Welcome to the Portfolio update of July 2020. -16k CHF Networth and a negative Savings Rate. Fuck x(

Let’s see how the the P2P Portfolio performed.

I passed the motorboating theoretical exam in the beginning of June. But that’s about it with good news (well July will be better because of some stock vesting, stay tuned). We kind of splurged quite a bit this month and also a hefty provisional tax bill killed the savings rate.

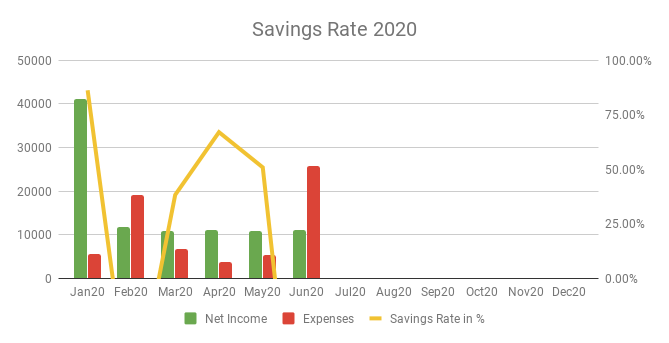

Savings Rate: June 2020

Total Income: 11’088 CHF – base salary plus ~100 CHF in dividends from my VT stocks and 21.50 CHF cashback.

Total Expenses: 25’669 CHF – Ouch, that one hurts. 16k CHF tax bill ate some of the savings aka emergency fund (I keep them in one account). The bad news is that’s not the final bill for 2019 just the provisional for 2020. There was also the quarterly 1’330 CHF maintenance & renovation fond of the house. And I bought an A/C for 2’002 CHF because working from home with increasing temperatures in a too well insulated home gets unbearable at 27°C indoors. But I will get some 700 CHF back from my employer in July, so that’s nice. We also splurged a bit on the groceries we hosted a party for 15 people which cost us roughly 350 CHF but it was worth to see my team mates again after such long time of working from home.

Savings Rate: -131.50% – Ouch again. The yearly saving rate average collapsed to 7.83% way under my goal of 35%. However in July there will be stocks worth 26’106 USD and the regular salary, plus the reimbursement for the A/C. On the expense side there might be the final tax bill for 2019 which might be another 12k CHF, we will see.

Stocks: My SPXU bet is currently at -20.58k CHF double Ouch. I will hold on to it a bit longer, I’m still convinced the stock markets are overbought and not reflecting reality thanks to the FED.

I upped my position in VT to 282 stocks currently worth 21.2k CHF with a nice unrealized gain of 2.5k CHF. I also bought 1000 LOIL for 3’268 CHF my bet is that Oil will go back to 20-30 USD before it becomes obsolete.

Net Worth lost some 16k CHF to 402k CHF see my portfolio page for details about the asset allocation.

P2P Portfolio

| Platform | Balance | Actual XIRR |

| Bondster | 5081 EUR | 13.00% |

| Crowdestor | 4744 EUR | 6.00% |

| DoFinance | 4845 EUR | 13.20% |

| FastInvest | 2901 EUR | 19.27% |

| Flender | 1049 EUR | 15.62% |

| Grupeer | 4787 EUR | 5.71% |

| IuvoGroup | 5113 EUR | 21.61% |

| Mintos | 6077 EUR | 17.36% |

| Monethera | 2047 EUR | 10.23% |

| PeerBerry | 5109 EUR | 21.37% |

| RoboCash | 4892 EUR | 12.86% |

| Swaper | 5128 EUR | 12.04% |

| Viventor | 4811 EUR | 7.31% |

| Wisefund | 1000 EUR | 11.32% |

| Total | 57589 EUR | 11.73% |

May Income from P2P Portfolio: +320 EUR

Calculated XIRR (of the platforms that generated money): 13.35%

FastInvest sent me a mail recently cancelling my affiliate partnership with them. They don’t like critical voices against their platform, lol. They also still owe me 1’128.05 EUR in pending withdrawals and the other 2’901 EUR which are still invested.

I will definitely write-off Monethera next month as the platform is dead. I’m not participating in any law suit as I find it silly to pay 1% of my investment to some random person up front. Sounds like a found meal for scammers.

I will have 10’042 EUR to invest in July but I’m not fully clear yet how I should distribute it.

Let’s dive into the detailed statistics and comments on each platform:

Bondster

Balance: 5’081.73 EUR

Income: 42.71 EUR

Platform XIRR: 13.57%

Calculated XIRR: 13.00 %

Bonster starts to live up to their displayed interest rate with 13% shown and matched being pretty close together.

There are currently 74 loans worth 1’242 EUR delayed for more than 60 days. I hope the buy back guarantee kicks in soon. I have about 50% of my loans with Kviku which might be a bit of a diversification risk.

For Bondster I use the following AutoInvest settings: Minimum interest rate: 15%, maximum loan term: 12 months, buy-back guarantee: yes

| If you would like to try Bondster and get 1% cashback on all investments in the first 90 days, please use this link to register. |

Crowdestor

Balance: 4’744 EUR

Income: 8.17 EUR

Platform XIRR: 19.17 %

Calculated XIRR: 6.00 %

A measly 8.17 EUR from the Meat Chef project were paid this month. Since End of May I’m waiting for the payment of the Fertilizer Project. Crowdestor claims that sending the money thru 3 banks takes time because each of them executes some AML processes. However what shitty banks do you have to have if that process takes over a month? Ok maybe sending around 850’000 EUR is not that easy, who knows.

For some reason I didn’t get any update email on the latest round of the fund raising for the platform itself. Sending emails is hard nowadays tho.

| If you would like to try Crowdestor and get 1% cashback on all investments in the first 90 days, please use this link to register. |

DoFinance

Balance: 4’847.80 EUR

Income: 43.62 EUR

Platform XIRR: 12 %

Calculated XIRR: 13.20 %

I withdrew another 42.87 EUR from the platform because they still don’t offer new loans, so the profits would be just sitting there.

| If you would like to try DoFinance yourself feel free to register thru this link. There is however no bonus nor support for my blog for using this link. |

FastInvest

Balance: 2’901.61 EUR

Income: 0.46 EUR

Platform XIRR: 12.99 %

Calculated XIRR: 19.27 %

Still no movement on my 1k EUR pending withdrawals. Also there were only two repayments in all of June worth 6.74 EUR.

They can’t pay out money but they have time and money to redesign their homepage, potentially to attract more people falling for their scam.

I do NOT recommend to invest money in FastInvest at this point.

Flender

Balance: 1’049.29 EUR

Income: 4.01 EUR

Platform XIRR: 10.33 %

Calculated XIRR: 15.62 %

Not much to report with Flender.

I will probably invest some of the mentioned money into Flender again.

| If you would like to try Flender and get 5% cashback on all your investments and 10% interest in the first 30 days, please use this link to register. |

Grupeer

Balance: 4’787 EUR

Income: 0 EUR

Platform XIRR: N/A (not available)

Calculated XIRR: 5.71 %

All account were reverted to the state of end of March (my pending withdrawal money appeared again, yay). And they claim they will start paying investors in July, we will see.

I do NOT recommend Grupeer at this point.

IuvoGroup

Balance: 5’113.21 EUR

Income: 40.84 EUR

Platform XIRR: 13.48 %

Calculated XIRR: 21.61 %

The platform is paying steadily. Unfortunately they seem have to ran out of 13% interest loans.

My Autoinvest settings look like this: Maximum in one loan 10 EUR, min interest 12.5%, loan status current, all 3 buy-back options. No other limitations.

I will consider this platform for the next investment round.

| If you would like to try IuvoGroup yourself and get up to 90 EUR when you invest 2500 EUR, please use this link to register. |

Mintos

Balance: 6’077.42 EUR

Income: 78.73 EUR

Platform XIRR: 15.68 %

Calculated XIRR: 17.36 %

I restructured my loans a bit and tried to sell all loans with interest rates below 12% on the secondary market. In return I grabbed some more of the 20%+ interest rate loans.

There must have been either a significant influx of money or a disappearing of some laon originators as right now there are only 16.5% loans on the secondary market available.

I will very likely throw another 1’000 EUR at it in the July investing round.

My Autoinvest settings look like this:

A high risk second market profile with all LOs with buy-back with 16.5%+ interest rate up to 3 months, no diversification across LOs, 5 – 25 EUR per loan.

A maximum interest profile with all LOs with buy-back with 17%+ interest rate up to 6 months terms, with diversification across LOs, 10 – 50 EUR per loan.

| If you would like to try Mintos yourself and get 1% cashback of all invested capital in the first 30 days, please use this link to register. |

Monethera

Balance: 2047.23 EUR

Income: 0.00 EUR

Platform XIRR: 19.05 % (average from 20.1 % and 18 % projects)

Calculated XIRR: N/A

Monethera is probably dead. The technical review of Monethera showed clearly that this platform is a scam. I will write the money off next month (this time for real, I promise…).

I definitely do NOT recommend to invest in this platform at this point.

PeerBerry

Balance: 5’109.89 EUR

Income: 55.66 EUR

Platform XIRR: 14.30 %

Calculated XIRR: 16.33 %

Not much to say here, pretty reliable. The account experienced some cash drag, which I manually invested in some 10.5% loans.

My Autoinvest settings have two profiles:

One for 15.0%+ loans with current status, buyback and any duration, max amount per loan 100 EUR.

One for 9%+ loans with current status but only 1 months remaining, max amount per loan 20 EUR.

| If you would like to try PeerBerry and support the blog, please use this link to register. |

Robo.cash

Balance: 4’892.38 EUR

Income: 27.29 EUR

Platform XIRR: 13.05 %

Calculated XIRR: 12.86 %

Robo.cash now accepts up to 125’000 EUR per investor

I will try to lift the invested amount to 5’000 EUR in July.

| If you would like to try Robo.cash and support this blog, please use this link to register. |

Swaper

Balance: 5’128.59 EUR

Income: 69.18 EUR

Platform XIRR: 9.39 %

Calculated XIRR: 12.04 %

Pretty nice income those 69.18 EUR. Looks like Swaper is not suffering from Corona too much at this point.

I will try to raise my account to 6’000 EUR in July.

| If you would like to try Swaper and support this blog, please use this link to register. |

Viventor

Balance: 4’811.22 EUR

Income: 4.76 EUR

Platform XIRR: 15.53 %

Calculated XIRR: 7.31 %

I’m still not very happy with Viventor. They now show funds in transit and it shows me 1’261 EUR from Twinero and 7.53 EUR from Monify. Not sure if they want me to write that amount off or something.

My Autoinvest settings are the following: max amount per loan 20 EUR, 15.9 – 16% loans only, up to 12 months term, all loan types, all countries, all LOs, buyback & payment guarantee.

| If you would like to try Viventor and earn 1% cashback on all investments in the first 30 days, please use this link to register and the code: XE0180 during the registration. |

Wisefund

Balance: 1000.00 EUR

Income: 0 EUR

Platform XIRR: 17.4 %

Calculated XIRR: 11.32 %

After my Technical review of Wisefund I will definitely NOT invest more money in this platform. Too few employees, too many red flags from the owner. However the quick withdrawal processing gives me hope that I see my still invested 1000 EUR again at some point.

No payments were made in June either however they started to post new projects and sent some updates on existing projects. The “Video Content Monetization” project however was not mentioned. The project page promises in-depth updates within a month posted on 19th of May… no futher update since.

As you can think due to the huge outflow of money there was not much left to invest in the P2P platforms. I did however put aside 10’000 EUR of the 26k USD vested/sold stocks to invest in July.

Blog statistics

Views: 483 (-217 from May) Ouch

Visitors: 140 (-42 from May) :'(

Followers: 10 (+0 from May)

Overall an ok month. My job and the boat license kept me very busy for the whole month, we’ve also ramped up restaurant visits and having guests at our home again. That all comes with the trade-offs for the blog unfortunately.

I didn’t post anything else in June besides the monthly update. Mea culpa.

My boat driving practical exam is in one and a half weeks and then I should definitely have more time for the blog again.

That’s it for this month. Like last month let me know if you like the style and the ordering of topics.

If you have any questions or comments, please leave a message below or contact me by email. I try to answer all comments and emails.

Did anyone ever receive an email from Crowdestor about the fund raising? I did not log in for a while so i missed the whole thing! Maybe it’s only meant for die hard fans that login everyday to check on their investments…

As far as I know there were already 4 rounds and yeah I don’t remember seeing it in a mail either.