Welcome to the Portfolio update of February 2023. A rather high income & high spend month that was.

Personal update

January started rather quickly with me going to work again on 2nd of January. SOC2 certification evidence was all provided and I got handed a rather important project to finish in Q1. So I was pretty busy work-wise.

In early January I’ve also completely ditched my crypto.com credit card, they’ve started charging 2% fees for CHF payments after mid of December. Completely unacceptable so I’m back to good old Revolut Metal instead.

All the regular kids activities started again too, swimming lessons, twice a week play group. In mid January we’ve attended some information event about the kindergarden entry of our son. Also new D&D sessions begun, this time around we play The One Ring 2nd Edition with a bunch of friends. Extremely nerdy hobby but I like it a lot. I’ve also kept up my weekly bouldering session, it’s really nice to slowly see the body transformation (upper body muscles) and noticing the technique improvements.

Also a new watch arrived in early January, a Zeroo T4 The Archer very cool watch with a tourbillion movement.

I also finally settled my generous gift voucher for my wife’s 40th birthday by buying a ring for her.

In February I will celebrate my birthday with a bunch of friends & family, go for a business trip to Paris (and to NFT Paris) and who knows what else that month will have ready for me.

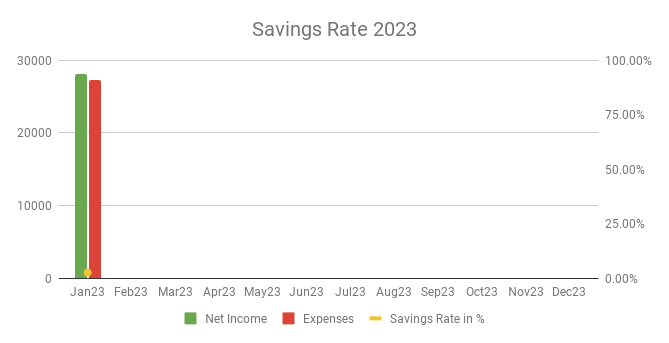

Savings Rate: January 2023

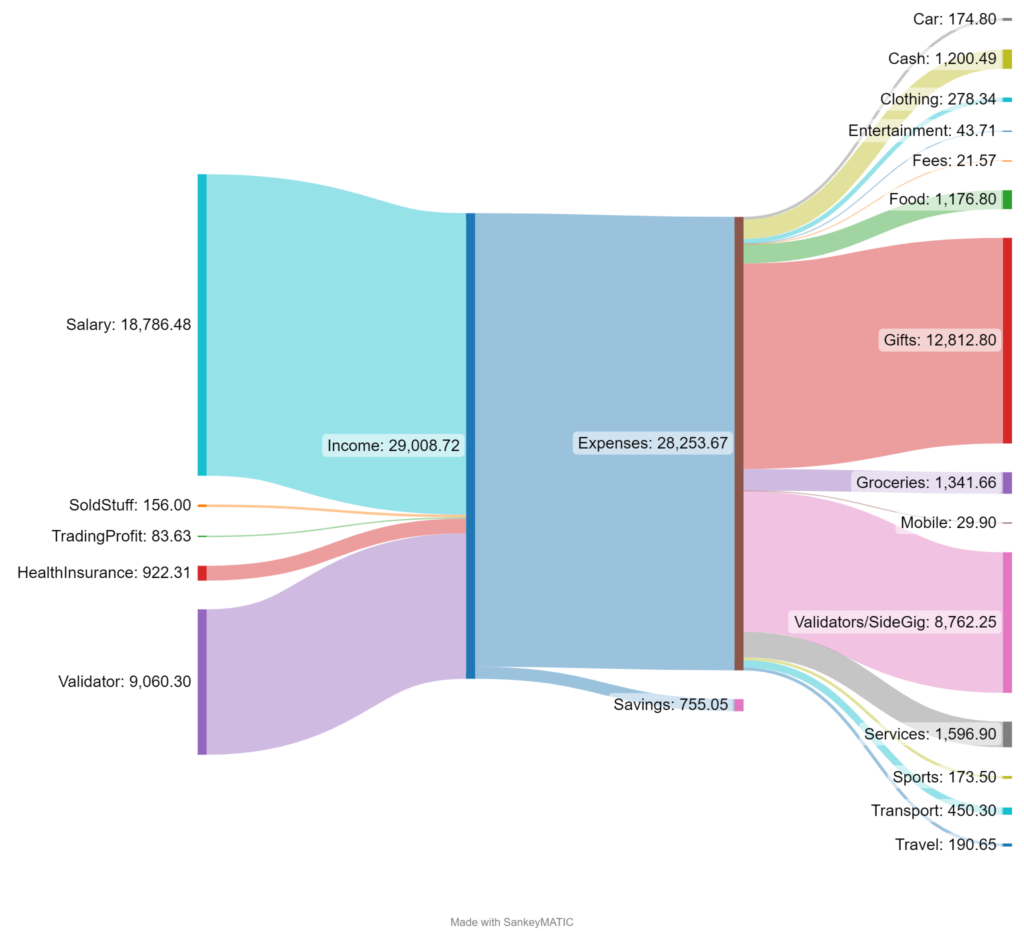

Cash flow: January 2023

Total Income: 28’086 CHF (-929 CHF vs. last month) – Regular salary (~18.5k CHF) and the validator income of ~9k CHF and some 156 CHF bucks of sold stuff. The Sankey diagram above also includes 922 CHF of health insurance reimbursements.

Total Expenses: 27’331 CHF (-582 CHF vs. last month) yeah well… I’ve spent almost 13k CHF on a ring for my wife, she had some fair points that after my 5th luxury watch she deserves something shiny too. 6k CHF of that are deferred from a birthday gift voucher I gave her on her birthday last May. Other large positions were validator fees at 3.8k CHF, then social security adjustment payments from the validator income at 4k CHF. I’ve also shipped my old 82″ TV for 100 CHF to the new owner of it. Then I’ve spent 444.82 CHF on a new tool for stock portfolio analysis called FastGraphs. Then some other yearly invoices like the 335 CHF of Radio/TV fees.

Savings Rate: 2.69% (-1.11 vs. last month) – well, let’s hope for next month. Also “noice”!

Net Worth: 969k CHF (+59k CHF vs. last month) – Stocks up, cryptos up, nice gains for sure.

Stock Portfolio

Stock Portfolio value: 244’441 CHF (+5’750 CHF vs. last month)

| Stock Symbol |

| VT |

| ABBA |

| GRNBF |

| SXOOF |

| ELBM |

| TSLA |

| RF |

| WBA |

| MMM |

| MO |

| ABM |

| CMCSA |

I’ve scored a very nice 60% gain on my 5k CHF TSLA investment after buying after seeing this video. Which got me interested in stock picking again. So I’ve divested the rater flat or at minor loss trading ETFs (AVDV, AVUV, Fundsmith) and bought some new companies with the goal for a dividend growth portfolio. All the mentioned new positions above have a history of paying 3%+ dividend and increasing the dividends every year for 5-10+ years. We will see how it goes. I can certainly recommend the tool to everyone that want’s to quickly figure out if a company is fairly valued.

Crypto HODL Portfolio

Current HODL portfolio value: 188’799 CHF (~7.7 BTC / 193 KSM / 1898 DOT / 92100 CRO / 2.2k+ PHA) (+49’407 CHF vs. last month)

Best horse in the stable, Bitcoin went from 15k to ~22k CHF, I’m hopeful that this is the next bull cycle for Bitcoin. The validator income from Phala could have been better, we’ve migrated some funds from the StakePools to Vaults which made us lose on some mining rewards. At least the PHA price right now is also rather good.

Blog statistics

Views: 1233 (-240 vs. last month) – Classic January hole?

Visitors: 479 (-32 vs. last month) – Less views, less viewers 🙁

Followers: 51 – (+1 vs. last month) – Nice, welcome new subscriber!

I posted 1 blog post last month, the monthly update. If you have ideas or are interested in more details let me know in the comments.

That’s it for this month. Like last month let me know if you like the style and the ordering of topics.

If you have any questions or comments, please leave a message below or contact me by email. I try to answer all comments and emails.

Hi, just wondering were you charged 2% fees for your crypto.com card? Their communication about it was unclear on whether the 2% applied for Switzerland so I reached out to them about it and they reassured me that we only have to pay the 0.2% rate.

So I’m still using mine, it’s better than nothing but honestly barely worth it.

I was charged 2% which I believe came from the fact that my level was downgraded to Royal Indigo with the 1500 EUR forex limit per month (it did align with the amount spent until 19th of December). Wierdly enough I still got the 3% cashback from the Icy White tier. My understanding was that the level will stay until someone unstaked which clearly wasn’t the case. I also never got the icy white card nor the private member club swag, so all in all a rather disappointing experience. I’ve unstaked the CRO and moved them to the DeFi wallet where they generate 10% APY until I dump them when/if the price recovers.

Weird! Are you sure there’s a 1500 limit? I’m only on the ruby tier and I don’t think I have that limit.

Very strange they downgraded you also without you unstaking.

All these inconsistencies definitely aren’t confidence inspiring.

https://help.crypto.com/en/articles/5977463-crypto-com-visa-card-fees-and-limits-europe I might have even been downgraded to the Ruby Steel level which is at 4k EUR/month. All I know is that there where foreign exchange and/or interbanking fees for transactions after mid December.

That Validator income. I would really like to see a detailed post on it. Any plans?

Hope you will some day explain us more in details what that phata validator is 🙂