Welcome to the Portfolio update of April 2025. We’re back… from Mexico… read on to learn more…

Personal update

Some people might have noticed the shorter than usual last update, reason for that was that I was in a hurry to go to the airport to enjoy 3 weeks off in Mexico with my family. It was really nice, started off with the wedding of my brother in law with 250+ people. Then some relaxing time at a beach at the pacific ocean (w/o running water in the apartment for 3 days), then some amazing food (specifically boneless chicken wings at a napoleatanian food stand at a mall, don’t ask but they were amazing, had them 3 times) and then another week back at the beach (same place but with running water this time) for working from beach. The Mexican wildlife is fun, we’ve seen some racoon families, lizards and even a crocodile in or next to the place we’ve been staying. Lots of retired Canadians tho.

The two weeks of no work and zen spirit mode however got immediately crushed by some incompetent dev’s messing up our pre-production stage. That pushed me all the way to start looking around for jobs and the willingness to hand in my notice by end of March. My boss however could convince me to give him another month to try to fix some of the major pain points. Also interviewing didn’t go amazingly so far, 2-3 interviews but usually no follow ups from the places.

On the flight back due to me and my son only having half a day to recover from Jetlag before going back to work/school I’ve splurged on a business class upgrade for 1’000 CHF per person (so 3’000 CHF).

Later in March we’ve also celebrated our sons birthday with a forest grill picnic, that was very nice. Sure the temperatures were still about 20C colder than Mexico but it was bearable. The 7 or so kids had a blast and I’ve enjoyed grilling some sausages.

On 1st of April I finally went back to climbing, unfortunately the spot changed and we now need roughly 40 mins to get to the place and back, extending the lunch break to 2h on Tuesdays… well I could immediately tell after that first session in months that I feel better (more grounded and energetic) so I will keep using the other 9 times of the package I’ve bought.

At the end of March after watching the Telsa Townhall I’ve fat fingered a Tesla Call purchase (400$ by Dec 2025) and accidentally bought 25k CHF worth of it instead of 2.5k CHF, sold some VT to get the account out of the negatives. And thanks to the black April week I’m down like 10k CHF :S I’m somewhat optimistic that if Optimus gets some traction that I can reach back it’s former heights.

Also the Validator side gig came to an abrupt stop as the Decentralized Nodes program did not nominate me anymore due to having the servers with OVH in France which is an overcrowded location. Fortunately I’ve managed to pull out of the 2 year commitment with them (I was with them for 4 years now, so I guess it as just good customer service) w/o any cost consequences. I probably should have invested some time in Mexico to find better providers distributed across LATAM or so.

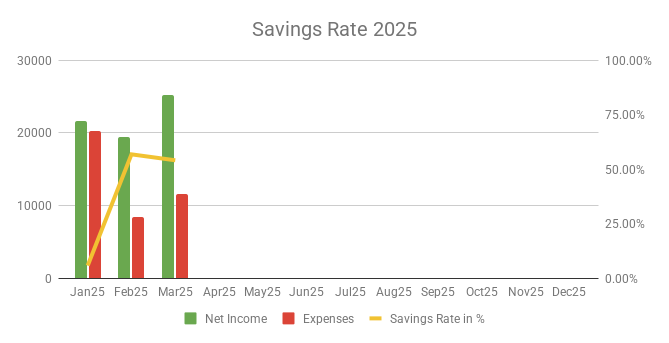

Savings Rate: March 2025

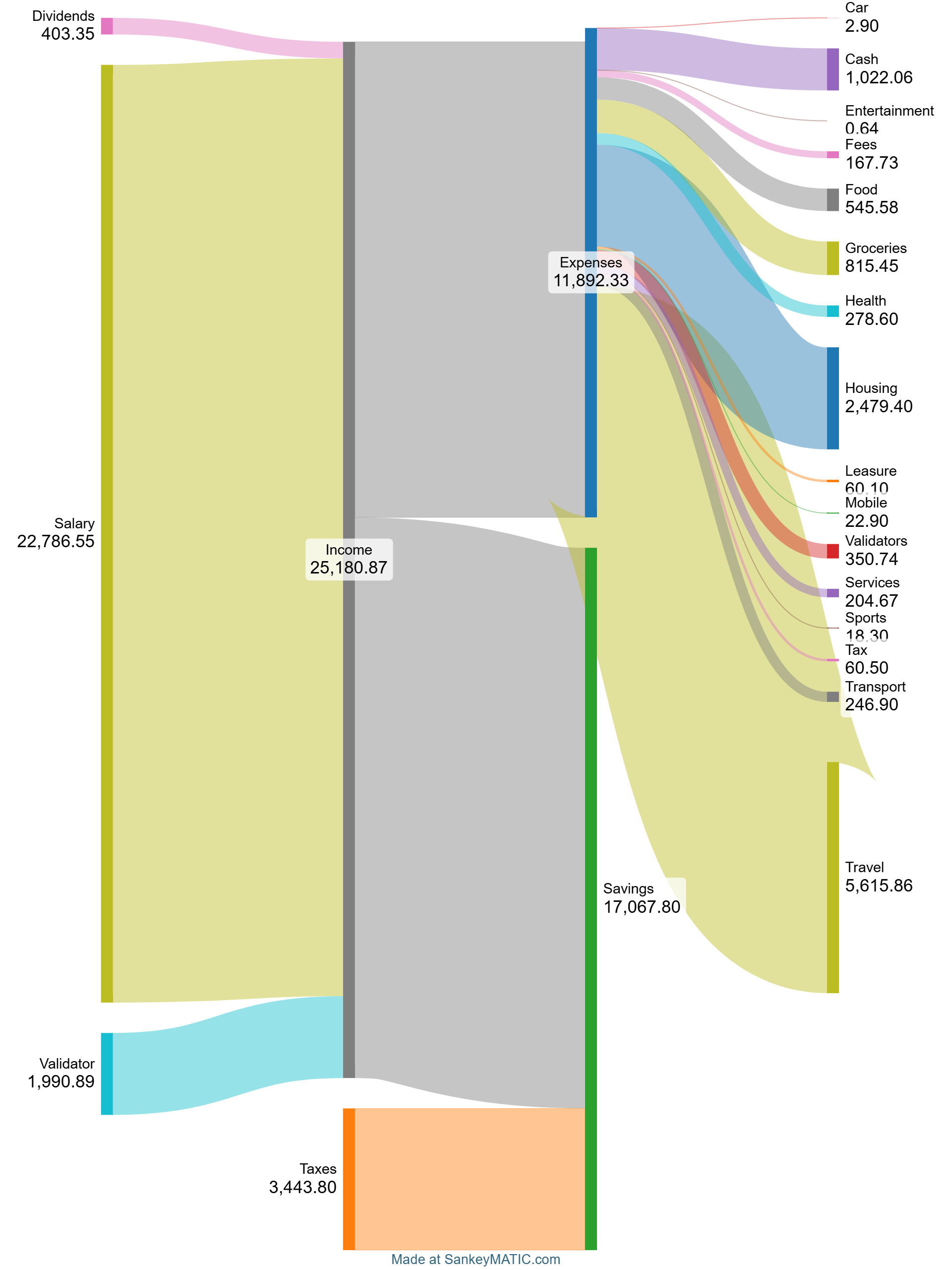

Cash flow: March 2025

Total Income: 25’180 CHF – Bonus time (~7.5k CHF which is 50% of the 50% of the 30k CHF bonus), also there should be some 15k CHF worth of stocks which I have yet to see on paper (I technically didn’t account for those yet). So 22k CHF of salary, 2k CHF from validators and some great dinner for 4 worth of dividends.

Total Expenses: 11’556 CHF (8’113 CHF incl. Tax refunds) – Three weeks of Mexico was 2’615 CHF which allowed us to live like kings (all means for the whole family paid, beach vacation for 8 days) plus then the 3k CHF for the business class upgrade on the flight back. I’ve also got a nice 3k CHF tax refund as I’ve accounted wrongly for a shared account in my 2023 taxes. The quarterly mortgage payment was due and some insurance for my watches.

Savings Rate: 54.1% – pretty acceptable savings rate

Net Worth: 2.0M CHF (-20k CHF vs. last month) – 1% of net worth is probably considerable as rounding error at this point.

Stock Portfolio

Stock Portfolio value: 146’820 CHF

| Stock Symbols |

| ABBA |

| AMZN |

| CMCSA |

| EBAY |

| ELBM – Sold at 96% loss, thanks to a moustachian forum poster two years ago or so |

| MMM |

| MO |

| MPW |

| MRK |

| PATH (UI Path) |

| SSTK (Shutterstock) |

| TSLA Calls 400$ Dec 25 |

| WBA |

| VT |

As mentioned above, I took a bit of a gamble with Tesla calls as I’m still super bullish. Yes the Q1 numbers were down but that’s explainable with the Model Y Juniper rollout and the general political scrutiny but I do believe Tesla will recover strongly. On the other hand I wouldn’t mind to buy a BYD U9 or a Xiaomi SU7 Ultra.

Equity Portfolio

Equity Portfolio value: 93’570 CHF (+13’500 CHF vs. last month)

First time for that to grow. Next week is a general assembly which might give my stocks a current valuation.

Crypto HODL Portfolio

Current HODL portfolio value: 633’259 CHF (~8.37 BTC / 674 KSM / 9449 DOT) (+85k CHF vs. last month)

I will probably liquidate all my DOT and KSM as I’m no longer running my validators. Maybe some fellow readers ended up stealing my spot, well I’m happy for you :/

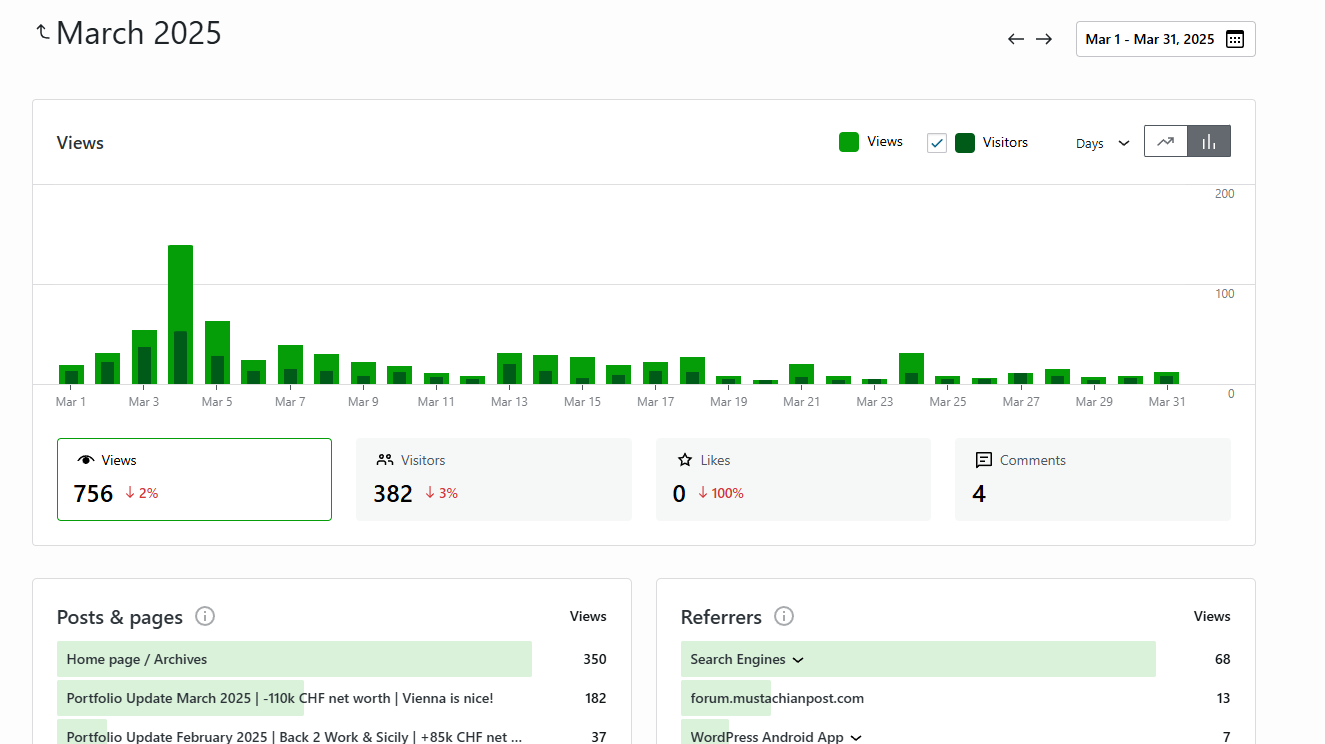

Blog statistics

I posted 1 blog post last month, the monthly update. If you have ideas or are interested in more details let me know in the comments.

That’s it for this month. Like last month let me know if you like the style and the ordering of topics.

If you have any questions or comments, please leave a message below or contact me by email. I try to answer all comments and emails.

One Reply to “Portfolio Update April 2025 | -20k CHF net worth | Back on track…”