Welcome to the Portfolio update of July 2022. Stocks and Crypto were in a free fall and took a good junk of our net worth with them… we’re down a whopping 217k CHF from our ATH net worth, that’s almost the money I would have spent on a new car… meh.

Personal update

June kicked off with a nice company retreat in Tenerife, 3 days of networking and discussing crypto & finance and some fun activities too. Some party where the company seemingly booked “The Roop” (never heard of that band and not upset to never hear them again).

I did the clever choice and flew my wife and son in for an added 7 days of vacation. We really enjoyed Tenerife, very mild climate (18-26 C all year round), heated swimming pools and some nice hotels. Our son was longer in the water than outside during these days, I tried to teach him swimming a bit but he was busy chilling in the water. Some nice day trips with the rented Jeep Wrangler and then back again to Switzerland.

Back home I immediately caught another cold (allegedly not COVID, but something bacterial) and was stuck (working from) home for 1.5 weeks. At the same time observing those dropping markets obliterating almost a Tesla Model S worth of net worth. Sad stuff.

On a positive note I’ve managed to expand the little joint venture into running a bunch more validators/collators. And I’ve signed up my company with the social insurance again since this year will probably yield some 16-25k CHF side income.

The regular job is really cool and all (if you counted, the third retreat since I’ve started) but with the current token price the total comp would come down to around 210k CHF. And that’s a little depressing, I haven’t earned that little since 2017 or so. Therefore I’ve started interviewing with a bunch of companies to see if they can offer some deal that doesn’t include explaining my wife and son why I make 15% less this year and that they can’t go to Mexico twice this year. One cool position as Head of Security unfortunately fell thru but I have some more interviews lined up. Not really something I enjoy, getting interviewed as an introvert is always a bit awkward.

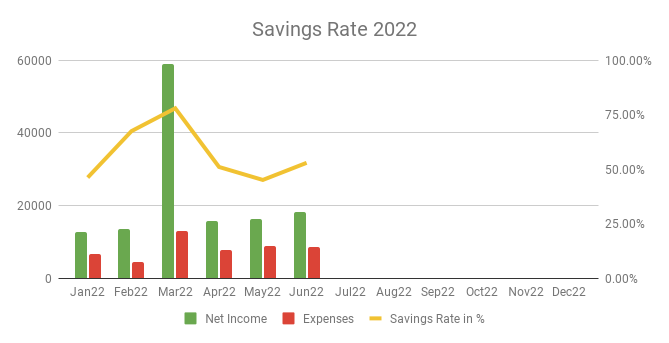

Savings Rate: June 2022

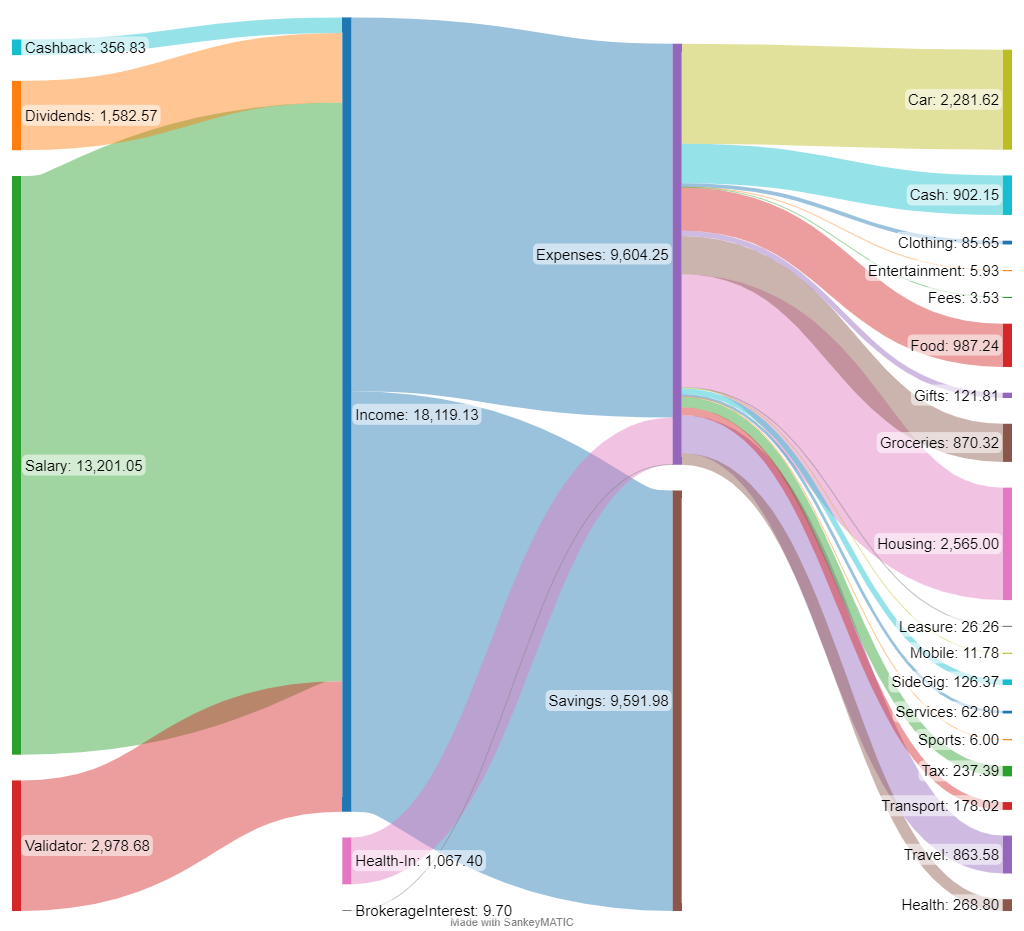

Cash flow: June 2022

There where some health insurance & brokerage related pay-backs which messed up the Sankey a little this month.

Total Income: 18’119 CHF (+1’912 CHF vs. May) – Regular salary plus oncall compensation plus ~3k CHF in crypto from the validators. Nice to see the side business slowly but steadily grow. And kind of crazy to make the equivalent of a (part-time) grocery store cashiers monthly salary on the side. I got to gonna hustle for FIRE I guess.

Total Expenses: 8’527 CHF (-370 CHF vs. May) being in a affordable EU country for almost two weeks helped a lot with the Groceries at 870 CHF. However the 5 star hotels we’ve stayed at were not exactly frugal. It’s also the end of a quarter so the maintenance and mortgage interest were due coming in at 2’476 CHF (not bad living on an equivalent of 825 CHF/month for rent excl. side costs in a high CoL place in Switzerland). Another notable position was the replacement of the rear bumpers of my almost 7 year old Tesla due to issues with the air suspension at 2’275 CHF.

Savings Rate: 52.94% (+7.84 vs. May) – Third highest saving rate this year, yay!

Net Worth: 890k CHF (-115k CHF vs. May) – As mentioned stocks and cryptos kept falling, my stock portfolio is actually underwater compared to what I’ve poured in. And as mentioned current “bonus” is worth 38k CHF of an original 170k CHF, that’s rather depressing.

Stock Portfolio

Stock Portfolio value: 222’064 CHF (-33’256 CHF vs. May)

| Stock Symbol |

| VT |

| AVUV |

| AVDV |

| ABBA |

| Fundsmith T Acc Mutual Fund |

| GRNBF |

| SXOOF |

| ELBM |

I’ve decided to just keep topping up the VT ETF on a monthly basis for now with 5k CHF. Small Caps and Fundsmith don’t seem to hold any better during this bear market.

Crypto HODL Portfolio

Current HODL portfolio value: 150’750 CHF (~6.7 BTC / 129 KSM / 589 DOT / 92100 CRO / 21k+ PHA) (-83’853 CHF vs. May)

Bitcoin and the whole crypto market tanked very very badly due to the Luna/UST crash, melting my portfolio significantly.

Crypto Gambling Portfolio

Didn’t trade on any signals this month and I don’t think this section adds any value to my posts. Let’s phase it out…

Blog statistics

Views: 1036 (-70 vs. May) I mean it’s holiday season right?

Visitors: 376 (-76 vs. May) Haven’t been very active in the MP Forum in the last few months, it’s not fun discussing losses :/

Followers: 50 (+2 vs. May) Cool a nice round number!

I posted 1 blog post in June, the monthly update. If you have ideas or are interested in more details let me know in the comments.

That’s it for this month. Like last month let me know if you like the style and the ordering of topics.

If you have any questions or comments, please leave a message below or contact me by email. I try to answer all comments and emails.

One Reply to “Portfolio Update July 2022 – 115k CHF down the market drain”