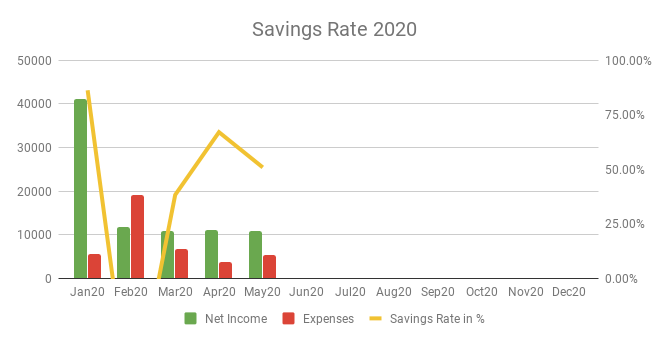

Welcome to the Portfolio update of June 2020. +11k CHF Networth and a Savings Rate of 50%. Awesome 😀

Let’s see how the the P2P Portfolio performed.

I’m still not at the weekly Technical Review pace which I would like to achieve. Sorry for that. In May I started to learn how to drive a motorboat (you could say I was motorboating a lot xD) which did cost over 1000 CHF so far. That’s for the first 10 lessons up front.

Beancount starts to slowly pay off as the monthly accounting run was rather quick. Not like I payed anything for that piece of open source software but the setup time was somewhat significant.

Savings Rate: May 2020

Total Income: 10’927 CHF – base salary plus some sold stuff minus a stupid endeavor in Options trading.

Total Expenses: 5’368 CHF – Super happy for that low number. It was mostly dominated by the somewhat average 1’266 CHF groceries and the 1’030 CHF for the first 10 boat driving lessons upfront. Then some 496 CHF on clothing for my son and wife. 333 CHF for restaurants and Take-Aways, our favorite Chinese restaurant is open again and we immediately got food there twice in May.

The reason why I start learning to drive a boat is mostly to provide a holiday alternative for my family. My wife and son love water so I plan to rent a boat on the lake of Lucerne for a few days. That will be a costly vacation but we clearly save on spending for regular holidays. The boat license itself can be up to 3’000 CHF however my employer reimburses 1/3 of it 😀

Savings Rate: 50.87% – Still over the yearly goal of 35%+ saving rate, the great news is that the average savings rate of this year now did also pass the 35% goal. I will try to stay somewhat frugal and maybe push it to 40% for this year. The only bigger expenses I see coming are Taxes (15k+ CHF) and Health Insurance (5.5k CHF) and maybe an A/C (2.5k CHF) for my home which will be partly reimbursed by my employer.

Stocks: My SPXU bet is currently at -18.8k CHF due to the completely irrational strength of the stock market. I will hold on to it a bit longer. The whole situation in the US and some blaming of Trump to China must have some effect to the stock market soon.

I upped my position in VT to 200 stocks currently worth 14.5k CHF. I setup a 1’000 CHF automatic transfer to Interactive Brokers every month with which I will buy VT once a month.

Net Worth gained some 11k CHF to 419k CHF see my portfolio page for details about the asset allocation.

P2P Portfolio

| Platform | Balance | Actual XIRR |

| Bondster | 5039 EUR | 10.16% |

| Crowdestor | 4736 EUR | 5.45% |

| DoFinance | 4850 EUR | 13.53% |

| FastInvest | 3033 EUR | 18.28% |

| Flender | 1045 EUR | 19.78% |

| Grupeer | 4787 EUR | 5.71% |

| IuvoGroup | 5066 EUR | 18.30% |

| Mintos | 6005 EUR | 13.79% |

| Monethera | 2047 EUR | 10.23% |

| PeerBerry | 5054 EUR | 12.55% |

| RoboCash | 4865 EUR | 10.98% |

| Swaper | 5059 EUR | 7.54% |

| Viventor | 4800 EUR | 6.57% |

| Wisefund | 1000 EUR | 11.32% |

| Total | 57389 EUR | 11.73% |

May Income from P2P Portfolio: +348.15 EUR

Calculated XIRR (of the platforms that generated money): 11.73%

I’m trying withdrawals with several platforms. FastInvest send the money I requested over one month ago. Platforms which fullfilled my withdrawal requests:

- DoFinance (one business day / requested on 28th of May, on bank 29th of May)

- FastInvest (too long / requested 320ish EUR 1st of April, on bank 15th of May)

Platforms for which I still wait:

- FastInvest (996 EUR requested in three 250ish EUR each on 17th of April, 1st of May, 12th of May, 22nd of May)

I stopped recommending FastInvest for now. They will pay interest on delayed withdrawals but it seems they effectively struggle with payouts. They also introduced KYC procedures now which I think block my payouts currently.

Let’s dive into the detailed statistics and comments on each platform:

Bondster

Balance: 5’039.02 EUR

Income: 66.19 EUR

Platform XIRR: 13.35%

Calculated XIRR: 10.16 %

Looks like they recovered a bit as the interests started to flow again. I added another 180 EUR to the account in May.

They added a lot of new loans with interest rates up to 15%.

For Bondster I use the following AutoInvest settings: Minimum interest rate: 15%, maximum loan term: 12 months, buy-back guarantee: yes

| If you would like to try Bondster and get 1% cashback on all investments in the first 90 days, please use this link to register. |

Crowdestor

Balance: 4’736 EUR

Income: 0 EUR

Platform XIRR: 19.17 %

Calculated XIRR: 5.45 %

No payments this month. Crowdestor gave every project an optional grace period up to 3 months. The Fertilizer investment should however be fully paid back at the end of May and they did inform that they got the money and will send it to investor accounts in the next few days.

I would have liked to invest in the Crowdestor crowd funding campaign as there is some possibility to convert the investment into shares at the end of the period. However I didn’t have any liquid amounts available on the account when the project was open.

| If you would like to try Crowdestor and get 1% cashback on all investments in the first 90 days, please use this link to register. |

DoFinance

Balance: 4’849.93 EUR

Income: 45.64 EUR

Platform XIRR: 12 %

Calculated XIRR: 13.53 %

The account indicates that there are now 20 EUR less accumulated interest than a month ago. However I did payout 49 EUR of the available interest because they still don’t accept new investments.

They stopped accepting new investments due to the uncertainty of the markets. A very mature decision in my opinion.

| If you would like to try DoFinance yourself feel free to register thru this link. There is however no bonus nor support for my blog for using this link. |

FastInvest

Balance: 3’033.42 EUR

Income: 31.24 EUR

Platform XIRR: 12.99 %

Calculated XIRR: 18.28 %

I received the withdrawal of the 1st of April after threatening the support with Legal action. Since then I requested 2 more withdrawals which are hanging. They eventually sent out newsletters about interest paid on pending withdrawals. Also they seem to have deleted my KYC information for some reason, so I uploaded my details again.

A total of 996 EUR are pending withdrawal from FastInvest at this point.

I do NOT recommend to invest money in FastInvest at this point.

Flender

Balance: 1’045.25 EUR

Income: 3.47 EUR

Platform XIRR: 10.33 %

Calculated XIRR: 19.78 %

Flender does have some cashback campaign again in June. Maybe I’ll give it another shot.

I can still recommend the platform for People with less risk appetite for now.

| If you would like to try Flender and get 5% cashback on all your investments and 10% interest in the first 30 days, please use this link to register. |

Grupeer

Balance: 4’787 EUR

Income: 7.37 EUR

Platform XIRR: N/A (not available)

Calculated XIRR: 5.71 %

Grupeer sent news from the Bahamas (lol, just kidding). They claim they will try to repay investors starting in June and they will also reset all accounts to the beginning of March. Their accounts are also frozen. No great signs for sure.

I do therefore NOT recommend Grupeer at this point anymore.

IuvoGroup

Balance: 5’066.60 EUR

Income: 40.68 EUR

Platform XIRR: 13.39 %

Calculated XIRR: 18.30 %

I added another 100 EUR to this platform this month. However the income this month did drop a bit, I guess the fallout of Coronavirus.

There are also several discounted loans available (at 2 – 4 %) which I might be able to scoop up.

My Autoinvest settings look like this: Maximum in one loan 10 EUR, min interest 13%, loan status current, all 3 buy-back options. No other limitations.

I will try to lift the balance to 5000 EUR on this platform.

| If you would like to try IuvoGroup yourself and get up to 90 EUR when you invest 2500 EUR, please use this link to register. |

Mintos

Balance: 6’005.66 EUR

Income: 81.52 EUR

Platform XIRR: 16.06 %

Calculated XIRR: 13.79 %

I’ve added another 575.97 EUR to the account making it reach over 6000 EUR.

I grabbed some discounted loans manually from loan originators which have buy-back guarantee, that should boost my account performance a bit.

My Autoinvest settings look like this:

A high risk second market profile with all LOs with buy-back with 19%+ interest rate up to 3 months, no diversification across LOs, 5 – 25 EUR per loan.

A maximum interest profile with all LOs with buy-back with 16.5%+ interest rate up to 6 months terms, with diversification across LOs, 10 – 50 EUR per loan.

| If you would like to try Mintos yourself and get 1% cashback of all invested capital in the first 30 days, please use this link to register. |

Monethera

Balance: 2047.23 EUR

Income: 0.00 EUR

Platform XIRR: 19.05 % (average from 20.1 % and 18 % projects)

Calculated XIRR: N/A

Monethera is probably dead. The technical review of Monethera showed clearly that this platform is a scam. I will write the money off next month.

I definitely do NOT recommend to invest in this platform at this point.

PeerBerry

Balance: 5’054.23 EUR

Income: 57.04 EUR

Platform XIRR: 14.75 %

Calculated XIRR: 12.55 %

I added another 160 EUR to this account.

My Autoinvest settings have two profiles:

One for 15.0%+ loans with current status, buyback and any duration, max amount per loan 100 EUR.

One for 12%+ loans with current status but only 1 months remaining, max amount per loan 20 EUR.

| If you would like to try PeerBerry and support the blog, please use this link to register. |

Robo.cash

Balance: 4’865.09 EUR

Income: 47.63 EUR

Platform XIRR: 12.87 %

Calculated XIRR: 10.98 %

The interest recovered 45 EUR more than last month!

I will try to lift the invested amount to 5’000 EUR in June.

| If you would like to try Robo.cash and support this blog, please use this link to register. |

Swaper

Balance: 5’059.41 EUR

Income: 24.16 EUR

Platform XIRR: 7.47 %

Calculated XIRR: 7.54 %

The Platform XIRR and actual XIRR are now more or less matching. Very nice.

I will very likely add more money to my account in the future.

| If you would like to try Swaper and support this blog, please use this link to register. |

Viventor

Balance: 4’800.22 EUR

Income: 9.18 EUR

Platform XIRR: 15.85 %

Calculated XIRR: 6.57 %

Viventor still can’t live up to the promised interest rates they state in the dashboard. I start to wonder how they calculate the XIRR or if I somehow managed to invest into bullet payment loans.

My Autoinvest settings are the following: max amount per loan 20 EUR, 15.9 – 16% loans only, up to 12 months term, all loan types, all countries, all LOs, buyback & payment guarantee.

I will regardless try to lift the invested amount to 5’000 EUR.

| If you would like to try Viventor and earn 1% cashback on all investments in the first 30 days, please use this link to register and the code: XE0180 during the registration. |

Wisefund

Balance: 1000.00 EUR

Income: 0 EUR

Platform XIRR: 17.4 %

Calculated XIRR: 11.32 %

After my Technical review of Wisefund I will definitely NOT invest more money in this platform. Too few employees, too many red flags from the owner. However the quick withdrawal processing gives me hope that I see my still invested 1000 EUR again at some point.

However no payments were made in May.

Still an up and down with the monthly earnings, some platforms seem to be over Coronavirus and others only start to see the struggle.

Blog statistics

Views: 700 (+80 from April) 😀

Visitors: 182 (+9 from April) 🙂

Followers: 10 (+2 from April) steadily growing, welcome new readers.

I’m happy to see the passive income still growing despite the turbulent times we’re living in.

In May I added a Technical Review for FastInvest and disqualified them definitely.

I will try to add more Technical Reviews in the coming weeks. Learning for the boat driving theory should come to an end this week (exam on Thursday).

That’s it for this month. Like last month let me know if you like the style and the ordering of topics.

If you have any questions or comments, please leave a message below or contact me by email. I try to answer all comments and emails.