Welcome to the Portfolio update of January 2025. Happy new year, except the net worth did not go up…

Personal update

Happy new year dear readers!

Job wise we had a bit of a calmer month with the company christmas party being the highlight of the months (it was Mexico themed and we had a mechanical bull setup in the office). On the 20th of December my 2 weeks of vacation started.

In December I tried playing Pickleball for the first time with a friend I made back in November, it was fun but kind of intense, especially when playing Singles. On the 16th of December I’ve ended up at a 100k USD Bitcoin party with an unexpected after party at a multi-millionaire (or maybe billionaire) mansion (which happens to be a historic castle in Zug). Pretty crazy how that family is living and the material possessions they’ve got (400+ (historic) weapons & 100+ watches, etc.). I ended up leaving the place at around 06:00 in the morning. Slept a few hours and then went bouldering with my coworker and the other guy that regularly joins. I was rather hung over but it certainly was a great memory/story.

Christmas itself went rather uneventful, the regular gift exchange within our family and with my extended family. My gift highlight were watch parts which I’ve custom ordered from AliExpress and then assembled myself (setting a second hand is a massive PITA!). For new years eve we were kind of late for planning something so we ended up cooking burgers at home and went to bed before midnight.

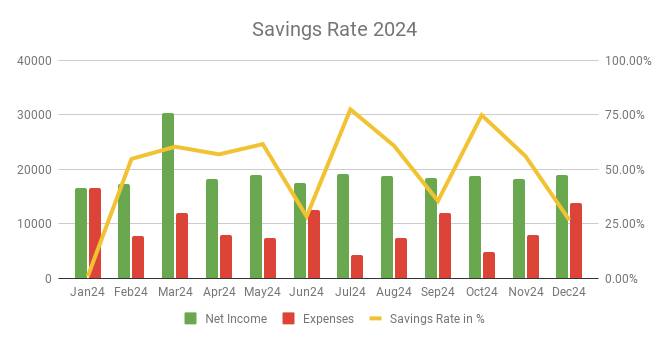

Savings Rate: December 2024

Cash flow: December 2024

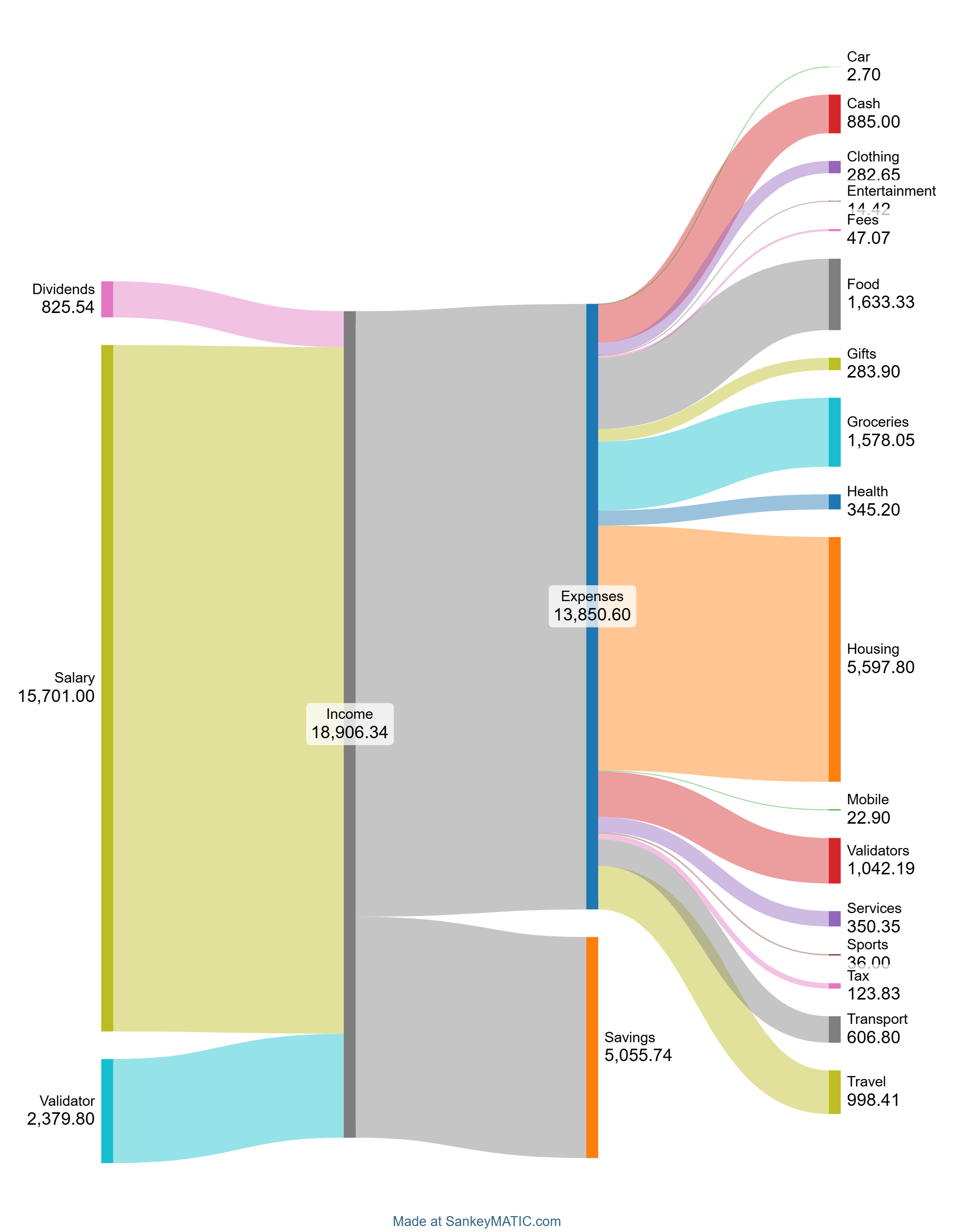

Total Income: 18’906 CHF (+740 CHF vs. last month) – Regular salary, ~2.4k CHF from validators, 825 CHF from dividends. I’ve got another validator into the Polkadot cohort of the new program which should yield a nice income for the next 3-4 months.

Total Expenses: 13’850 CHF (+5’852 CHF vs. last month) Big positions were Housing (quarterly mortgage, plus maintenance fund), Cash (mostly for gifts & allowance for wifey), Transport (some Uber rides from/to parties) and Travel (I planned a trip to Catania, Sicily with my friends).

Savings Rate: 26.74% (vs. 55.97% last month) – Meh… but it’s ok as long as there are some savings.

Net Worth: 2.017M CHF (-36k CHF vs. last month) – some attentive readers might note that it should have only been ~17k CHF however I found some accounting mistakes when doing the year end review which made it an effective delta of 36k CHF from last month.

Stock Portfolio

Stock Portfolio value: 148’674 CHF (-2’091 CHF vs. last month)

| Stock Symbols |

| ABBA |

| AMZN |

| CMCSA |

| EBAY |

| ELBM |

| MMM |

| MO |

| MPW |

| MRK |

| PATH (UI Path) |

| SSTK (Shutterstock) |

| WBA |

| VT |

Setting that stop loss didn’t work out for PATH and SSTK as they didn’t trigger. I need to review how to set stop loss orders for selling positions if they fall below a defined price on Interactive Brokers

Equity Portfolio

Equity Portfolio value: 80’070 CHF (+0 CHF vs. last month)

Nothing changed on that front. This position will be growing by ~30k CHF/year around March.

Crypto HODL Portfolio

Current HODL portfolio value: 745’379 CHF (~8.35 BTC / 574 KSM / 7590 DOT) (-26k CHF vs. last month)

I’ve bought more BTC for another 10k CHF to lower the cash position, that yielded 0.11 BTC.

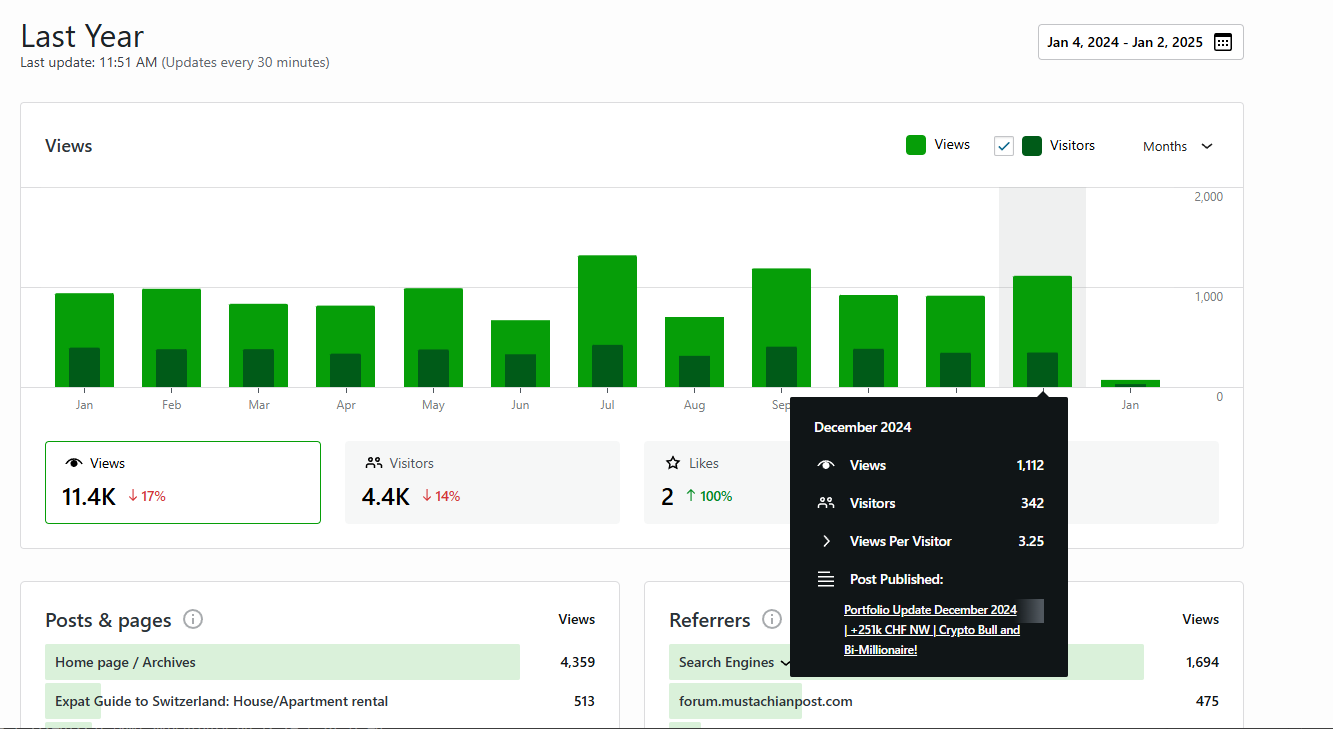

Blog statistics

I posted 1 blog post last month, the monthly update. If you have ideas or are interested in more details let me know in the comments.

That’s it for this month. Like last month let me know if you like the style and the ordering of topics.

If you have any questions or comments, please leave a message below or contact me by email. I try to answer all comments and emails.

What is the meaning of the picture you chose for your October update?

It was referring to the nice weekend excursions in the Swiss nature/alps.

Hum. Perhaps we are not seeing the same pictures but for me the nice outing landscape appears on the November update. The October one is see is, shall we say, a visual ode to vitality and germinal potential.

Ah that one was in reference of a stain I had to remove at the skin doctor which left a scar on my arm.

Did you also see the big gold nugget at the party?

Blog Article Idea:

Since you’re invested in VT (Vanguard Total World Stock ETF), I’d be curious to know how inheritance tax applies to it. There are varying opinions circulating online. For instance, Marc Pittet believes the rate is 0%, while Vontobel suggests a different approach, explaining it as:

1 ÷ 5 × tax exemption for US persons = applicable tax exemption threshold for Swiss estate

So, what’s the truth?

No the gold nugget wasn’t there but some nice JLC watch box under the Christmas tree.

No idea regarding the inheritance tax regarding VT. I’d assume there’s no taxation as the portfolio doesn’t fall under US tax law.

Ups, one line was missing:

Vontobel says this example calculation is for CHF 1 million in US assets with an estate of CHF 5 million.