Welcome to the Portfolio update of December 2023. Crypto and stocks were pumping, is the dry spell of decreasing income over? In other news, the blog turned 4 years old, wohoo!

Personal update

The job is interesting enough to keep me happy for now. I’m looking to hire my next team member in a Senior DevSecOps role.

My physio therapy ended and the very next day I’ve went to Barcelona with a friend where we walked around 30+ km over the course of 3 days and oh boy did my left foot hurt again. Fortunately it was more sore muscles instead of a regression in the health of the foot. We had some nice weekends with the family and friends in November too. My personal highlight was the visit of the H. Moser & Cie watch manufacturing in Schaffhausen with a group of watch enthusiasts. Absolutely wonderful watches they sell there, unfortunately slightly over my budget (entry price is around 25k CHF). Those guys are a bit the trolls of the watch industry, they’ve mocked the Apple Watch when it was originally released and this year they’ve built a “Troll watch” that mocks almost all popular brands of the industry.

During my Barcelona trip Tesla managed to deliver a faulty Firmware upgrade that killed the Autopilot feature of my Model S, the front and rear cameras are unavailable since. I’ll get it checked at the service center soon.

Crypto rallied quite a bit and the income from the validator business recovered quite nicely after cutting some 30 servers from the bill. All in all a good month.

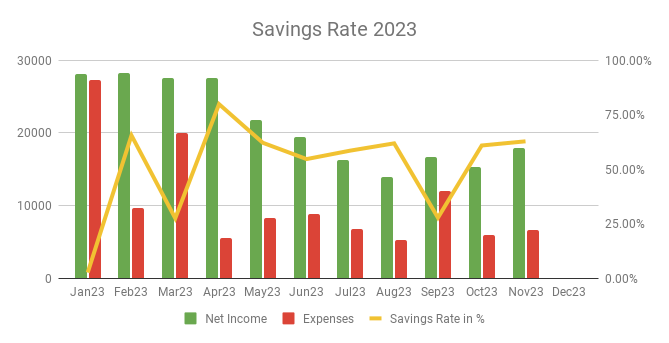

Savings Rate: November 2023

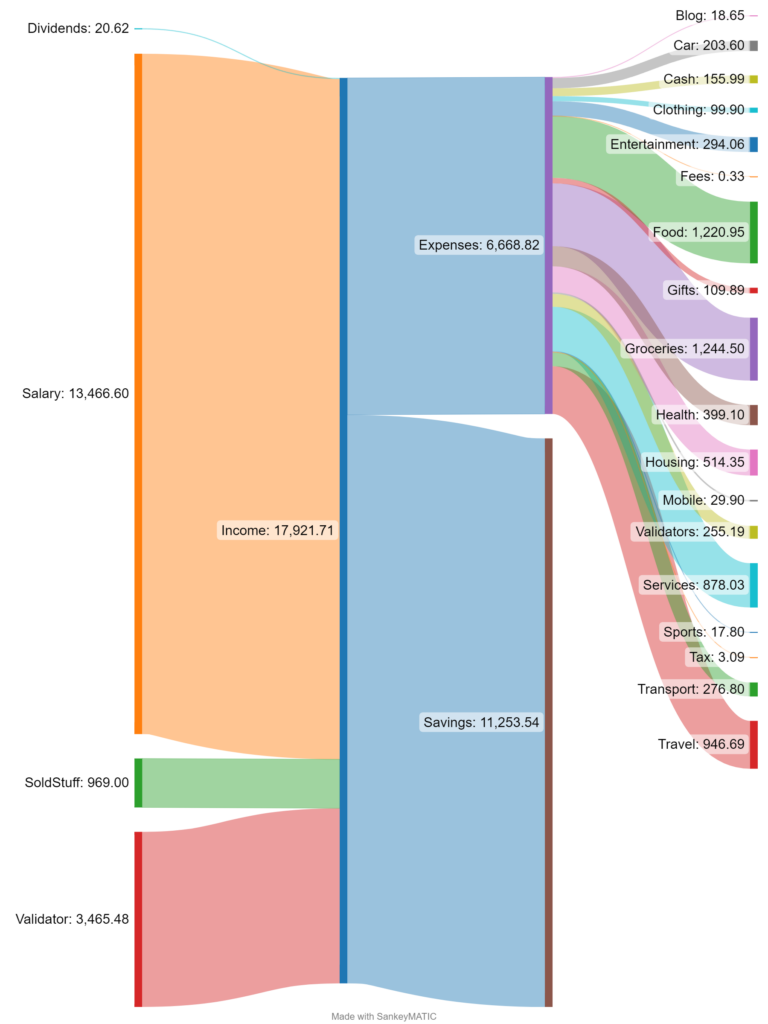

Cash flow: November 2023

Total Income: 17’921 CHF (+2’606 CHF vs. last month) – Regular salary, plus 3.5k CHF validator income, plus 969 CHF of privately sold crypto, plus some dividends. Anything beyond 15k CHF income makes me happy.

Total Expenses: 6’668 CHF (+677 CHF vs. last month) Some early christmas gift purchases. German lessons for my wife, plus almost 950 CHF of splurging on my weekend trip in Barcelona (we did use the taxi quite often to go easy on my foot) around 450 CHF of that was for the flight & hotel. I’ve put my winter wheels on the car and stored my summer tyres and we went for a nice circus show with the family for 256 CHF (tickets & beverages/popcorn).

Savings Rate: 62.79% (vs. 60.88% last month) – Trying to keep it above 60+% savings rate. But knowing that the Health insurance premiums are due in December.

Net Worth: 1.026M CHF (+37k CHF vs. last month) – Bitcoin kept going to 35k+ CHF.

Stock Portfolio

Stock Portfolio value: 101’548 CHF (+14’111 CHF vs. last month)

| Stock Symbols |

| ABBA |

| ABM |

| CMCSA |

| CMI |

| DLR |

| ELBM |

| GRNBF |

| MMM |

| MO |

| MPW |

| RF |

| SXOOF |

| WBA |

| VT |

In November I’ve added another 10k CHF to the stock portfolio to get it back above 100k CHF. The other 4k CHF were gains during the month.

Equity Portfolio

Equity Portfolio value: 80’070 CHF (+0 CHF vs. last month)

I’m patiently waiting for the new fair market value of the company to see if my investment was worthwhile, this probably wont change for a while.

Crypto HODL Portfolio

Current HODL portfolio value: 299’413 CHF (~7.7 BTC / 382 KSM / 4517 DOT / 100600 CRO / 2.2k+ PHA) (+28k CHF vs. last month)

Majority of the net worth gains.

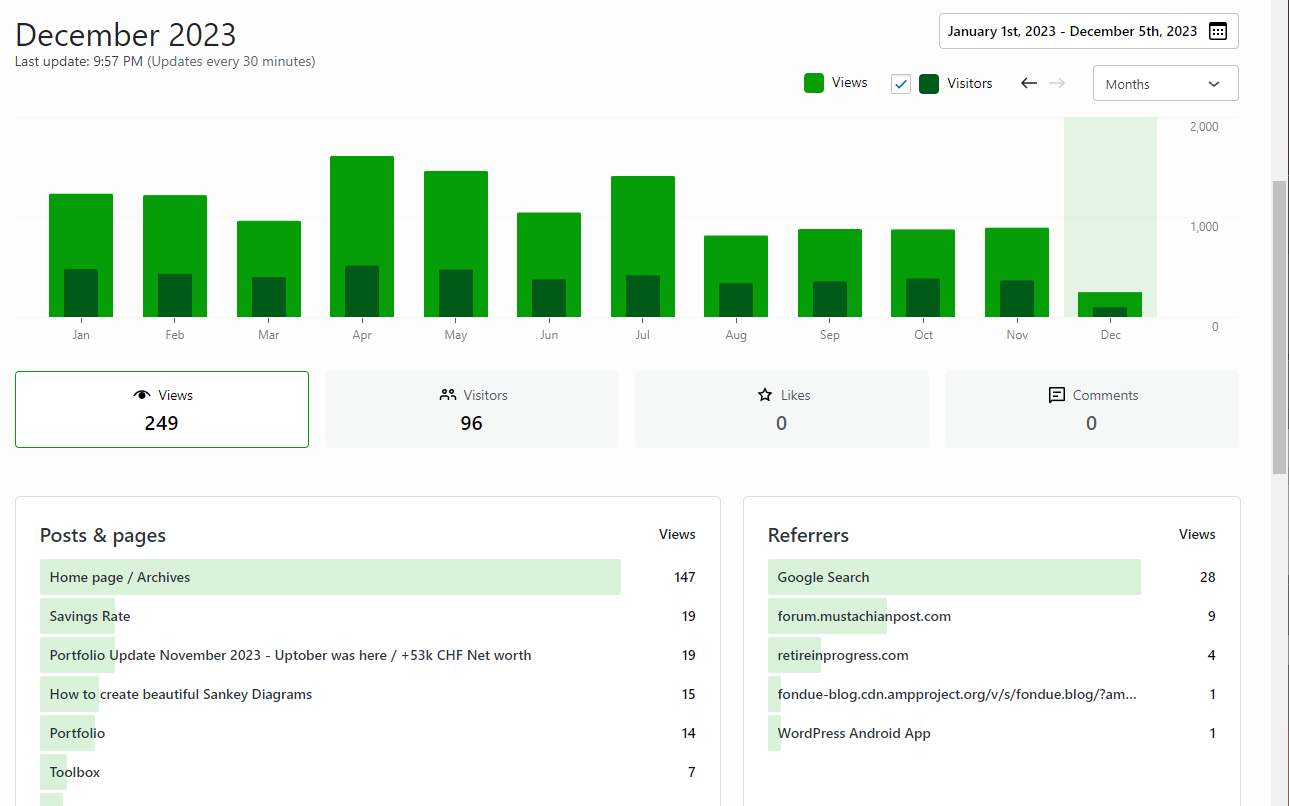

Blog statistics

Last month was same same as this month…

I posted 1 blog post last month, the monthly update. If you have ideas or are interested in more details let me know in the comments.

That’s it for this month. Like last month let me know if you like the style and the ordering of topics.

If you have any questions or comments, please leave a message below or contact me by email. I try to answer all comments and emails.

ugliest watch ever.. 😀

Absolutely, their CEO also had to apologize to the 10-13 brands they mocked. But still funny they actually built one.

Hi Mr. Cheese,

I am following your monthly blog and I am still puzzle that you pay only 20’000 .- of taxes per year based on your income. Do you leave in Canton of Zoug?

Another point, why you do not include your taxes in your monthly calculation of saving rate, you artificially push-up your saving rate.

Thank you in advance for your feedback, cheers 🙂

Correct that’s how low taxes in Zug look like. They also had some post pandemic tax reductions in the last two years.