Happy new year and welcome to the Portfolio update of January 2021. What a month! Exceptionally good stock market performance and cryptos going thru the roof.

Personal update

My family is back and my life is pretty busy again. That’s despite the fact that I’m off work since 18th of December.

I recently passed the 65th day exercising with the Nintendo Ring Fit Adventure game. My fitness level is probably close to the highest it used to be in years.

Christmas was the usual deal of meeting my parents and my sister and some brunch (not much difference regardless of the corona situation), however except for meeting a friend 19th of December I haven’t met any of my friends since. Looking forward to open restaurants and bars again…

I put my money where my mouth is and bought the Carl F. Bucherer Patravi SubaTec Manta Trust Edition last week.

A pretty nice way to end the year. I also technically got my stock options from December but they only hit my Revolut account on the 1st of January at 01:56 so these 36k USD will show up on the next monthly update.

Savings Rate: December 2020

A little note to the savings graph. I’ve retroactively excluded taxes from my savings graph after some discussion in the MP forum. Which brings the yearly savings rate to a nice 61%! I also noticed I had a calculation error in the yearly savings rate because I took the average of every months rate instead of the total. The savings rate for 2019 including taxes was 42% and the savings rate for 2020 including taxes was 45%.

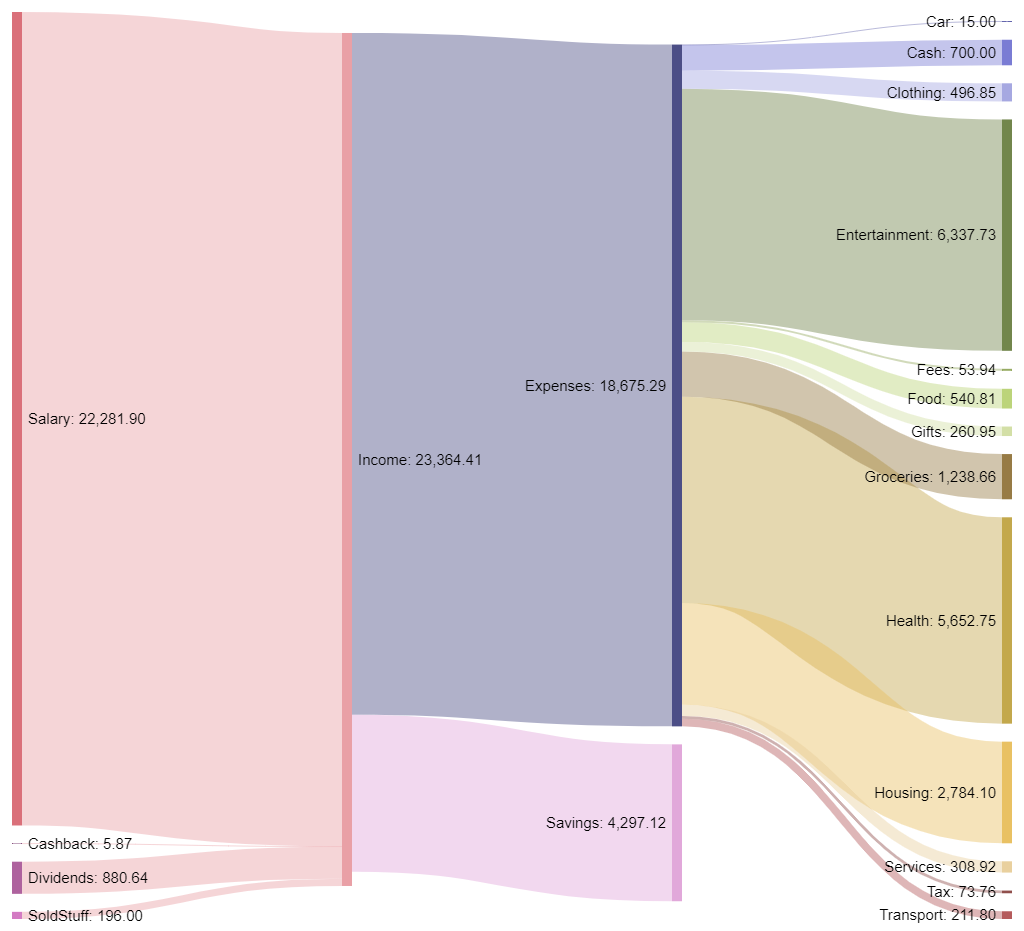

Cash flow: December 2020

Total Income: 22’972 CHF (+10’838 CHF vs. Nov) – Regular salary plus 13th salary. Then 880 CHF dividends from ARKK and VT stocks and minus 446 CHF of sold stuff which however belonged to my side business.

Total Expenses: 18’675 CHF (+15’706 CHF vs. Nov) – Well what shall I say? The family is back and they’re hungry. Hehe, kidding aside. The biggest position was certainly the watch for 6’200 CHF. Then the yearly paid health insurances for 5’649 CHF and December is also a mortgage interest payment month (quarterly) plus maintenance for another 2’434 CHF.

Savings Rate: 18.71% (-56.83% vs. Nov) – As said a rather expensive month and certainly below my target savings rate of 60%+ pre-taxes. But I got a expensive watch which is nice. 😉

Net Worth: 573k CHF (+69k CHF vs. Nov) – Another very nice step towards my net worth goals! Mostly thanks to the crazy Bitcoin rally and the good stock market. I feel like we will pass the 600k CHF mark in January as there will be a regular salary, the 36k USD stocks and a 30k CHF bonus payment. You might understand now why I call December and January the fat months.

Stock Portfolio

Stock Portfolio value: 132’099 CHF (+25’144 CHF vs. Nov)

| Stock Symbol | # Shares | Avg. price | Current price | Unrealized P/L |

| VT | 1201 | 81.63 USD | 92.58 USD | 13’150 USD |

| ARKK | 215 | 96.97 USD | 124.60 USD | 5’940 USD |

| CSCO | 26 | 37.96 USD | 44.76 USD | 177 USD |

| SPXU | 1200 | 20.17 USD | 5.88 USD | -17.15k USD |

| ABBA | 8 | 60.86 CHF | 59.97 CHF | -7 CHF / -8 USD |

| Total | 2642 | N/A | N/A | 2109 USD |

I was getting a bit too concerned about my cash stack of 62k CHF and moved 20k CHF to IB and invested it in VT and ARKK. I also bought some ABBA (Crypto ETF product from 21Shares) as an investment for my sons gift money which he received when he was born. I generously rounded the 400 CHF up to 480CHF and bought 8 shares.

I was particularly happy to see the 880 CHF in dividends however they came with 112 CHF of withholding taxes.

P2P Portfolio

| Platform | Value |

| Bondster | 2913 EUR |

| Crowdestor | 823 EUR |

| DoFinance | 4900 EUR |

| FastInvest | 2242 EUR |

| Flender | 1218 EUR |

| Grupeer | 4787 EUR |

| IuvoGroup | 1353 EUR |

| Mintos | 2256 EUR |

| PeerBerry | 1831 EUR |

| RoboCash | 2899 EUR |

| Swaper | 0 EUR |

| Viventor | 3284 EUR |

| Wisefund | 1000 EUR |

| Total | 29’510 EUR |

December Income from P2P Portfolio: +226 EUR

Calculated XIRR (of the platforms that generated money): 10.10%

Noteworthy updates:

I liquidated a total of 5721 EUR of my P2P Portfolio in December.

- FastInvest has again new delays for payouts… 4 pending payouts requested in December

- Crowdestor introduced a second market on which I sold almost all my investments with 50% discount to make sure to get at least some money back from that platform. A total of 2084 EUR was payed out with some 829 EUR stuck in the Fertilizer scam project.

- Swaper is completely liquidated, this was the platform with the least hassle by far.

Blog statistics

Views: 1780 (+533 vs. Nov) I wrote some more Expat guides and Mr. RIP mentioned me in at least one post.

Visitors: 520 (+38 vs. Nov) Welcome new readers!

Followers: 23 (+5 vs. Nov) Always happy to see new subscribers 😀

I posted a whopping 7 blog posts in December. The monthly update, and my new blog series Expat Guide to Switzerland: Child Care & Insurances, an anniversary post, the Sankey diagram how-to, my story of 31x growth of my salary and another business idea for an app for suggesting the best cashback credit card. I guess my plan to blog more regularly worked out nicely. I will try to keep up that dedicated evening in the week for blogging.

That’s it for this month. Like last month let me know if you like the style and the ordering of topics.

If you have any questions or comments, please leave a message below or contact me by email. I try to answer all comments and emails.

One Reply to “Portfolio Update January 2021 – +69k CHF Net Worth O.o”