Welcome to the Portfolio update of August 2020. 35k CHF Income and 19k CHF savings. Yay. And I passed my boat exam 😀

Let’s see how the the P2P Portfolio performed.

Updated: 05.08.2020 I found the missing 19k CHF net worth xD

I start to doubt if P2P investments are the way to go. Delays with Crowdestor project payouts and the write-off of Monethera totaling the P2P losses at over 7’200 CHF and P2P Income at 2’114 CHF make a net loss of 5’086 CHF so far.

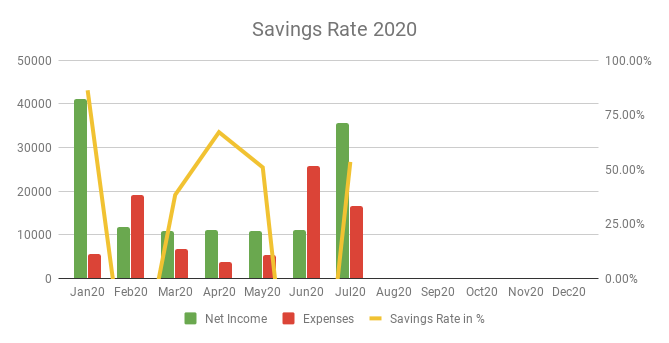

Savings Rate: July 2020

Inspiration from onemillionjourney.com:

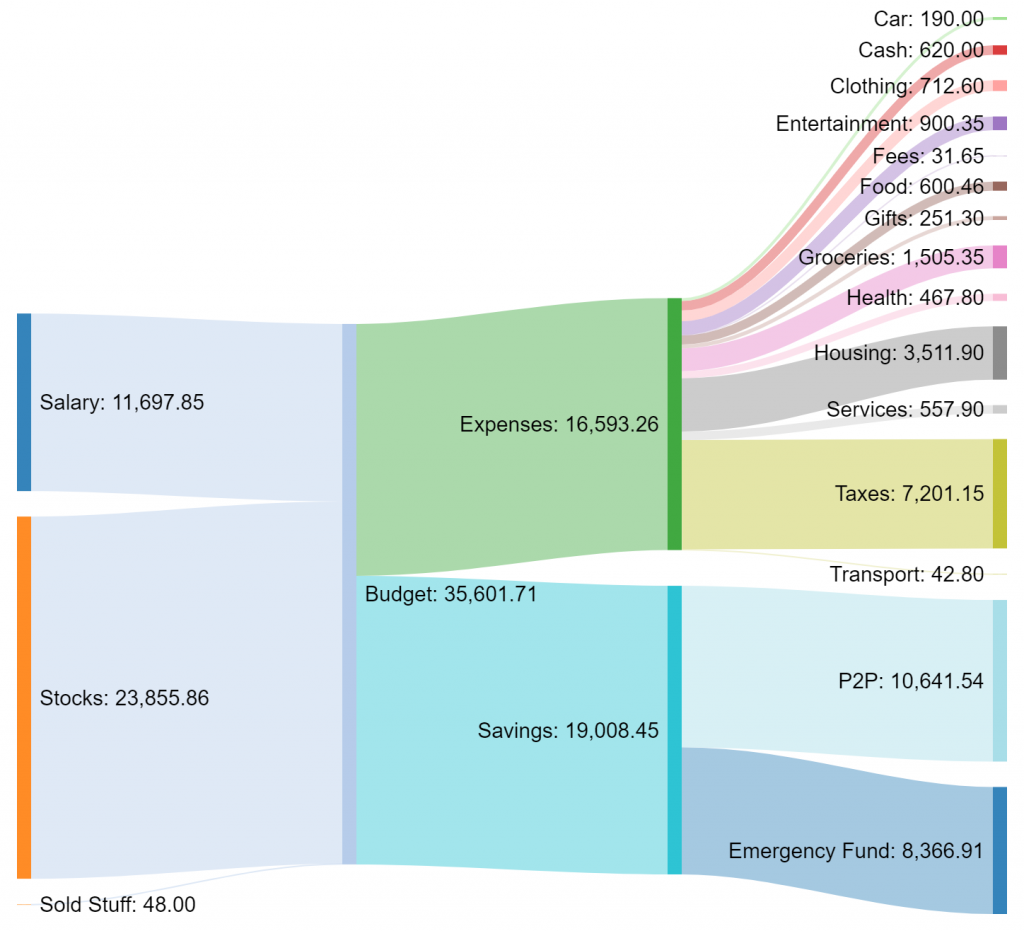

Total Income: 35’601 CHF – base salary plus 26k USD in Stocks and 48 CHF of sold stuff. Plus the refund from the A/C.

Total Expenses: 16’593 CHF – Another 7’201 CHF in taxes bringing up the total of 2019 taxes to 32k CHF. On my net income of 230k CHF in 2019 that’s a effective tax rate of 14%. That would be much higher in most other counties but still given the fact that one can buy a cheap car for 16k CHF, two cars for the state right there. Since I will probably work from home for a good part of the next 12 months I bought a new monitor for 1’649 CHF replacing my 3x 24″ Monitors which turned 10 years this year. I also bought a professional hair trimmer for 130 CHF but only paid 64 CHF because I sold some baby stuff on the same platform. That hair trimmer should save me some money down the line. I mean I would have to use it twice and be already profitable (haircuts here cost ~50 CHF for a men). We also bought a pair of new shoes for each member of the family paying 167 CHF but we had a 44% discount code from a friend who works at that shoe brand. Then we bought a new car seat for my son as he became too big for the Maxi-Cosi Pearl. And we spent 475 CHF on a half day of renting a boat. That was by far the most relaxing afternoon in a long long time.

Savings Rate: 53.39% – Savings rate recovered nicely. I would have hoped to be able to save some more but with the taxes done for this year I think the remaining months should be around or above 60% savings rate. The overall savings rate recovered to 14.34%. I also moved some money around (from the Stocks) and replenished my emergency fund back to 25k CHF.

Stocks: I realized that having 25k CHF uninvested money laying around at Interactive Brokers will not earn me anything. So I bought another 59 VT stocks. I also got some FOMO and bought 10 TSLA at 1’524 USD, I hope them being added to the S&P500 index will make some significant amounts of money flow into the stock.

Net Worth gained 19k CHF to 421k CHF see my portfolio page for details about the asset allocation. I’m a bit confused how the Net Worth was only gaining so little while I was able to save 16k CHF. Probably Forex fluctuations? ¯\_(ツ)_/¯ I realized I accidentally used the price of TLSA instead of TSLA in my calculations xD

P2P Portfolio

| Platform | Balance | Actual XIRR |

| Bondster | 5977 EUR | 14.00% |

| Crowdestor | 4764 EUR | 7.36% |

| DoFinance | 4886 EUR | 19.43% |

| FastInvest | 2903 EUR | 3.65% |

| Flender | 2057 EUR | 13.15% |

| Grupeer | 4787 EUR | 5.71% |

| IuvoGroup | 6971 EUR | 18.40% |

| Mintos | 7956 EUR | 17.90% |

| Monethera | 0 EUR | -100% |

| PeerBerry | 6159 EUR | 16.23% |

| RoboCash | 6700 EUR | 8.09% |

| Swaper | 7014 EUR | 12.86% |

| Viventor | 4843 EUR | 9.53% |

| Wisefund | 1013 EUR | 17.94% |

| Total | 66037 EUR | 12.64% |

August Income from P2P Portfolio: +350 EUR (or -1697.23 EUR when adding Monethera write-off)

Calculated XIRR (of the platforms that generated money): 12.64%

As promised I wrote-off Monethera this month as the platform is dead. I will no longer mention it in the monthly updates.

I did invest the 10’042 EUR in July. That’s how I invested the money:

- Flender: 1000 EUR

- IuvoGroup: 1800 EUR

- Mintos: 1800 EUR

- PeerBerry: 1800 EUR

- RoboCash: 1800 EUR

- Swaper: 1800 EUR

- Bondster: 842 EUR

Let’s dive into the detailed statistics and comments on each platform:

Bondster

Balance: 5’977.23 EUR

Income: 52.63 EUR

Platform XIRR: 13.81%

Calculated XIRR: 14.01 %

Looks like Bondster recovered a bit again, however the average interest rate of new loans dropped to 14%. I adjusted my AutoInvest settings.

For Bondster I use the following AutoInvest settings: Minimum interest rate: 14%, maximum loan term: 12 months, buy-back guarantee: yes

| If you would like to try Bondster and get 1% cashback on all investments in the first 90 days, please use this link to register. |

Crowdestor

Balance: 4’764 EUR

Income: 20.12 EUR

Platform XIRR: 19.17 %

Calculated XIRR: 7.36 %

Two projects payed in July a total of 20.12 EUR. One was the Meat Chef project and one the Beach Volleyball field. I’m still upset that the Fertilizer project turned from a promised 3 months to over 8 month now. And still no sign of the money.

I’ll test if withdrawal works with them before I decide if I invest more money.

| If you would like to try Crowdestor and get 1% cashback on all investments in the first 90 days, please use this link to register. |

DoFinance

Balance: 4’886.33 EUR

Income: 19.99 EUR

Platform XIRR: 12 %

Calculated XIRR: 19.43 %

I think I have some bug in my XIRR calculation as it jumped up significantly. I will withdraw another 78 EUR which are sitting around idle in my account.

| If you would like to try DoFinance yourself feel free to register thru this link. There is however no bonus nor support for my blog for using this link. |

FastInvest

Balance: 2’903.28 EUR

Income: 1.67 EUR

Platform XIRR: 12.99 %

Calculated XIRR: 3.65 %

I’m still upset about the unprofessionalism of FastInvest. The fact that they can’t pay out uninvested money means that their accounting is more than shady.

There was also a blog post from Kristaps Mors about an alleged law suit against him.

I do NOT recommend to invest money in FastInvest at this point.

Flender

Balance: 2’057.59 EUR

Income: 8.30 EUR

Platform XIRR: 10.33 %

Calculated XIRR: 13.15 %

I invested another 1000 EUR into Flender. Like in January the money got absorbed rather slowly. I invested actively in two open projects on the Marketplace. 550 EUR are still in the “Live Bids” status.

| If you would like to try Flender and get 5% cashback on all your investments and 10% interest in the first 30 days, please use this link to register. |

Grupeer

Balance: 4’787 EUR

Income: 0 EUR

Platform XIRR: N/A (not available)

Calculated XIRR: 5.71 %

Looks like they’re missing around 2.5 Million EUR to be able to pay back all investors. Sounds like somebody is having a nice time in the Bahamas.

I do NOT recommend Grupeer at this point.

IuvoGroup

Balance: 6’971.61 EUR

Income: 53.18 EUR

Platform XIRR: 13.21 %

Calculated XIRR: 18.40 %

The interest payments seem to have picked up again.

My Autoinvest settings look like this: Maximum in one loan 10 EUR, min interest 12.5%, loan status current, all 3 buy-back options. No other limitations.

| If you would like to try IuvoGroup yourself and get up to 90 EUR when you invest 2500 EUR, please use this link to register. |

Mintos

Balance: 7’956.78 EUR

Income: 62.54 EUR

Platform XIRR: 16.86 %

Calculated XIRR: 17.90 %

I stupidly picked up some defaulted loans on the secondary market because my filters weren’t right. And probably lost some 20 EUR due to that.

The average interest rates of my loans are now 16.31%, nice.

My Autoinvest settings look like this:

A high risk second market profile with all LOs with buy-back with 16.5%+ interest rate up to 3 months, no diversification across LOs, 5 – 25 EUR per loan.

A maximum interest profile with all LOs with buy-back with 16%+ interest rate up to 6 months terms, with diversification across LOs, 10 – 50 EUR per loan.

| If you would like to try Mintos yourself and get 1% cashback of all invested capital in the first 30 days, please use this link to register. |

PeerBerry

Balance: 6’161.07 EUR

Income: 49.70 EUR

Platform XIRR: 13.86 %

Calculated XIRR: 16.23 %

There was some more cash drag, with 213 EUR sitting uninvested in the account. Not sure if there is some bug with their AutoInvest feature. Looking deeper into it, it seems that there are no more short term loans available. Not sure what’s up with that.

My Autoinvest settings have two profiles:

One for 15.0%+ loans with current status, buyback and any duration, max amount per loan 100 EUR.

One for 9%+ loans with current status but only 1 months remaining, max amount per loan 20 EUR.

| If you would like to try PeerBerry and support the blog, please use this link to register. |

Robo.cash

Balance: 6’700.62 EUR

Income: 8.24 EUR

Platform XIRR: 13.09 %

Calculated XIRR: 8.09 %

Disappointing interest payments so far. But maybe I managed to pick some bullet payments for some reason.

| If you would like to try Robo.cash and support this blog, please use this link to register. |

Swaper

Balance: 7’014.79 EUR

Income: 86.21 EUR

Platform XIRR: 10.91 %

Calculated XIRR: 12.86 %

Best paying platform this month. Very nice.

| If you would like to try Swaper and support this blog, please use this link to register. |

Viventor

Balance: 4’843.95 EUR

Income: 12.90 EUR

Platform XIRR: 15.53 %

Calculated XIRR: 9.53 %

Viventor seems to be busy with empty promises and running after investors money.

My Autoinvest settings are the following: max amount per loan 20 EUR, 15.9 – 16% loans only, up to 12 months term, all loan types, all countries, all LOs, buyback & payment guarantee.

| If you would like to try Viventor and earn 1% cashback on all investments in the first 30 days, please use this link to register and the code: XE0180 during the registration. |

Wisefund

Balance: 1013.97 EUR

Income: 13.97 EUR

Platform XIRR: 17.4 %

Calculated XIRR: 17.94 %

After my Technical review of Wisefund I will definitely NOT invest more money in this platform. Too few employees, too many red flags from the owner. However the quick withdrawal processing gives me hope that I see my still invested 1000 EUR again at some point.

Funnily enough the “Video Content Monetization” project payed a whopping 13.97 EUR. So there’s hope to get all my money out of this platform in like 10 years.

I held my promise and invested over 10’000 EUR in July. With 350 EUR income it was my best paying month so far. I hope there will be a steady increase of monthly income.

Blog statistics

Views: 456 (-27 from June)

Visitors: 152 (+12 from June) Welcome new readers

Followers: 10 (+0 from June) Plz like and subscribe ;D

I kind of self diagnosed with Burnout in July, I tried to do a rotation at my job but it turned out that I couldn’t just put my main responsibilities aside so instead of getting some fresh breath doing different work I got overloaded doing new work and my regular work. And I ended up in a state where I didn’t find any motivation to be productive and getting up in the morning anymore. Since then I ended the rotation at the end of July and already feel the motivation for my regular job coming back.

I’m however having vacation from the 6th to the 23rd of August which should give me some recovery time. I hope I can recharge my batteries. Looking forward to my new Samsung Odyssey G9 monitor which hopefully arrives soon. And to the Microsoft Flight Simulator 2020 to stimulate my need to be in a airplane.

I didn’t post anything else in July besides the monthly update. Very disappointing to me and my readers. I would love to see more comments so I can get some feedback and motivation to post more.

That’s it for this month. Like last month let me know if you like the style and the ordering of topics.

If you have any questions or comments, please leave a message below or contact me by email. I try to answer all comments and emails.

Thanks for the shout out, I am glad to see that the Sankey Diagram is being useful to you.

Well done on those saving rates!

I also doubt that P2P is the way to go, but I am happy to keep the few I like the most and look trustworthy, as it provides a welcoming amount of passive income. We’ll see how that plays out long term though.

Keep up the good work 😉

Thanks for the nice words. I wished I could reach the 75%+ saving rate of yours.

I btw have the same weight goal like you. Already lost 5kg but the remaining 6 seem to keep sticking to my belly.

Stay save.

Hey Mr Cheese what percentage of your total investments portfolio do you plan for P2P?

I will try to keep it under 20% for now. Right now it’s at 18% but I really want to up the Stocks portfolio to over 100k so I don’t pay the 10USD/Month fees at Interactive Brokers anymore.