Welcome to the Portfolio update of February 2022. Back in Switzerland without family, got Corona infected and other stories of how our net worth lost 20k CHF.

Personal update

In January I’ve worked in Mexico for two more weeks and eventually returned on January 15th to Switzerland. One day later I would have had my booster appointment (on a Sunday at 07:55) however after what I though was a rough night due to jetlag a proactive Corona self-test turned out positive. Fucking great… cancelled the booster appointment and got a PCR test instead. That turned out positive and therefore put me in quarantine for the next 5 days. Fortunately besides the rough night with chills and fever, the Sunday with a headache and a Monday with light cold symptoms I managed to survive the infection.

My family decided to stay 2 more weeks to celebrate my mother in law’s birthday. After eventually surviving the quarantine I tried to enjoy live to the fullest possible. Several nights out with friends. A missed business trip because of an obviously still positive PCR tests 9 days after the first. And unhealthy but frugal eating habits.

On the last day of January Corona once again foiled my plans by cancelling my families flight back. (A big fuck you to Cheapoair for not informing us in any form or way). So wasted another 2 hours in some silly chat support to hopefully get my family back on February 5th. We’ll see.

Cryptos, stocks and therefore net worth kept dropping in January but thanks to my clever accounting with counting the watches towards my net worth the loss was acceptable.

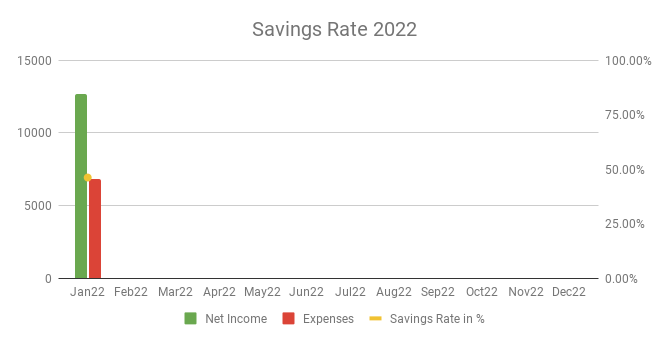

Savings Rate: January 2022

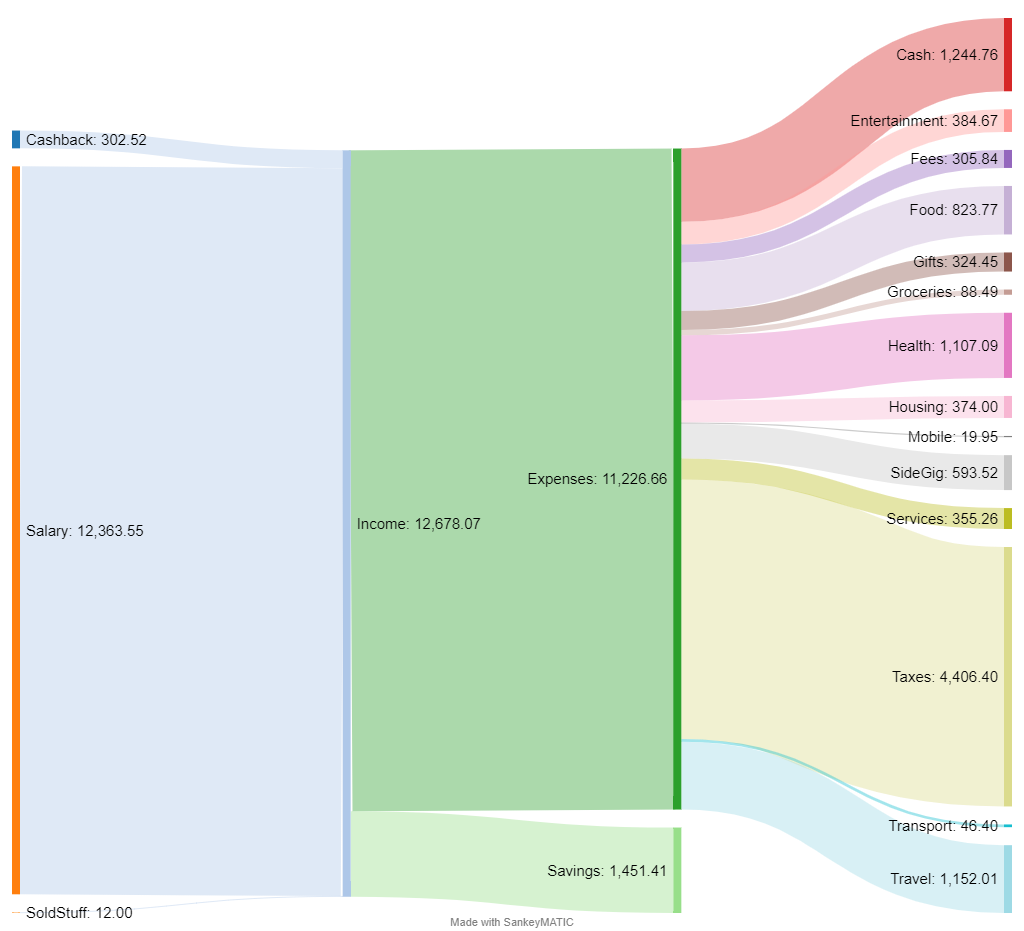

Cash flow: January 2022

Total Income: 12’678 CHF (-2’965 CHF vs. December) – January used to be one of the fat months at mega corp, I’ll miss them. Noteworthy nice thing 302 CHF from crypto.com cashback and referrals! Thanks to everyone that signed up.

Total Expenses: 6’820 CHF (-9’833 CHF vs. December) (incl. Taxes 11’226 CHF) – As a nice welcome gift I got some tax invoices over 4’406 CHF for 2020 taxes. 1’152 CHF travel expenses included the 500 CHF rebooking fee for my family and a 300 CHF business class upgrade for my 11h flight from Mexico to Madrid. 593 CHF Side-Gig expenses include the yearly server fees (including this blog) plus 60 CHF for the new Polkadot/Kusama validators I run. I will try to include the income of the validators in the future. Lots of cash expenses for several payments in Mexico. And a new air humidifier for home.

Savings Rate: 46.20% (+52.66% vs. December) – Not exactly on target even excluding taxes. I do expect March/April and October onwards to be more rewarding as the bonuses from the last and current job start to trickle in.

Net Worth: 1.015M CHF (-20k CHF vs. December) – Still the wrong direction, I hope the stocks and crypto to recover noticably.

Stock Portfolio

Stock Portfolio value: 257’744 CHF (-9’763 CHF vs. December)

| Stock Symbol | # Shares | Current price | Unrealized P/L |

| VT | 1690 | 102.51 USD | 22’872 USD |

| ARKK | 371.58 | 75.43 USD | -13’449 USD |

| AVUV | 552.72 | 77.23 USD | 2’536 USD |

| AVDV | 436.51 | 62.47 USD | -144 USD |

| ABBA | 48 | 16.98 CHF | 328 USD |

| Total | 3092 | N/A | 12’143 USD |

The news are full, January was one of the worst and most volatile months in a long time. ARKK mostly pulled my portfolio down. The ETF is full of meme & tech stocks that bleed heavily.

This month I did invest the regular 5’000 CHF again. But instead of buying the trusted VT I’ve added Fundsmith Equity “T” to my portfolio, unfortunately the purchase itself only was executed on the 1st of February that’s why it will only show up next month. I will ultimately replace ARKK with the Fundsmith fund. I personally don’t believe that Cathie Woods can turnaround ARKK in a useful timeframe.

Crypto HODL Portfolio

Current HODL portfolio value: 229’492 CHF (~6.2 BTC / 50+ KSM) (-45’376 CHF vs. December)

In January I’ve earned 2.2 KSM (457.24 CHF) with my Kusama validator, I’ve also fulfilled the requirements to become a thousand validator program supported Polkadot validator which already showed some promising returns in early February.

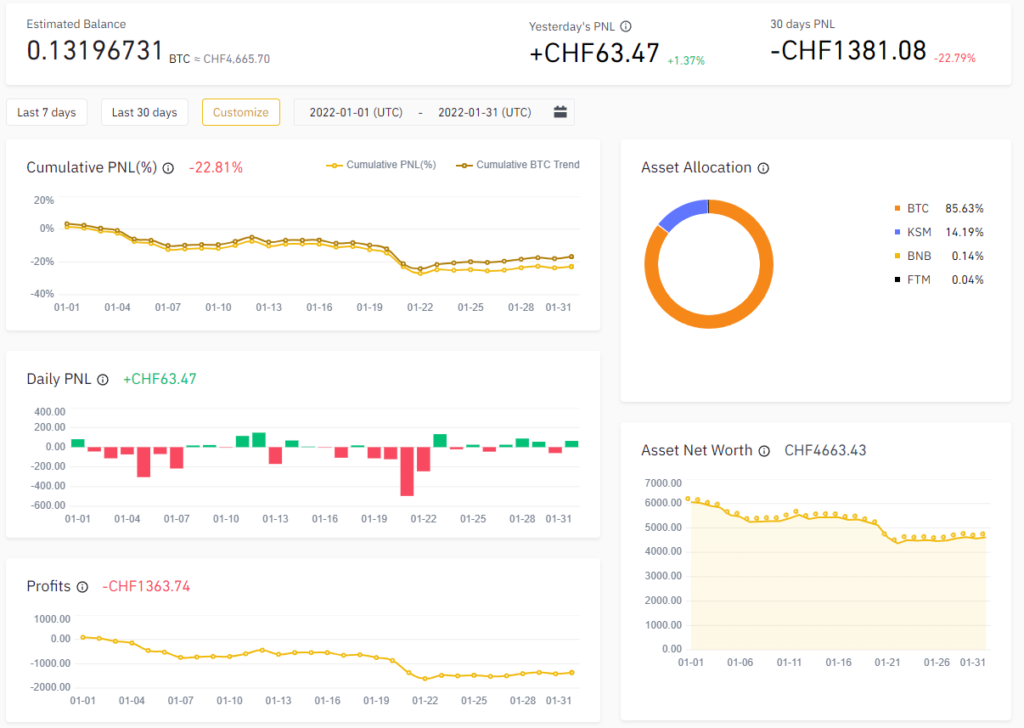

Crypto Gambling Portfolio

I optimize for BTC growth in this small crypto portfolio.

Gains/Losses this month: -1’363 CHF (-0.0063586 BTC vs. December)

I’ll just post my Binance portfolio picture here:

I didn’t trade much but when I traded I underperformed BTC. Waiting for another bull run.

P2P Portfolio

Still trying to abandon the P2P assets as there were too many scams.

January Income from P2P Portfolio: 12.28 EUR

Noteworthy updates:

I liquidated a total of 179 EUR of my P2P Portfolio in January.

Blog statistics

Views: 1963 (+135vs. December) nice more views is always good!

Visitors: 602 (-49 vs. December) huh so less readers visiting more often? Works for me 🙂

Followers: 45 (+0 vs. December) same same.

I posted 1 blog post in January, the monthly update. If you have ideas or are interested in more details let me know in the comments.

That’s it for this month. Like last month let me know if you like the style and the ordering of topics.

If you have any questions or comments, please leave a message below or contact me by email. I try to answer all comments and emails.

If your Sankey diagram is right, your expenses were 11,226 CHF and your income was 12,678 CHF. However you claim that your savings rate is 46.2%. The math doesn’t seem to check out.

Also, I hope your family will fly business, otherwise that looks very douchey.

Easy to criticize people with a burner email address isn’t it?

The savings rate is calculated w/o taxes. And based on the mentioned ~7k CHF expenses (11k – 4k taxes).

I’m not sure why it would be douchy if my family doesn’t fly business, my wife and son have the gift of being able to sleep 5-7h during flights no matter the seat. While I’m 1.8m and barely close an eye during flights. But thanks for your considerations.

I don’t understand the NW -20k number

Earning were 1.4k higher than expense

stock -10k

Crypto HODL -45k

Crypto gambling -1.3k

Total -55k

I’ve added 25k in watches as assets to my net worth. Plus I got 10k payed out from the new mortgage (basically all amortisation payments of the last 5 years were payed back). Sorry for the intransparency.