Welcome to the Portfolio update of June 2024. I’ve re-negotiated my current salary after getting an interesting offer from a crypto company and adjusted the real-estate value linearly for the past years. Read more to learn more…

Personal update

May was an up and down of emotions job wise. I finally found a good new DevOps employee who will start in the beginning of June and I got a job offer as Head of Security at some crypto company. Out of loyalty to the current company I did give them a chance to match it which they almost achieved. They laid out a plan where I would make betwee 700-1.3M CHF in the next 3 years with them which sounded enticing enough to keep my lazy self at the role. My salary will be bumped immediately from 180k CHF to 210CHF plus my 30k CHF bonus will be replaced with shares in the company effectively worth the same amount. Plus there will be some key-player incentive that should yield another 100-200k CHF/year if the company gets sold in the next 3 years (which is the current exit strategy). That compared to the 235k CHF base + 0.5%, of god knows what that crypto company is worth (hard to evaluate from the outside for an unlisted company), sounded like the safer bet. It was a bit of a struggle as the team and the job at the crypto gig did look pretty interesting but changing jobs yet again would also be tiresome.

Otherwise a rather calm month. We celebrated my wife’s birthday, my son went back to Kindergarten, climbing and swimming lessons. A few meetups with friends to play D&D and have drinks. Generally a good month (besides the shitty weather in Switzerland). We’ve booked a trip to Rome in early July. And used quite some cash to go to our favorite Cordon blue restaurant twice.

Something I’ve discovered thanks to a friend that blew my mind recently is suno.com an AI music generator. It’s pretty amazing, I’ve since created a wrestling intro song for my son (we sometimes fool around and play pretend wrestling) and the official theme song of this blog:

https://suno.com/song/9b3b1f09-c9ec-4c64-a55e-91768560b52f

The join-venture income numbers for this month were roughly estimated as my business partner didn’t just yet return from his vacation. Will update with the correct numbers next month. Additionally I’ve added the current real-estate valuation based on houzy.ch and applied the gained appreciation in a linear way since the last estimation early 2021 retroactively. So incase you look at the Portfolio page and wonder where that extra 460k CHF net worth is coming from, now you know. Going forward I will take the current market value based from that website.

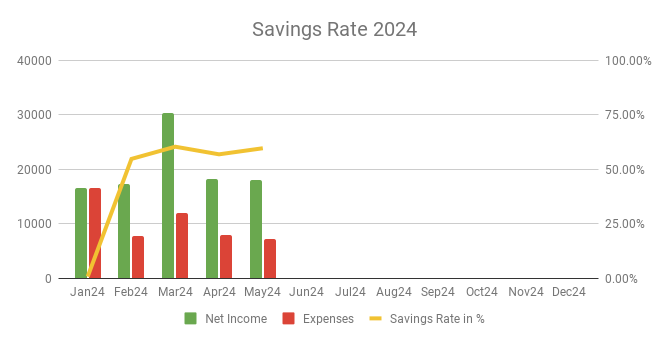

Savings Rate: June 2024

Cash flow: June 2024

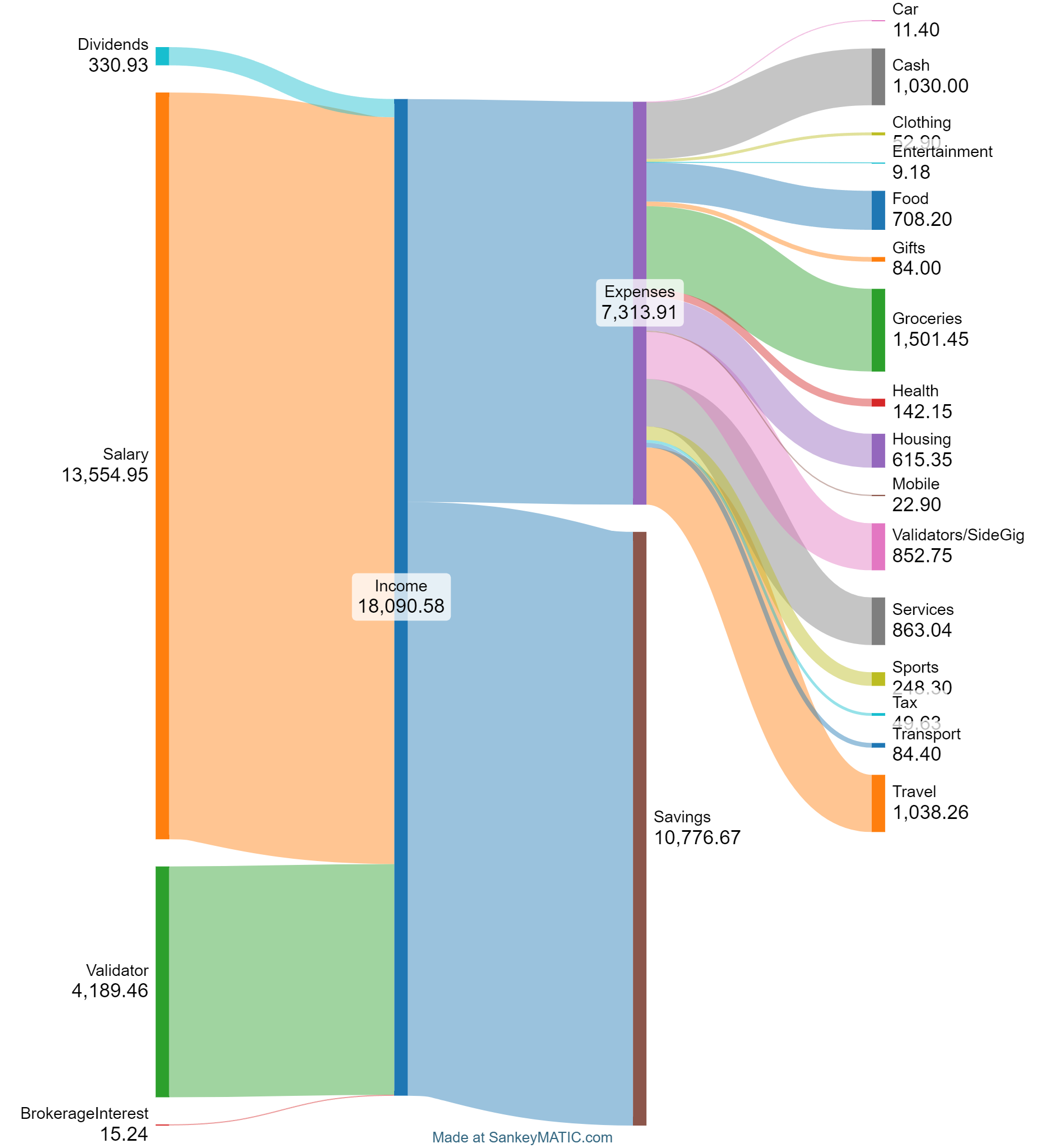

Total Income: 18’075 CHF (-153 CHF vs. last month) – Regular salary, ~4.1k CHF from validators and 330 CHF from dividends. I expect this number to increase in the future by roughly 2.5k CHF due to the new salary. However in June there will be another Phala halving which might bring down the validator income a bit.

Total Expenses: 7’298 CHF (-569 CHF vs. last month) Spending mostly in check, 888 CHF for a trip to Rome in July, groceries at 1500 CHF a bit above average but food I buy at work thanks to the new office and more affordable options down to 700 CHF (was usually around 1-1.2k CHF), german lessons for wife 750 CHF and sports lessions for my son ~248 CHF.

Savings Rate: 59.62% (vs. 56.84% last month) – Almost at the target rate of 60%.

Net Worth: 1.772M CHF (+59k CHF vs. last month) – Crypto and stocks went up noticably. Attentive readers might notice that the actual difference between the last blog post is quite significant. Read above for the reason, I re-accounted the actual real-estate worth.

Stock Portfolio

Stock Portfolio value: 141’234 CHF (+24’231 CHF vs. last month)

| Stock Symbols |

| ABBA |

| ABM |

| AMZN |

| CMCSA |

| EBAY |

| ELBM |

| GRNBF |

| MMM |

| MO |

| MPW |

| MRK |

| RF |

| SXOOF |

| WBA |

| VT |

As announced I’ve dumped 20k CHF cash into the stock market. I’ve bought Amazon (AMZN) and Maerck (MRK) as both look fairly valued right now. I’m still sitting on too much cash for my taste and will probably send another 10-15k CHF to interactive brokers in June.

Equity Portfolio

Equity Portfolio value: 80’070 CHF (+0 CHF vs. last month)

Nothing changed on that front.

Crypto HODL Portfolio

Current HODL portfolio value: 541’087 CHF (~7.9 BTC / 467 KSM / 5134 DOT / 23k+ PHA) (-54k CHF vs. last month)

I’ve dumped another shitcoin called Polimec (PLMC) which I’ve invested some Phala to in December and bought more Bitcoin with it, was roughly worth 5k USD. Otherwise Bitcoin appreciated in value quite a bit again which makes me happy.

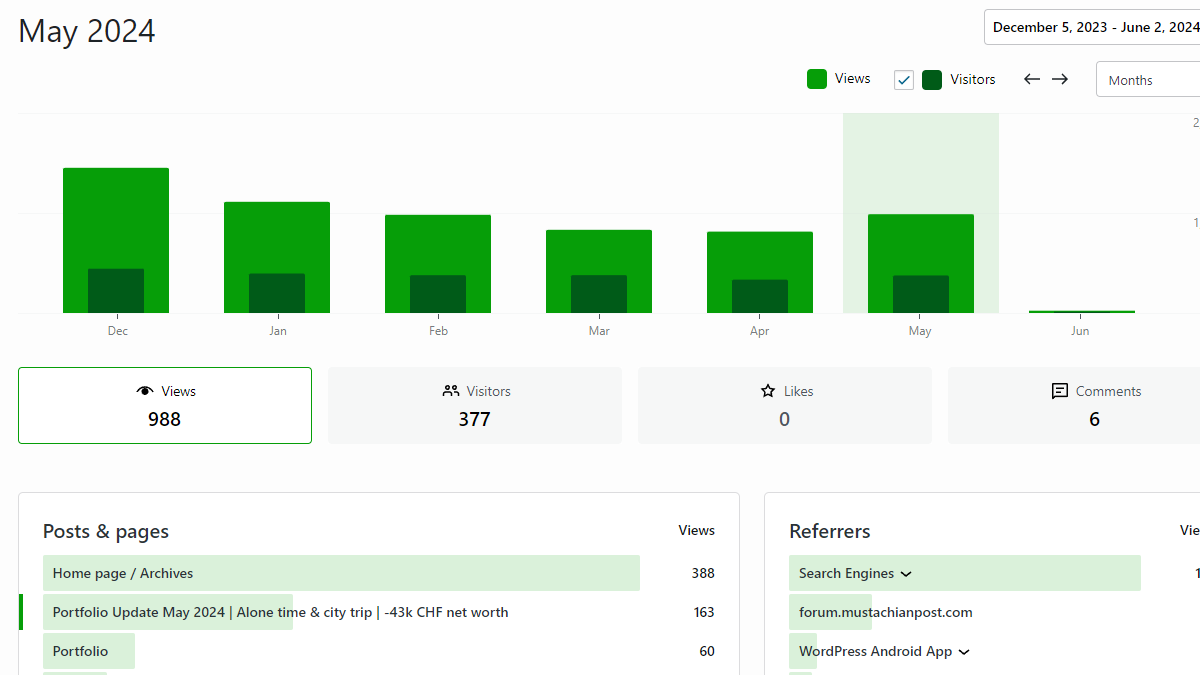

Blog statistics

I posted 1 blog post last month, the monthly update. If you have ideas or are interested in more details let me know in the comments.

That’s it for this month. Like last month let me know if you like the style and the ordering of topics.

If you have any questions or comments, please leave a message below or contact me by email. I try to answer all comments and emails.

Are you constantly looking for jobs ? Or how did this option come up ?

I get a lot of requests from recruiters and sometimes follow interesting leads yeah. In tech you generally should always be interviewing with companies to assess your market value.

Is it possible that the equity value of your RE almost tripled in a couple of years? In general I would be quite sceptic on Houzy as it gives way higher estimations than any other appraisal tool I found online…

From my experience it matches the valuation that the banks get when using the Wuest&Partner tool internally. And no it “just” doubled from 850k to 1.55M

how do you track your expenses?

With beancount, see https://forum.mustachianpost.com/t/beancount-getting-started/2701

Can you tell more about your job evolution? How did you end up at your latest job? What steps/actions did you take to be interesting for a crypto company? What skills do i need to be interesting for such type of companys where you work?

You can find more info about my job history in these two posts:

https://fondue.blog/how-i-grew-my-salary-by-31x-in-the-last-17-years/

https://fondue.blog/sad-news-laid-off-again/