Welcome to the Portfolio update of March 2020. As usual we look at income and spending of the month and then at the P2P Portfolio value and changes.

Let’s see how the added 30k EUR to the P2P Portfolio performed.

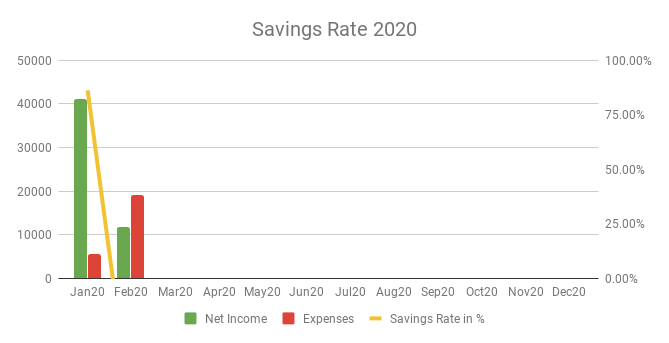

Savings Rate: February 2020

Total Income: 11’683 CHF – just the base salary. This will stay around this number until end of June.

Total Expenses: 19’151 CHF – 13k CHF federal tax bill for 2019 and that’s not the final one. Except for that we spent 1’449 CHF on meals out of home, I met some friends and dinner with alcohol can quickly add up to some 200 CHF per night out. I also had my birthday and we invited my parents for lunch which added to that category. Then some 700 CHF on gifts for my and the mexican family. Definitely overall too much spent to reach the savings goal 🙁

Savings Rate: -63.93% – Fortunately not a new all time low (which was in June 2019) but still not enough.

I also liquidated my Stock Portfolio with TrueWealth. Since those guys don’t trade every day, my nice 5’000 CHF gain since March 2018 crashed down to 330 CHF on Friday the 28th. Such a**holes. I will start investing with InteractiveBrokers and stick to some simple ETF portfolio instead.

P2P Portfolio

| Platform | Balance | Actual XIRR |

| Agrikaab | 2’000 EUR | 0.00% |

| Bondster | 4’727.43 EUR | 6.44% |

| Crowdestor | 4’739.76 EUR | 4.10% |

| DoFinance | 4’759.8 EUR | 11.43% |

| FastInvest | 4’742.48 EUR | 8.93% |

| Flender | 1’031.61 EUR | 8.43% |

| Grupeer | 4’737.33 EUR | 8.76% |

| IuvoGroup | 4’830.55 EUR | 29.09% |

| Mintos | 4’758.34 EUR | 12.25% |

| Monethera | 2’047.39 EUR | 0.10% |

| PeerBerry | 4’740.09 EUR | 8.29% |

| RoboCash | 4’740.58 EUR | 2.49% |

| Swaper | 4’719.31 EUR | 5.13% |

| Viventor | 4’717.84 EUR | 4.79% |

| Wisefund | 1’020.49 EUR | 29.08% |

| Total | 58’313 EUR | 9.29% |

February Income from P2P Portfolio: +386.13 EUR

Calculated XIRR (of the platforms that generated money): 9.29%

February was much better in terms of actual passive income. I got a nice 386.13 EUR. I think the interest rate should still increase as the numbers are a bit skewed because I didn’t transfer the second round of investments exactly on the 1st of Feburary.

Let’s dive into the detailed statistics and comments on each platform:

Agrikaab

Balance: 2’000 $

Income: 0 $

XIRR: 0.00 %

I didn’t invest more into Agrikaab. They also seem to wind down P2B loans and instead migrate to a P2P micro loans concept. They claimed that they will sell the proceeds of the supplies they bought for the Farm store and Water pond and then reimburse the investors.

We will wait and see.

Bondster

Balance: 4’727.43 EUR

Income: 23.39 EUR

Platform XIRR: 12.99%

Calculated XIRR: 6.44 %

There are still some 500 EUR in 15+ days delayed loans. Other than that performing as advertised.

The second round of investment was quickly absorbed but I currently have 2’472 EUR showing as waiting for entry.

For Bondster I use the following AutoInvest settings: Minimum interest rate: 12.5%, maximum loan term: 12 months, buy-back guarantee: yes

I will try to lift the balance to 5000 EUR on this platform.

| If you would like to try Bondster and get 1% cashback on all investments in the first 90 days, please use this link to register. |

Crowdestor

Balance: 4’739.76 EUR

Income: 15.09 EUR

Platform XIRR: 19.17 %

Calculated XIRR: 4.10 %

Calculated XIRR tanked a lot this month, mostly due to being invested in loans that start paying after 6-12 months.

I put the second round of investments into Fur processing facility (II) (payouts start in one year) 1’000 EUR, Meat Chef Old Town 700 EUR, Indoor Beach Volleyball 1’024 EUR. Only the last two loans are expected to pay monthly immediately. The others are all waiting for the payback schedule to start.

| If you would like to try Crowdestor and get 1% cashback on all investments in the first 90 days, please use this link to register. |

DoFinance

Balance: 4’759.80 EUR

Income: 40.76 EUR

Platform XIRR: 12 %

Calculated XIRR: 11.43 %

The second round of investment was manually invested in their 12% interest rate product. They do deliver steady performance as advertised. Still the platform that comse closest to it’s promised interest rate.

I will try to lift the balance to 5000 EUR on this platform.

| If you would like to try DoFinance yourself feel free to register thru this link. There is however no bonus nor support for my blog for using this link. |

Envestio

No updates from the Estonian police. I will not mention Envestio in the future.

FastInvest

Balance: 4’742.48 EUR

Income: 32.25 EUR

Platform XIRR: 12.99 %

Calculated XIRR: 8.97 %

The income looks good but I read a concerning article about FastInvest.

Is it another scam? I recommend Kristaps Mors who wrote an extensive article about what he found.

I switched off my AutoInvest on the platform and will withdraw the money in the future. There are platforms with less risk in the P2P universe.

| If you would like to try FastInvest and support this blog please use this link to register. |

Flender

Balance: 1’031.61 EUR

Income: 6.61 EUR

Platform XIRR: 9.87 %

Calculated XIRR: 8.43 %

Flender is unfortunately still a platform which will not satisfy my target XIRR of 12%+.

And I still don’t like the intransparency of their loans. Some are not showing up on the market place. So there is no chance to check the loans for any legitimacy.

| If you would like to try Flender and get 5% cashback on all your investments and 10% interest in the first 30 days, please use this link to register. |

Grupeer

Balance: 4’737.33 EUR

Income: 31.51 EUR

Platform XIRR: N/A (not available)

Calculated XIRR: 8.76 %

Grupeer performed very nicely this month. They have more loans with 14% interest rates.

The income of 31.51 EUR is much better than the measly 6 EUR from last month. Contributing to that were 2 EUR cashback and 1.10 EUR referral bonus.

My AutoInvest profile on Grupeer looks like this: Everything except Mortgage Loans, From 14 – 25%, between 1 – 24 months, all Countries, all loan originators, with buy-back and max amount per loan 10 EUR

I will try to lift the balance to 5000 EUR on this platform.

| If you would like to try Grupeer yourself and support this blog, please use this link to register. |

IuvoGroup

Balance: 4830.55 EUR

Income: 97.02 EUR (60 EUR cashback)

Platform XIRR: 13.80 %

Calculated XIRR: 29.09 %

Thanks to the second investment round I qualified for the additional 60 EUR cashback for having a balance above 2’500 EUR. Besides that 37 EUR of regular income, nice.

On the 12th of February I noticed that I forgot to adjust my Autoinvest settings to include the added 2’700 EUR after that was done the money was quickly absorbed.

My Autoinvest settings look like this: Maximum in one loan 10 EUR, min interest 12%, loan status current, all 3 buy-back options. No other limitations.

I will try to lift the balance to 5000 EUR on this platform.

| If you would like to try IuvoGroup yourself and get up to 90 EUR when you invest 2500 EUR, please use this link to register. |

Mintos

Balance: 4758.34 EUR

Income: 43.48 EUR (13.41 EUR from cashback)

Platform XIRR: 17.61 %

Calculated XIRR: 12.25 %

Mintos announced that they changed their XIRR calculation to be more optimistic. Not sure if I like that. I grabbed a fair amount of 15%+ loans on the secondary market. There are also 600+ EUR in 15+ days late loans.

My Autoinvest settings look like this:

A high risk second market profile with all LOs with buy-back with 15%+ interest rate up to 12 months, no diversification across LOs, 5 – 25 EUR per loan.

A maximum interest profile with all LOs with buy-back with 12%+ interest rate up to 12 months terms, with diversification across LOs, 10 – 50 EUR per loan.

I will try to lift the balance to 5000 EUR on this platform.

| If you would like to try Mintos yourself and get 1% cashback of all invested capital in the first 30 days, please use this link to register. |

Monethera

Balance: 2047.39 EUR

Income: 0.16 EUR

Platform XIRR: 19.05 % (average from 20.1 % and 18 % projects)

Calculated XIRR: 0.10 %

All payments of the projects are late as of 2nd of March. This is not a good sign as Monethera is also on the list of possible scam platforms.

I definitely do NOT recommend to invest in this platform at this point.

PeerBerry

Balance: 4740.09 EUR

Income: 29.89 EUR

Platform XIRR: 13.22 %

Calculated XIRR: 8.29 %

Both the calculated XIRR and the platform XIRR keep climbing, very nice. The invested 2’700 EUR from the second round were quickly invested.

My Autoinvest settings have two profiles:

One for 12.5%+ loans with current status, buyback and any duration, max amount per loan 100 EUR.

One for 11.5%+ loans with current status but only 1 months remaining, max amount per loan 20 EUR.

I will try to lift the balance to 5000 EUR on this platform.

| If you would like to try PeerBerry and support the blog, please use this link to register. |

Robo.cash

Balance: 4740.58 EUR

Income: 9.24 EUR

Platform XIRR: 12.00 %

Calculated XIRR: 2.49 %

With only 9.24 EUR the returns of RoboCash don’t convince me yet. This platform has to perform much better in the future or it wont see any new money from me.

After investing the 2’700 EUR in the second round I had to manually update the autoinvest settings before they money was put to work.

I will regardless try to lift the invested amount to 5’000 EUR.

| If you would like to try Robo.cash and support this blog, please use this link to register. |

Swaper

Balance: 4719.31 EUR

Income: 18.72 EUR

Platform XIRR: 4.52 %

Calculated XIRR: 5.13 %

Swaper still mirrors the actual Interest rate w/o giving transparency of the expected XIRR. I would prefer if they show the expected XIRR instead.

However the income of 18.72 EUR is nice. I will try to raise the total balance to 5’000 EUR.

| If you would like to try Swaper and support this blog, please use this link to register. |

Viventor

Balance: 4717.84 EUR

Income: 17.52 EUR

Platform XIRR: 16.28 %

Calculated XIRR: 4.79 %

Much better return than last month (remember the 0.39 EUR?) but still not quite keeping up to the 16% promise.

My Autoinvest settings are the following: max amount per loan 20 EUR, 14 – 16% loans only, up to 24 months term, all loan types, all countries, all LOs, buyback & payment guarantee.

I will regardless try to lift the invested amount to 5’000 EUR.

| If you would like to try Viventor and earn 1% cashback on all investments in the first 30 days, please use this link to register and the code: XE0180 during the registration. |

Wisefund

Balance: 1020.49 EUR

Income: 20.49 EUR

Platform XIRR: 17 %

Calculated XIRR: 29.08 %

I still have the same concerns like I mentioned in the Envestio vanished blog post. Wisefund only managed to add two new projects in February.

I will NOT invest more money in Wisefund for now.

| If you would like to try Wisefund and get 0.5 % cashback on all investments in the first 270 days, please use this link to register. |

So we had 5 very nicely performing platforms yielding over 30 EUR each, with: Mintos, IuvoGroup, FastInvest, DoFinance and Wisefund (well only 20 EUR but on 1k EUR)

And some very disappointing platforms like: Monethera, Robocash and Crowdestor (somewhat expecte tho)

Blog statistics

Views: 1216 (+334 from January) yay!

Visitors: 273 (-185 from January) oh no 🙁

I stopped the Google and Facebook Ads. Mostly because I don’t trust the Facebook Ads. However I announced my blog in some forums and other blogs which seem to have given a nice bump of views. In the end I rather have returning but loyal readers than hundreds or thousands of one time visitors.

That’s it for this month. Like last month let me know if you like the style and the ordering of topics. I’m still new to the blogging world.

I still plan to make a blog post series about some due dilligence of the platforms: Are the owners on Linkedin, where are the platforms hosted, are the DNS records hidden?

If you have any questions or comments, please leave a message below or contact me by email. I try to answer all comments and emails.

One Reply to “Portfolio update March 2020”