Welcome to the Portfolio update of April 2023. I’ve sent my family to Mexico, and took two short vacations myself.

Personal update

March was rather uneventful work wise, but we have plenty of stuff in the personal/investing department.

So March, as teased in the last update we’ve bought a 5.5 room apartments with roughly 150sqm space, including basement storage and two parking spots for a whopping 1.95M CHF. This is mainly to expand our home a bit, it will also have some nice grass area around the northern part of it. The old apartment will be rented out and should generate some 3k CHF in revenue per month. Moving in date is approximately February 2024. We’ve so far paid down 100k CHF (using a margin loan on the stock portfolio) and some 20k CHF as a security for the upcoming 3 slices of mortgage (~500k CHF each) with some other 200k CHF coming from pension fund and third pillar and raising the mortgage of the current apartment by 140k CHF. That will give us roughly 450k CHF downpayment and 1.5M CHF from the mortgages.

March came with the roughly 2 month vacation for my wife & son, they left for Mexico mid March. The reason for their long stay is that it’s the last time before my son enters the Swiss school system and after that we won’t be able to spend time abroad for that long anymore. I’ve used the time to reconnect with some friends and went for a city trip to Alicante the second last weekend of March. Then at the end of March I’ve went for a short 5 day visit to Mexico to celebrate my sons 5th birthday and my brother in law’s wedding. Turns out a short trip combined with an alcohol fueled Mexican wedding can take some toll on health. I basically couldn’t keep anything (food/liquids) in my body for 2 days after that, what a fun way to travel home (no… not really). Well here I am one week sober xD (we’ll see how long that lasts).

At the airport when heading to Alicante I’ve also got a phone call from Tesla, if I was willing to take over a showroom car before end of March… I thankfully declined and mentioned that it was unrealistic to do the handover before I leave for Mexico. Let’s hope it doesn’t take too long to the next call.

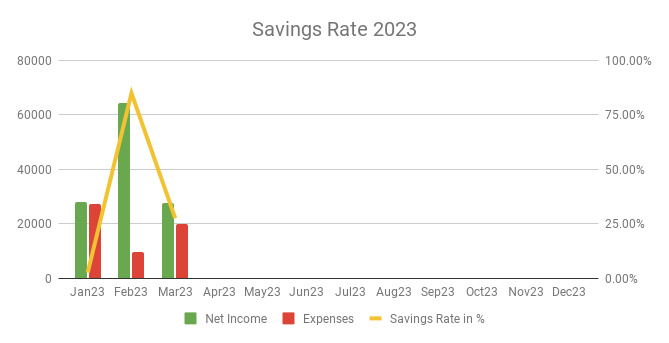

Savings Rate: March 2023

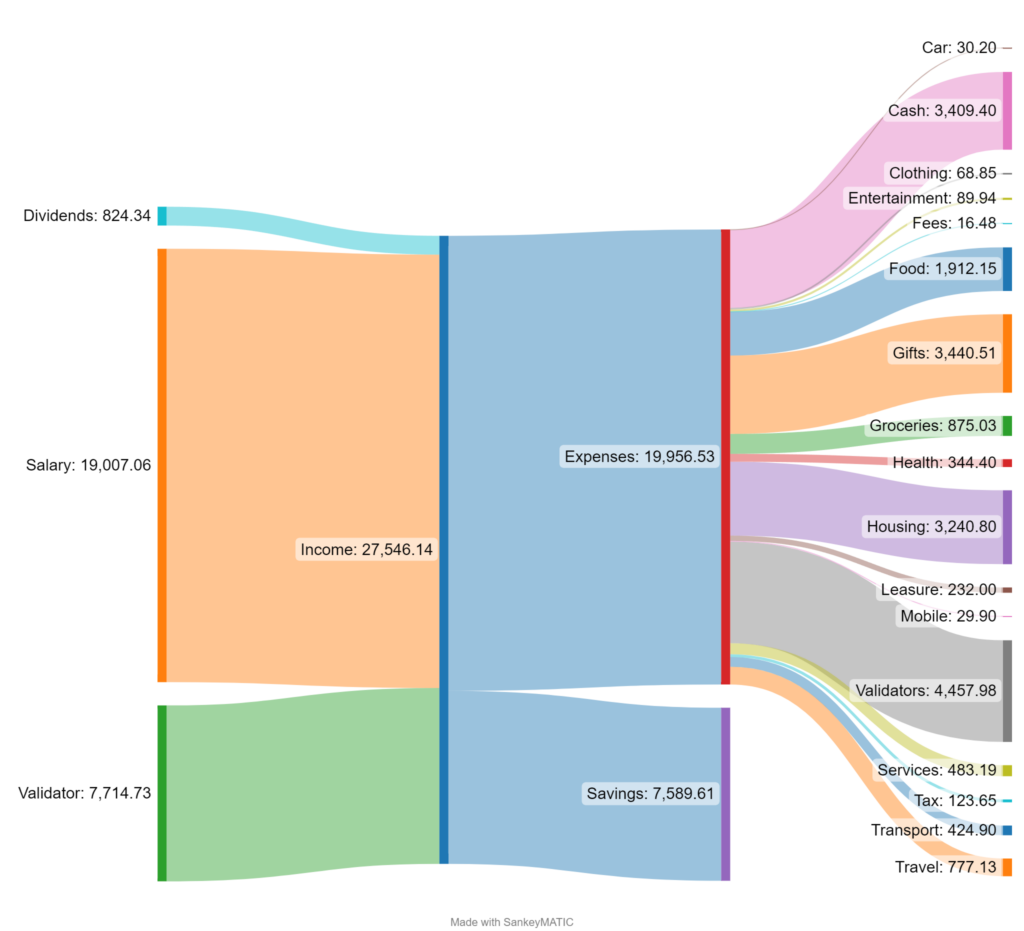

Cash flow: March 2023

Total Income: 27’546 CHF (-36’677 CHF vs. last month) – Regular salary (~18.5k CHF) plus some 600 CHF health insurance benefits backdated to January, validator income of ~7.7k CHF and 824 CHF in dividends from stocks.

Total Expenses: 19’957 CHF (+10’216 CHF vs. last month) – Whooops, let’s see what contributed to this, 4.4k CHF from Validator business (server cost & social security premiums), 3.4k CHF in Gifts (mostly the remainder of the ring, I’ve bought my wife & wedding gifts), Somewhat unplanned 1.8k CHF on a new washing machine & tumbler and roughly 3k CHF for my wife & sons Mexico stay.

Savings Rate: 27.6% (vs. 84.8% last month) – Well well lots of travel, lots of purchases, let’s hope for April to be cheaper (unless the new car arrives xD).

Net Worth: 1.042M CHF (+20k CHF vs. last month) – Attentive readers might notice that this is effectively 21k lower than last month, however turns out I’ve found some accounting errors which I’ve fixed after writing last months blog post, so this months number is more accurate.

Stock Portfolio

Stock Portfolio value: 263’541 CHF (-11’887 CHF vs. last month) (176’037 CHF incl. margin loan)

| Stock Symbols |

| AAP |

| ABBA |

| ABM |

| CMCSA |

| ELBM |

| GRNBF |

| MMM |

| MO |

| MPW |

| RF |

| SXOOF |

| VT |

| WBA |

Well most stocks went to shit in March and I took out 100k CHF for the reservation deposit for the apartment, so there wasn’t anything left to do. I’ve sold my TSLA position for 8.5k CHF (base price at 5.2k CHF) for a nice profit. At the end of the month the margin loan was paid down to 87.7k CHF. The net worth number above does consider the stock portfolio at 176k CHF.

Crypto HODL Portfolio

Current HODL portfolio value: 225’580 CHF (~7.7 BTC / 230 KSM / 2334 DOT / 92100 CRO / 2.2k+ PHA) (+25’359 CHF vs. last month)

Another nice 12% gain in crypto valuation.

Blog statistics

Views: 962 (-257 vs. last month) – I haven’t posted in the mustachian post forum much…

Visitors: 400 (-31 vs. last month) – At least a lower loss than for the views.

Followers: ¯\_(ツ)_/¯ looks like some update of the Jetpack plugin actually removed the ability to see the number of subscribers/followers, so I have no idea.

I posted 1 blog post last month, the monthly update. If you have ideas or are interested in more details let me know in the comments.

That’s it for this month. Like last month let me know if you like the style and the ordering of topics.

If you have any questions or comments, please leave a message below or contact me by email. I try to answer all comments and emails.

Whats the interest rate for a Stock Margin loan?

See https://www.interactivebrokers.com/en/trading/margin-rates.php currently it’s at 2.33%

How much mortgage do you still have on the other apartment? Was it revalued to get the higher mortgage, does not seem to show up in your net worth?

580k CHF, I didn’t recall the new valuation and the mortgage wasn’t raised just yet because I’m still waiting for the contract draft of the new apartment.

interesting, far better than anything that flatex would offer

What’s a margin loan on your stock exchange?

In Switzerland the thing is known as “Lombardkredit”. Basically a loan against your assets.