’s not pleasant to be at home 24/7, I usually barely leave home during the week but try to go for walks with Mrs Cheese and Baby Cheese. Still the situation sucks, I wish it’s soon over.

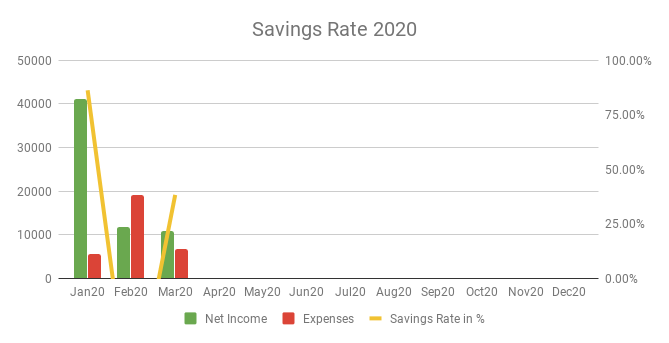

Savings Rate: March 2020

Total Income: 10’969 CHF – just the base salary. This will stay around this number until end of June.

Total Expenses: 6’769 CHF – Baby Cheese had his birthday, so we some bought gifts. We spent 1’800 CHF for the quarterly mortgage payment (including the maintenance fees we pay some 970 CHF for our 100 sqm appartment, a comparable rental appartment would be close to 3’000 CHF per month, neat). Since I’m working from home the groceries spend is a bit higher with 1’214 CHF this month.

Savings Rate: 38.29% – Back on track for the yearly goal of 35%+ saving rate.

I effectively got 86k CHF back from my TrueWealth liquidation. Moved the money to my new Interactive Brokers account and invested 30k CHF into SPXU an 3x leveraged inverse ETF tracking the S&P 500 index. Made 5k CHF within a few days, sold and bought again later. However the second round is currently at -7k CHF thanks to the billions of USD which the FED pumps in to the stock market. I’m however convinced now that the quarterly earning reports start to trickle in that the market will go further south.

All in all I face a Net Worth reduction of about 16k CHF down to 399k CHF thank you Coronavirus.

P2P Portfolio

| Platform | Balance | Actual XIRR |

| Agrikaab | 0 EUR | 0.00% |

| Bondster | 4’762.2 EUR | 6.77% |

| Crowdestor | 4’758.52 EUR | 6.36% |

| DoFinance | 4’806.49 EUR | 11.81% |

| FastInvest | 4’331.76 EUR | 10.33% |

| Flender | 1’038.48 EUR | 5.38% |

| Grupeer | 4’779.92 EUR | 8.77% |

| IuvoGroup | 4’873.7 EUR | 9.05% |

| Mintos | 5’283.69 EUR | 13.77% |

| Monethera | 2’047.23 EUR | 6.57% |

| PeerBerry | 4’785.07 EUR | 16.77% |

| RoboCash | 4’765.06 EUR | 7.56% |

| Swaper | 5’056.34 EUR | 5.96% |

| Viventor | 4’748.34 EUR | 9.25% |

| Wisefund | 1’035.03 EUR | 23.30% |

| Total | 57’071.83 EUR | 10.12% |

March Income from P2P Portfolio: +423.25 EUR or −1577 EUR with Agrikaab loss

Calculated XIRR (of the platforms that generated money): 10.12%

Coronavirus shit again here with all the P2P platforms sending emails that they might face trouble paying interests. I however think due to the raising numbers of unemployed people we might see an increase of popularity for P2P platforms when borrowers no longer can get loans with banks.

Let’s dive into the detailed statistics and comments on each platform:

Agrikaab

Balance: 0 $ (Total Loss)

Income: 0 $

XIRR: -100.00 %

Agrikaab sent a mail that they effectively ran out of money. Their transition to micro loans wasn’t successful and they claim that they have no funds left in the bank. A few days ago they still showed me a balance of 1200 $, so that’s gone too.

Fuck.

Bondster

Balance: 4’762.2 EUR

Income: 34.77 EUR

Platform XIRR: 13.02%

Calculated XIRR: 6.77 %

Now there are over 2300 EUR in 15+ days delayed loans. Will Corona give me another middle finger here?

I currently still have 1’499 EUR showing as waiting for entry.

For Bondster I use the following AutoInvest settings: Minimum interest rate: 12.5%, maximum loan term: 12 months, buy-back guarantee: yes

I will try to lift the balance to 5000 EUR on this platform in the future.

| If you would like to try Bondster and get 1% cashback on all investments in the first 90 days, please use this link to register. |

Crowdestor

Balance: 4’758.52 EUR

Income: 18.76 EUR

Platform XIRR: 19.17 %

Calculated XIRR: 6.36 %

Calculated XIRR recovered a bit this month, however most of the projects will start paying interest at a later date.

The news that they’re in negotiations with one of the top 3 streaming providers for the War Hunt Movie project sounds great, however I’m not invested in that project.

| If you would like to try Crowdestor and get 1% cashback on all investments in the first 90 days, please use this link to register. |

DoFinance

Balance: 4’806.49 EUR

Income: 46.69 EUR

Platform XIRR: 12 %

Calculated XIRR: 11.81 %

Still the platform which is the closest to the promised interest rates. I’m curious what I can dig out about it in my Technical review.

I will try to lift the balance to 5000 EUR on this platform.

| If you would like to try DoFinance yourself feel free to register thru this link. There is however no bonus nor support for my blog for using this link. |

FastInvest

Balance: 4’331.76 EUR

Income: 47.32 EUR

Platform XIRR: 12.99 %

Calculated XIRR: 10.33 %

I’m still actively withdrawing from this platform as I’m not sure if it’s legit. I also have a pending Technical review which should shed some light. On the 1st of April I’ve requested a withdrawal of another 376.98 EUR, let’s see if I ever get it.

| If you would like to try FastInvest and support this blog please use this link to register. |

Flender

Balance: 1’038.48 EUR

Income: 6.87 EUR

Platform XIRR: 4.66 %

Calculated XIRR: 5.38 %

Another 6 EUR of interest. Neat however as mentioned before Flender doesn’t satisfy my 12%+ interest rate goal.

I can still recommend the platform for People with less risk appetite for now.

| If you would like to try Flender and get 5% cashback on all your investments and 10% interest in the first 30 days, please use this link to register. |

Grupeer

Balance: 4’779.92 EUR

Income: 42.59 EUR

Platform XIRR: N/A (not available)

Calculated XIRR: 8.77 %

Steady performance for Grupeer, however given the 12 – 25% settings I use for my AutoInvest profile I would expect a higher XIRR.

My AutoInvest profile on Grupeer looks like this: Everything except Mortgage Loans, From 14 – 25%, between 1 – 24 months, all Countries, all loan originators, with buy-back and max amount per loan 10 EUR

I will try to lift the balance to 5000 EUR on this platform.

| If you would like to try Grupeer yourself and support this blog, please use this link to register. |

IuvoGroup

Balance: 4’873.7 EUR

Income: 42.67 EUR

Platform XIRR: 13.84 %

Calculated XIRR: 9.05 %

No more cashbacks, so the returns are a bit lower tho. I still don’t like the fact that their XIRR is almost 5% off from what I effectively see in returns.

My Autoinvest settings look like this: Maximum in one loan 10 EUR, min interest 12%, loan status current, all 3 buy-back options. No other limitations.

I will try to lift the balance to 5000 EUR on this platform.

| If you would like to try IuvoGroup yourself and get up to 90 EUR when you invest 2500 EUR, please use this link to register. |

Mintos

Balance: 5’283.69 EUR

Income: 63.93 EUR (12.36 EUR from cashback campaigns)

Platform XIRR: 17.39 %

Calculated XIRR: 13.77 %

I moved 458 EUR from FastInvest to Mintos in the middle of March. I also lifted up the interest rates for my AutoInvest profiles (see updated profiles below). I also have to update the loan originators from time to time as they either add new countries or new LOs.

My Autoinvest settings look like this:

A high risk second market profile with all LOs with buy-back with 17%+ interest rate up to 12 months, no diversification across LOs, 5 – 25 EUR per loan.

A maximum interest profile with all LOs with buy-back with 16.5%+ interest rate up to 12 months terms, with diversification across LOs, 10 – 50 EUR per loan.

I will try to lift the balance to 5000 EUR on this platform.

| If you would like to try Mintos yourself and get 1% cashback of all invested capital in the first 30 days, please use this link to register. |

Monethera

Balance: 2047.23 EUR

Income: 32.63 EUR

Platform XIRR: 19.05 % (average from 20.1 % and 18 % projects)

Calculated XIRR: 6.57 %

I requested a withdrawal of 32.79 EUR on 20st of March which I didn’t receive so far. Red Flags intensifies. I personally think this platform is a scam.

I definitely do NOT recommend to invest in this platform at this point.

PeerBerry

Balance: 4’785.07 EUR

Income: 44.98 EUR

Platform XIRR: 13.79 %

Calculated XIRR: 16.77 %

Either my XIRR calculation is wrong or theirs, but this is the only platform which effectively has a higher return than they promise. As a Swiss I like understatement very much. They also have slightly increased interest rates which is nice. See updated AutoInvest settings below.

My Autoinvest settings have two profiles:

One for 13.5%+ loans with current status, buyback and any duration, max amount per loan 100 EUR.

One for 12%+ loans with current status but only 1 months remaining, max amount per loan 20 EUR.

I will try to lift the balance to 5000 EUR on this platform.

| If you would like to try PeerBerry and support the blog, please use this link to register. |

Robo.cash

Balance: 4’765.06 EUR

Income: 24.48 EUR

Platform XIRR: 12.06 %

Calculated XIRR: 7.56 %

Actual XIRR slowly climbing up. However the fact that 2’900 EUR in loans are overdue doesn’t give me a good feeling about it.

I will regardless try to lift the invested amount to 5’000 EUR.

| If you would like to try Robo.cash and support this blog, please use this link to register. |

Swaper

Balance: 5’056.34 EUR

Income: 37.03 EUR

Platform XIRR: 7.03 %

Calculated XIRR: 5.96 %

Swaper still mirrors the actual Interest rate w/o giving transparency of the expected XIRR. I would prefer if they show the expected XIRR instead.

I added another 300 EUR to my account to profit from the 1% extra interest for accounts with more than 5’000 EUR.

| If you would like to try Swaper and support this blog, please use this link to register. |

Viventor

Balance: 4748.34 EUR

Income: 30.50 EUR

Platform XIRR: 16.06 %

Calculated XIRR: 9.25 %

Viventor still can’t live up to the promised interest rates they state in the dashboard. However there are 630 pages of loans with 16% interest rate available. I therefore updated my AutoInvest settings too.

My Autoinvest settings are the following: max amount per loan 20 EUR, 15.9 – 16% loans only, up to 12 months term, all loan types, all countries, all LOs, buyback & payment guarantee.

I will regardless try to lift the invested amount to 5’000 EUR.

| If you would like to try Viventor and earn 1% cashback on all investments in the first 30 days, please use this link to register and the code: XE0180 during the registration. |

Wisefund

Balance: 1035.03 EUR

Income: 14.44 EUR

Platform XIRR: 17.4 %

Calculated XIRR: 23.30 %

After my Technical review of Wisefund I will definitely NOT invest more money in this platform. Too few employees, too many red flags from the owner.

So we had 6 very nicely performing platforms yielding over 42 EUR each, with: Mintos, FastInvest, DoFinance, PeerBerry, IuvoGroup, Grupeer

The platforms which yield less than 6% XIRR are very disappointing. Less than half of my interest goal is not great, let’s see how they develop over time.

Blog statistics

Views: 913 (-303 from February) 🙁

Visitors: 230 (-43 from February) less bad than the Views count…

I kind of hoped my guest post about “P2P LENDING – THE GOOD, THE BAD, AND THE UGLY” over at retireinprogress.com would have given me some more visitors & views but it looks like Mr. RIP has more classic investing focused readers.

I started my Technical review blog post series with Wisefund being analysed and disqualified a the first platform.

I’m genuinely sorry that I didn’t write more blog posts but the whole Corona situation affects all aspects of life and slows things down.

That’s it for this month. Like last month let me know if you like the style and the ordering of topics.

If you have any questions or comments, please leave a message below or contact me by email. I try to answer all comments and emails.

Hi! Have you noticed that Mintos introduced a fee for second market selling? That’s really bad, since now it’s quite expensive to get the liquidity especially in these time, when it could be needed.

By the way, you’re right saying that a crisis brings more clients to P2P platforms, but it brings more risks as well. What do you think about that?

I’m using only Mintos as a P2P platform right now, I want to diversify a little bit and I was thinking about peerberry as a second operator. Is it a good choice or could you suggest something better?

Thank you. Regards from Italy.

Hi, thanks for your comment.

Good point about the fees for second market selling. I did indeed miss that. I’m however not concerned too much as I see the P2P investment as long term investments. If I would need the money I would just let run out all the loans.

You’re right about the increased opportunity and risk during this situation but I hope in the long run the economy will recover.

Regarding a second platform, I do like Peerberry however I think Swaper and Iuvo Group might be less risky at this point. I will try to cover about one platform per week with my technical reviews in the future and then I will end up with a list of platforms I surely can recommend given the investigation.

As always don’t invest money you can’t afford to loose.

Hello,

I don’t know if you are aware but Grupeer is a scam … many LO were Fake … no Withdrawal since mid March … everyone fired and CEO disapeared …

sorry 🙁

Yep unfortunately. And Monethera is very likely scam too, still waiting for my withdrawal from mid March.