Welcome to the Portfolio update of June 2021. The stress at work continued, product launch and oncall (working at least one day per weekend) and shitty Bitcoin development. Read more to learn more about our May.

Personal update

I would not have expected that startup live is soo tough. I work crazy hours (kind of regularly 12h days) plus also mandatory oncall where we have to sit around 8 hours in a Zoom meeting and watch graphs of the system to not go crazy. Unfortunately also on the weekends w/o any form of compensation so far (neither days off nor the extra money that the Swiss law mandates).

Also the token price since it was listed on several exchanges dropped to 20% of its listing value 🙁 Current 4 year token estimate is still in the region of 2.5M CHF. As long as the price doesn’t drop below 16 CHF per token I will still have a higher total comp than at my previous job.

YouTube makes it very hard to monetize my channel… their requirement is 4000 watch hours which is kind of hard to achieve with dozens of 60 second clips that are only relevant for one day.

We managed to bring my son overnight to my parents which gave me and Mrs. Cheese the opportunity to go out in the first time in what feels like an eternity. We’ve enjoyed the sun and had some drinks in Lucerne. Had another very relaxing evening out in Lucerne with a good friend of mine. Best beer in the city: Rathaus Brauerei Luzern!

With passing the 1M CHF net worth mark a new watch would have been due which was postponed due to the FTTH project I mentioned last month, and we’ve also dropped below the millionaire status again, so I would have needed to return it :'(

Tomorrow I will meet one of my readers in Zurich, I’m very excited to be in the position where the other person knows more about me than I know about them. I had this situation with Mr. RIP before, where I asked him about some financial details of his net worth 😀

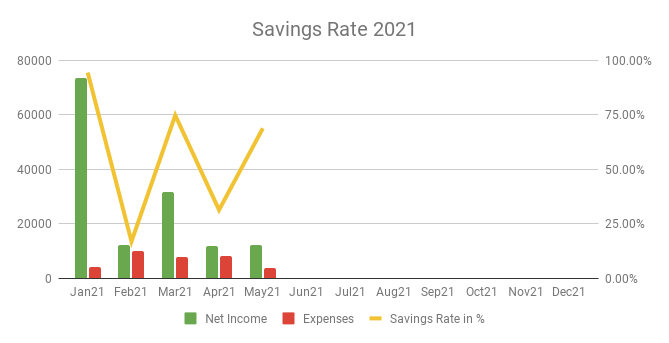

Savings Rate: May 2021

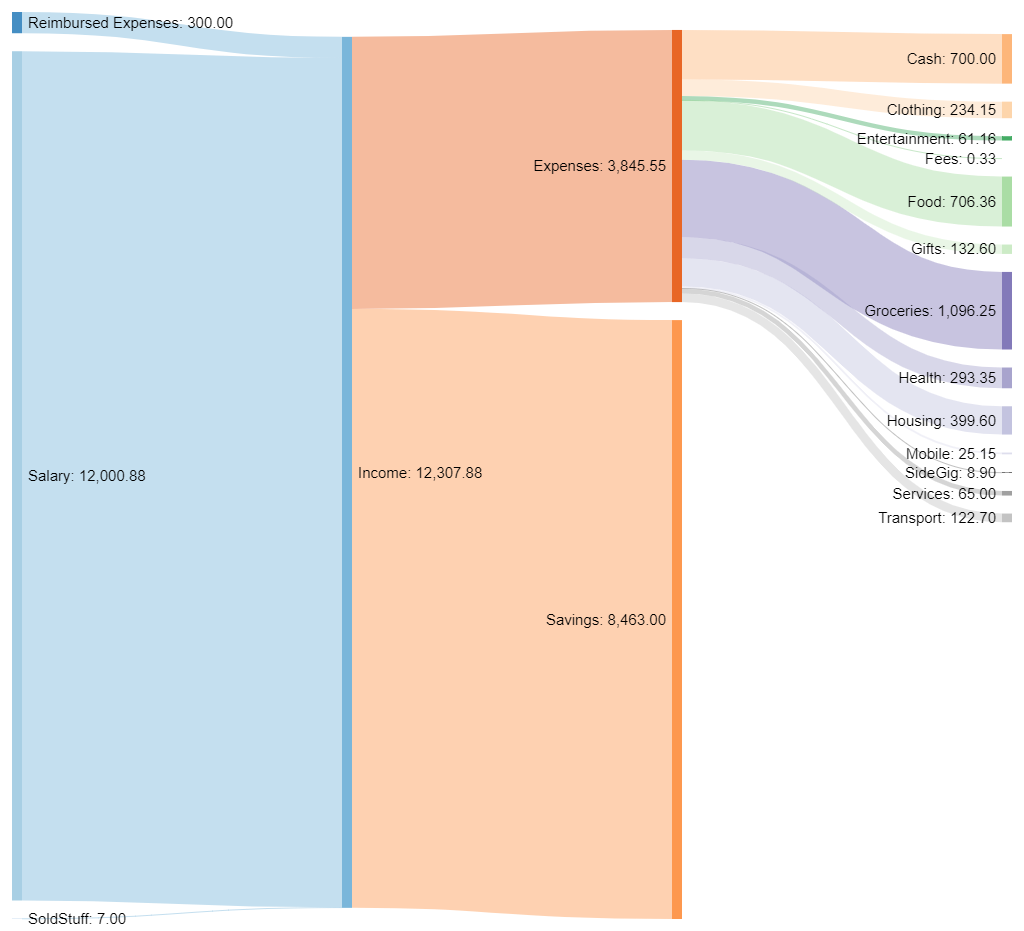

Cash flow: May 2021

Total Income: 12’307 CHF (+290 CHF vs. Apr) – Regular salary plus 300 CHF reimbursed headphones. Plus some 7 CHF of sold stuff.

Total Expenses: 3’844 CHF (-4405 CHF vs. Apr) – Wow I’m kind of surprised by this one. It felt that we went out for food more often but we’re at 706 CHF (vs. 659 CHF last month) of restaurant visits/drinks besides the 1’096 CHF of groceries (also a new low this year iirc). Well no new grill (BBQ) and no other big spending kept the overall expenses in check. I actually got a 88 CHF reimbursement for an installed network socket which the utility company fucked up originally when they wired the apartment. 234 CHF spent on clothing which included 107 CHF (technically 169 CHF but paid with cashback vouchers from Migros) for new On shoes for me (I have one pair of shoes that I wear for 1-1.5 years and then get a new pair).

Savings Rate: 68.76% (+37.4% vs. Apr) – Savings level above target of 65% again. Very happy to see that. However that FTTH bill is still looming and probably will hit the savings rate in July or August.

Net Worth: 981k CHF (-108k CHF vs. Apr) – Holy f*ing shit 🙁 Now I’m depressed. Well the Bitcoin portfolio alone fell from 341k CHF to 218k CHF. According to the net worth spreadsheet (I btw use the one from retireinprogress.com with some modifications) we’ve dropped from 39% FI down to 37% FI 🙁

Stock Portfolio

Stock Portfolio value: 244’345 CHF (+12’832 CHF vs. Apr)

| Stock Symbol | # Shares | Avg. price | Current price | Unrealized P/L |

| VT | 1512 | 85.94 USD | 102.83 USD | 23’070 USD |

| ARKK | 329 | 110.17 USD | 107.72 USD | -750 USD |

| AVUV | 499 | 72.26 USD | 78.24 USD | 2’690 USD |

| AVDV | 384 | 62.45 USD | 67.03 USD | 1’674 USD |

| SPXU | 240 | 100.87 USD | 19.70 USD | -17’610 USD |

| ABBA | 48 | 10.14 CHF | 17.28 CHF | 343 USD |

| Total | 3012 | N/A | N/A | 9’417 USD |

Damn those nice gains from ARKK went all down the drain. The small caps with AVUV and AVDV performed nicely tho in return. ABBA also halved its gains thanks to the weak crypto sector.

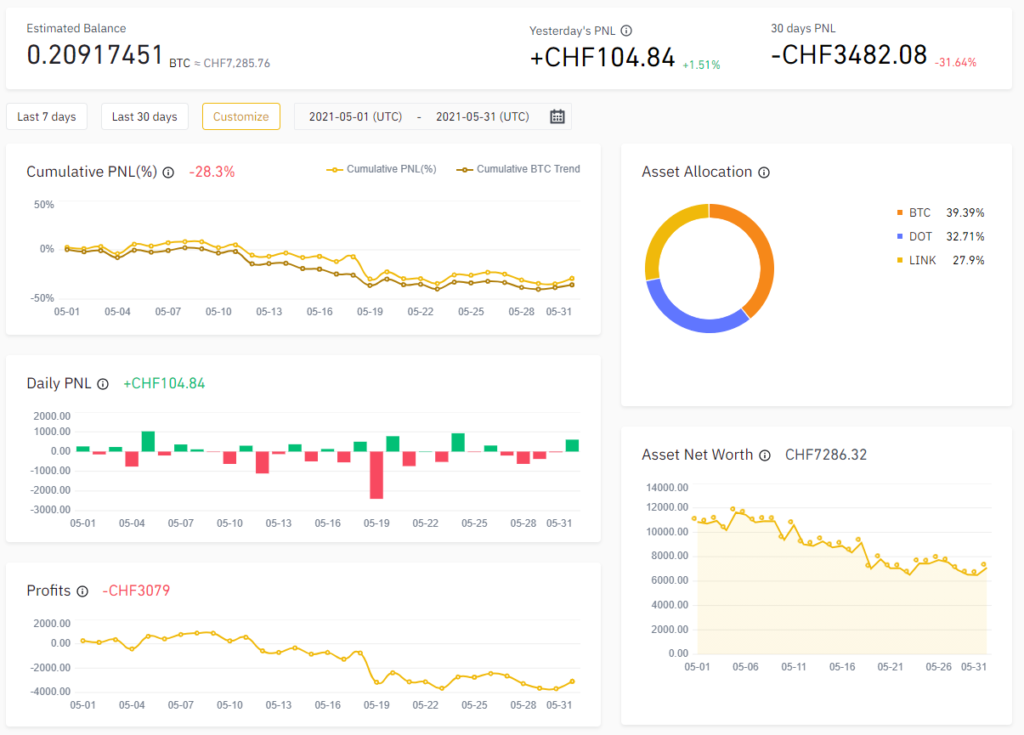

Crypto Gambling Portfolio

Invest in cryptos they said, it will be great they said. Well on the positive side measured in BTC I gained 0.002 BTC so it’s just the Fiat currencies that are too strong right now.

Gains/Losses in April: -3’079 CHF (vs. +1’765 CHF in May)

I’ll just post my Binance portfolio picture here:

My cash & carry trade experiment was somewhat successful. I will look into this more in the future.

P2P Portfolio

| Platform | Value |

| Bondster | 1167 EUR |

| Crowdestor | 823 EUR |

| DoFinance | 4144 EUR |

| FastInvest | 1394 EUR |

| Flender | 1616 EUR |

| Grupeer | 4787 EUR (more likely 0) |

| IuvoGroup | 1315 EUR |

| Mintos | 2083 EUR |

| PeerBerry | 1068 EUR |

| RoboCash | 2809 EUR |

| Swaper | 9.84 EUR |

| Viventor | 3349 EUR |

| Wisefund | 1000 EUR |

| Total | 25’570 EUR |

May Income from P2P Portfolio: +125 EUR

Noteworthy updates:

I liquidated a total of 740 EUR of my P2P Portfolio in May.

- Nothing noteworthy, I’m done with P2P…

Blog statistics

Views: 1599 (+164 vs. Apr) huh counter intuitive but thanks for coming 🙂

Visitors: 482 (+23 vs. Apr) I like the idea that 482 people out there enjoy my content.

Followers: 39 (+-0 vs. Apr) é_è

I posted 1 blog posts in May. the monthly update and that’s it. Same as before, the lack of 2 day weekends is really draining my (creative) energy. If you have ideas or are interested in more details let me know in the comments.

That’s it for this month. Like last month let me know if you like the style and the ordering of topics.

If you have any questions or comments, please leave a message below or contact me by email. I try to answer all comments and emails.

That’s the same carrot on a stick bullshit I’ve been thru in the last few years. Emotional or not I rather do a job with some passion than becoming a corporate robot.

Yeah sure the crazy amount of work hours is probably not sustainable long term but at least I’m really feeling like moving the needle for the company compared to the last gig.

Interesting way of seeing it but makes sense indeed. Thanks good luck to you too.

I personally don’t think it’s worth sacrificing personal/family life (that’s what I get from your posts) in order to do a job with passion. There are many jobs in Zurich with a similar salary that would not require to work on weekends.

They usually don’t come with that 2.5M CHF of Bonus/Stocks upside potential tho. I think I’m at the right time of my life where I still have the energy to pull this off for a few years before I’m either FIRE or want to settle to some less demanding 9-5 job.

Not really, the amount of tokens (== stocks) is contractually fixed. The price of them is the gamble I take. At the current price they’re valued at around 2.5M CHF. As long as they’re valued above 400k CHF I walk away with a net total comp increase. The upside potential is a multiple of the 2.5M CHF, the downside potential if the tokens end up being worth 0 (highly unlikely IMHO) is limited to a 100k CHF total comp hit per year.

“Carrots-on-a-stick” for me are statements like “4 years from now you would have been promoted more than once” for which there is no guarantee as I was at a level where there was no more growth expectation. Sure maybe I could have optimistically thinking gotten maybe one more promo at the end of this year or beginning of next year getting myself to around 380k CHF total comp but over 4 years that’s still “only” 1.52M CHF (minus the delay to get the actual raise). Two promos in 4 years, highly unlikely with my lack of social skills and hate for political games.

Why don’t you sell the tokens now? Even if you have to stay your time with the company.

They are coupled to a vesting scheme, I will only be able to control/sell 1/4 after a year and from then on the remaining 1/36 every month. No company hands out stocks/tokens w/o you having worked for a bit. Was the same concept at the last company.