Welcome to the Portfolio update of April 2024. We went to Hong Kong & China and celebrated our sons birthday on Easter! Read more to learn more…

Personal update

March was very nice. job-wise the company didn’t burn down while I was out for a week and we’ve took some measures regarding the new guy (spoiler alert: we’ve let him go during the probation period). The work in general was much more manageable while working from home the whole month (we’ve moved offices but the new one wasn’t ready yet).

At the beginning of March we’ve celebrated our wedding anniversary by going to Rigi-Kaltbad for two nights. Then there was my moms birthday and on the 17th of March we flew to Hong Kong to attend a wedding of a friend late that week in China. Hong Kong was pretty cool, very international, everyone speaks English and super smooth infrastructure and friendly people with good food (I’ve been to Din Tai Fung twice :D). Mainland China was a bit of a contrast to that internationality, almost nobody spoke English anymore. People were staring at us as Europeans and half of the car brands were unknown to me. I’ve expected it to be much more socialistic/communistic but the city of Foshan itself felt like any other large western city. The wedding was very nice and the karaoke with the grooms side of friends afterwards legendary. When we came back we’ve celebrated our sons 6th birthday, the first one with some friends from Kindergarten at an indoor playground which was very nice. The next day was his actual birthday which fell on Easter Sunday this year so we’ve gathered at my parents place to celebrate with the family. “This was one of the best days ever” is a statement that every parent is happy to hear from their children.

Money wise it was a rather expensive month with the traveling and splurging on Premium Economy upgrades for the flight home. Fortunately I’ve also got my bonus for 2023 so the income almost felt like the ones from early 2023. For April I’m hoping for a bit better weather I really enjoyed the 19-22 degrees Celcius in Hong Kong and up to 32 degrees in Foshan. I will travel to Porto with some friends and my wife and son will visit Mexico during the spring holidays.

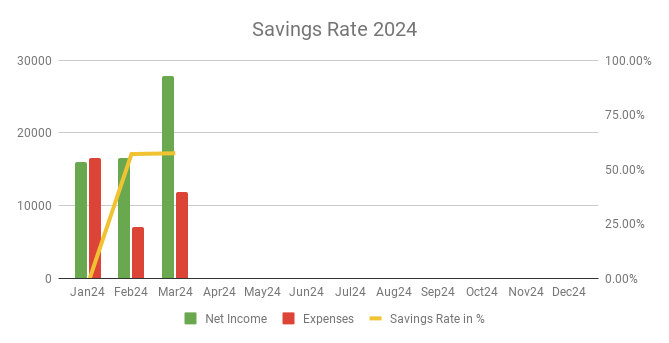

Savings Rate: March 2024

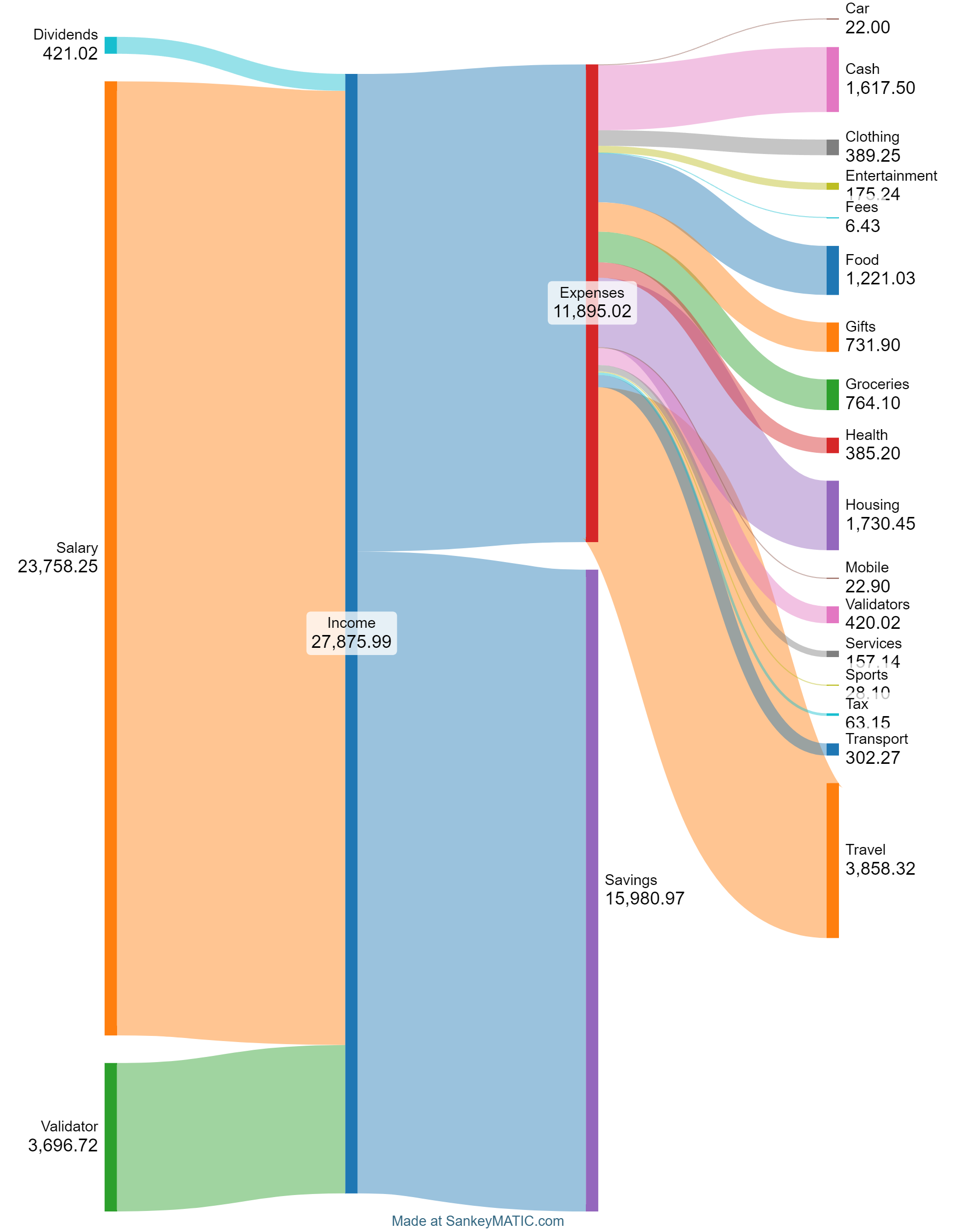

Cash flow: March 2024

Total Income: 27’876 CHF (+11’307 CHF vs. last month) – Salary with bonus, almost 3.7k CHF from validator and another unaccounted 2.4k CHF from the joint venture. And some 421 CHF in dividends.

Total Expenses: 11’895 CHF (+4’763 CHF vs. last month) Traveling cost us 3’858 CHF (incl. the flights accounted in January almost 6k CHF for that one week incl. the 1k CHF equivalent in cash we’ve brought :-/) but hey, you don’t get to see a top floor Hyatt Regency Suite every day. That birthday party and the gifts were another 731 CHF, the quarterly mortgage interest payment of 1’173 CHF, some 420 CHF of validator and side gig business cost. All in all an expensive but not too crazy month.

Savings Rate: 57.33% (vs. +0.37% last month) – Acceptable savings rate given the expenses.

Net Worth: 1.312M CHF (+86k CHF vs. last month) – The bitcoin rally continued, so net worth went up.

Stock Portfolio

Stock Portfolio value: 115’522 CHF (+5’378 CHF vs. last month)

| Stock Symbols |

| ABBA |

| ABM |

| CMCSA |

| CMI |

| EBAY |

| ELBM |

| GRNBF |

| MMM |

| MO |

| MPW |

| RF |

| SXOOF |

| WBA |

| VT |

The EBAY play turned into 9.9% profit already. I believe CMI was split/sold into ATMU and SOLV which both are not doing particularly well. My ABBA (Bitcoin 21Shares ETP) is up 150% since I’ve bought it a few years ago, which is nice. It was funded with the money we were gifted for my sons birth and I will fully hand it out to him on his 18th birthday. Maybe I will transition it into VTI or SPY in 6 to 12 month when the next crypto bull run comes to an end.

Equity Portfolio

Equity Portfolio value: 80’070 CHF (+0 CHF vs. last month)

Nothing changed on that front. There will be a general assembly at the end of April which I will join.

Crypto HODL Portfolio

Current HODL portfolio value: 562’437 CHF (~7.9 BTC / 467 KSM / 5134 DOT / 23k+ PHA) (+70k CHF vs. last month)

Bitcoin still going strong. I expect another 50% to 100% rally due to two factors:

- The Bitcoin ETFs are older than 90 days which is a requirement for some more traditional investment companies like pension funds etc.

- Bitcoin halving which is due at the end of April will make Bitcoin even more scarce and historically that was a driver for the price of it.

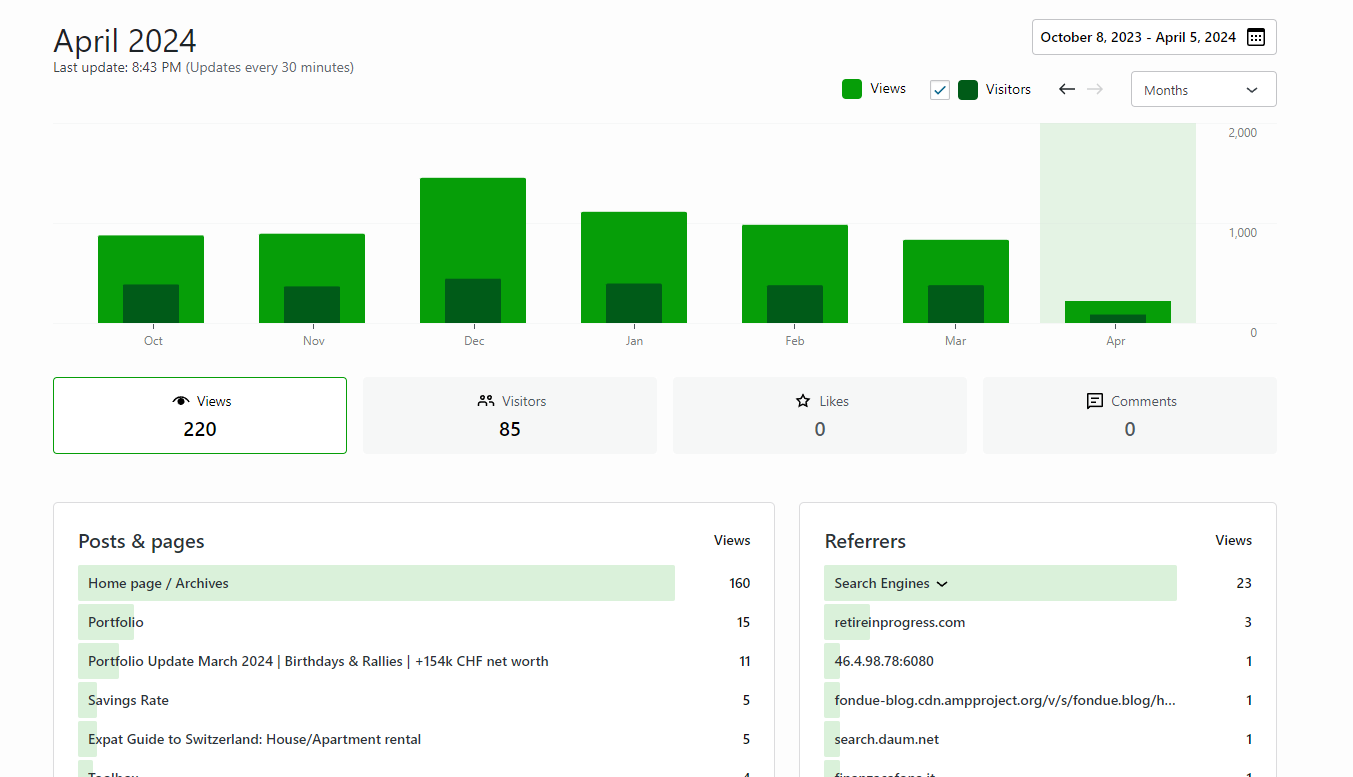

Blog statistics

I posted 1 blog post last month, the monthly update. If you have ideas or are interested in more details let me know in the comments.

That’s it for this month. Like last month let me know if you like the style and the ordering of topics.

If you have any questions or comments, please leave a message below or contact me by email. I try to answer all comments and emails.

Hi. I have been following your blog through your newsletter for some time. I truly enjoy reading about your investment journey.

Your crypto portfolio is amazing. Do you have any advice for someone less technical to have a passive income similar to what you are doing as a validator? Thanks!

For now I can only leave the link to it: https://wiki.polkadot.network/docs/thousand-validators

How did the CTO application proceed?

Hilarious email address… Well, they were looking for some paranoid privacy lover which I clearly wasn’t.