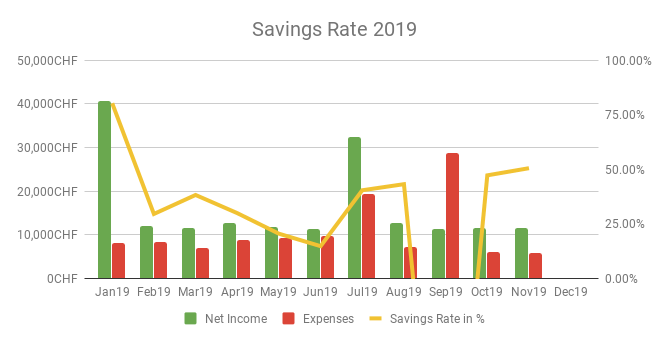

Welcome to the Portfolio income update of December 2019. Well there’s no P2P portfolio yet, so let’s talk about income, expenses and saving rate of 2019 so far.

Savings Rate 2019 so far

The tracking of our expenses as a family only started this year and I was mostly shocked about the high expenses. Looking at the saving rates so far May, June and September stood out as net negative months.

In May I booked a flight for my wife and son to visit her family. That flight cost some 2’656.40 CHF. Unfortunately they were affected by the big issue at the airport in Amsterdam at the end of July. Hundreds of flights were grounded that day due to kerosine supply issues. She was indecisive but ended up flying anyway. However in the meantime my son grew quite a bit. So we replaced his “infant on lap” ticket with an “infant on seat” ticket. That increased the price for his ticket from 10% to 60% of a regular ticket costing 3’682.70 CHF. That went into the August expenses, fortunately the previously paid money was reimbursed effectively costing us some 1’026.30 CHF. On the positive side the groceries expenses for July were noticeably lower with the family out of the house, .

The June spendings came from a request by my wife of hanging the 4 year old 75″ TV to the wall. Our son became more and more mobile and she was scared that he would tip the TV over. I however argued that I won’t hang a 4 year old TV to the wall and instead bought a new 82″ TV including wall mount executed by professionals. An extra spend of 3’196.90 CHF was the result of that.

So the July and September high spend was caused by some expected and some unexpected taxes, totalling in some 32’735 CHF spent. With my gross total salary of about 240k CHF that gives me tax rate of some 13.6%. Hooray for low tax cantons in Switzerland. (Numbers are not totally accurate since some of the 32k were delayed taxes for 2017 and 2018 combined)

As you might figure out I’m not one of the hardcore FIRE people which get worried if the savings rate is below 30% or so. You should and can enjoy some luxuries on your way to FIRE.

To the positive sides of the graph above. January and July are quite fat months. January is the month when my bonus get’s paid. That netted this year some extra 27’500 CHF (minus taxes) and then in July stock vesting events flush some additional 20’000 CHF into the bank. I usually use that stock vesting event to pay the taxes. For those I usually get the invoice around July.

Saving Rate: November

My Saving Rate for November was 50.51%

Yay, first time over 50% saving rate for a regular income month may many follow.

I onboarded of my wife to the potential FIRE future included an explanation that the savings rate has to improve for us to be successful. With a savings rate above 45% for both October and November I think we’re going to the right direction.

See more info about my Savings Rate

Outlook December

December will be another pretty fat month with the 13th monthly salary and another stock vesting event which should rain some extra 30’000 CHF.

However today being middle of December I’m already aware that we kind of splurged on Christmas gifts which I expect to be close to 2’000 CHF.

Let me know in the comments if you have questions or suggestions to improve/change the monthly update. Since the whole blogging thing is still new for me I will probably restructure the updates in the following months.