Welcome to the Portfolio update of March 2024. The crypto bulls are back and we’ve had the highest net worth gain in one month ever!

Personal update

February was a bit less stressful job wise, we’ve delivered our stuff from January and people start using it. I’m a bit on the fence regarding the new guy as he doesn’t seem to be very productive nor motivated to help out beyond his assigned work. Quite a let down given his experience on paper. We’ll see if we keep him beyond the probation period.

This month I’ve also celebrated my birthday and boy was it an expensive one. We’ve invited close friends and family for a party at home and then two days later we went to a bar with a broader set of friends to celebrate there. I usually invite everyone which brought the bill to 750 CHF this time. I’ve also had the chance to meet some friends which all manifested in the Food spendings.

I’m seemingly in the next round for the CTO position and will meet the founders of the company in Mid March. I still have a low believe that I’m the best fit for that job but keep exploring the opportunity. Since the bonus at my current job basically turned out to be almost 0, I project to be about 100k CHF short on income this year. That lack of savings potentail would move out the FIRE goal quite a bit which sucks big time. So yes, if I get an offer above 250k CHF I’ll move on once more.

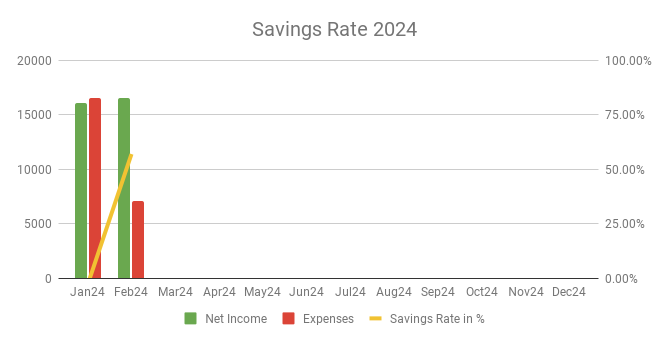

Savings Rate: February 2024

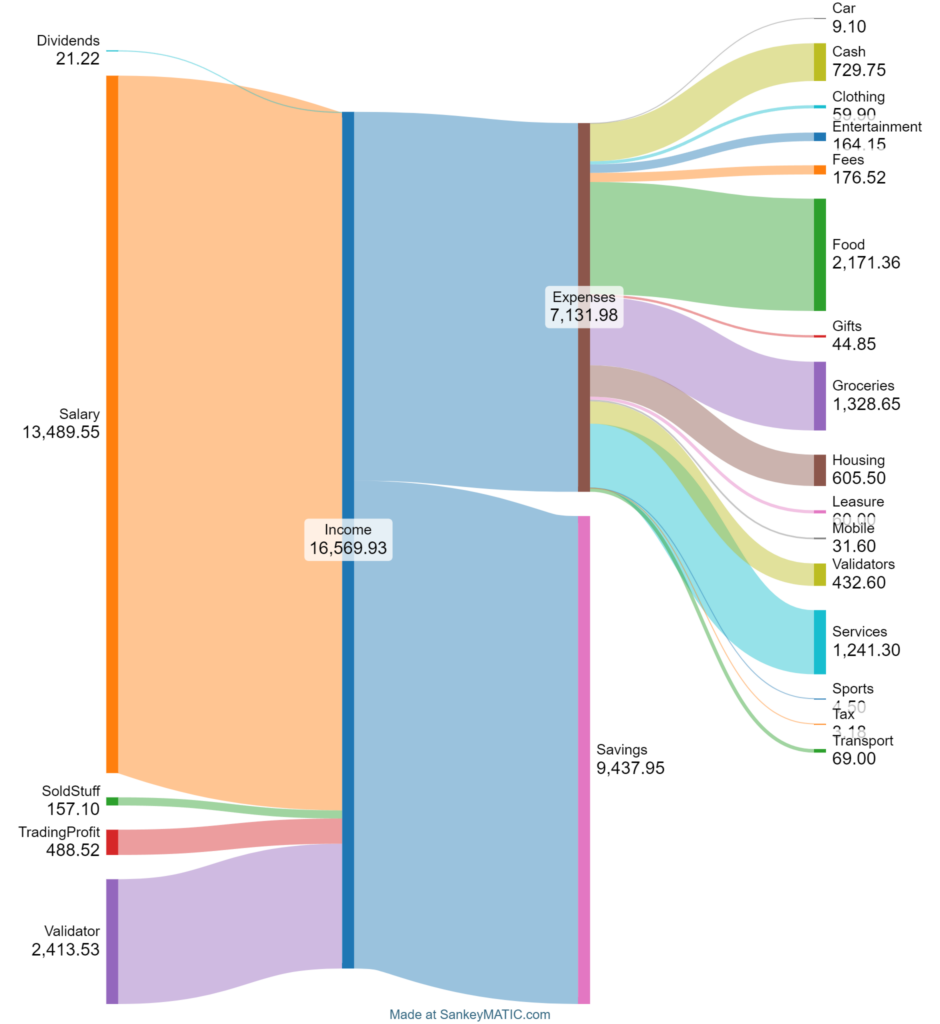

Cash flow: February 2024

Total Income: 16’569 CHF (+506 CHF vs. last month) – Regular salary, sold my old NAS and my old Oculus Quest 1, got 488 CHF in claims from the Mt.Gox recovery (listed as TradingProfit), sold 1343 CHF worth of PHA that counts towards the Validator income.

Total Expenses: 7’131 CHF (-9’378 CHF vs. last month) (22372 CHF incl. Taxes) As outlined some big spending on food/drinks out with friends, German classes for my wife, and 15k CHF of taxes (only government ones, not the cantonal ones yet) and 537 CHF for my watch insurance.

Savings Rate: 56.96% (vs. -2.78% last month) – Much better savings rate (when conveniently ignoring the taxes).

Net Worth: 1.225M CHF (+154k CHF vs. last month) – Bitcoin rallied hard to almost 56k CHF/BTC which was the main source of this amazing net worth growth.

Stock Portfolio

Stock Portfolio value: 110’144 CHF (+7’635 CHF vs. last month)

| Stock Symbols |

| ABBA |

| ABM |

| CMCSA |

| CMI |

| EBAY |

| ELBM |

| GRNBF |

| MMM |

| MO |

| MPW |

| RF |

| SXOOF |

| WBA |

| VT |

After paying the taxes the cash balance looked much lower again and I didn’t move any additional capital to the stock market. Today (technically March) I’ve sold DLR at 54% in profit and instead bought EBAY which currently is attractively valued.

Equity Portfolio

Equity Portfolio value: 80’070 CHF (+0 CHF vs. last month)

Nothing changed on that front

Crypto HODL Portfolio

Current HODL portfolio value: 491’537 CHF (~7.9 BTC / 404 KSM / 4718 DOT / 27k+ PHA) (+154k CHF vs. last month)

Here we go, the Bitcoin ETFs have massive influx of money and currently gobble up more BTC that are mined every day. I therefore expect this position to keep growing. Incase I haven’t mentioned in a while, I will only sell my BTC when one coin reaches 1M CHF at which point I will be able to comfortable retire.

Blog statistics

I see some downwards trend again 🙁

I posted 1 blog post last month, the monthly update. If you have ideas or are interested in more details let me know in the comments.

That’s it for this month. Like last month let me know if you like the style and the ordering of topics.

If you have any questions or comments, please leave a message below or contact me by email. I try to answer all comments and emails.

Nice month for BTC, 1M CHF/coin ? That’s mean 18x from here, more than the market cap of Gold.. ambitious. In how many years do you thing this target will be reach ?

I think within the next 6 years the 1M CHF/BTC can be reached.