Welcome to the Portfolio update of March 2025. We were in (cold) Vienna and crypto is dumping…

Personal update

Low motivation for work continues. My team mate is great but the company doesn’t realize what heroic efforts our team is pulling to keep the lights on.

We went to Vienna which was surprisingly nice, I didn’t have much expectations but it was very clean, great food (several Schnitzels and Spaetzle). Generally a city I’d go to again.

Not much else to write about, besides the fact that some blood vessel in my eye exploded but doc and eye doc claim everything is ok…

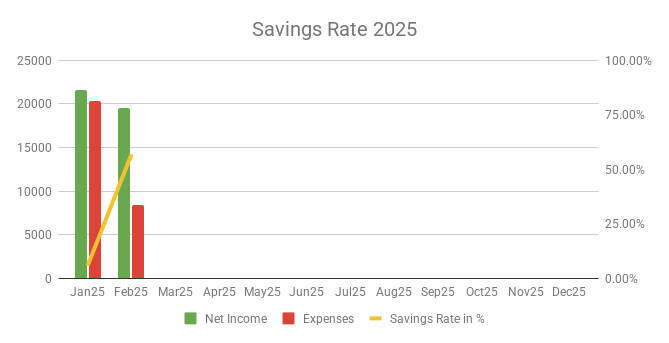

Savings Rate: February 2025

Cash flow: February 2025

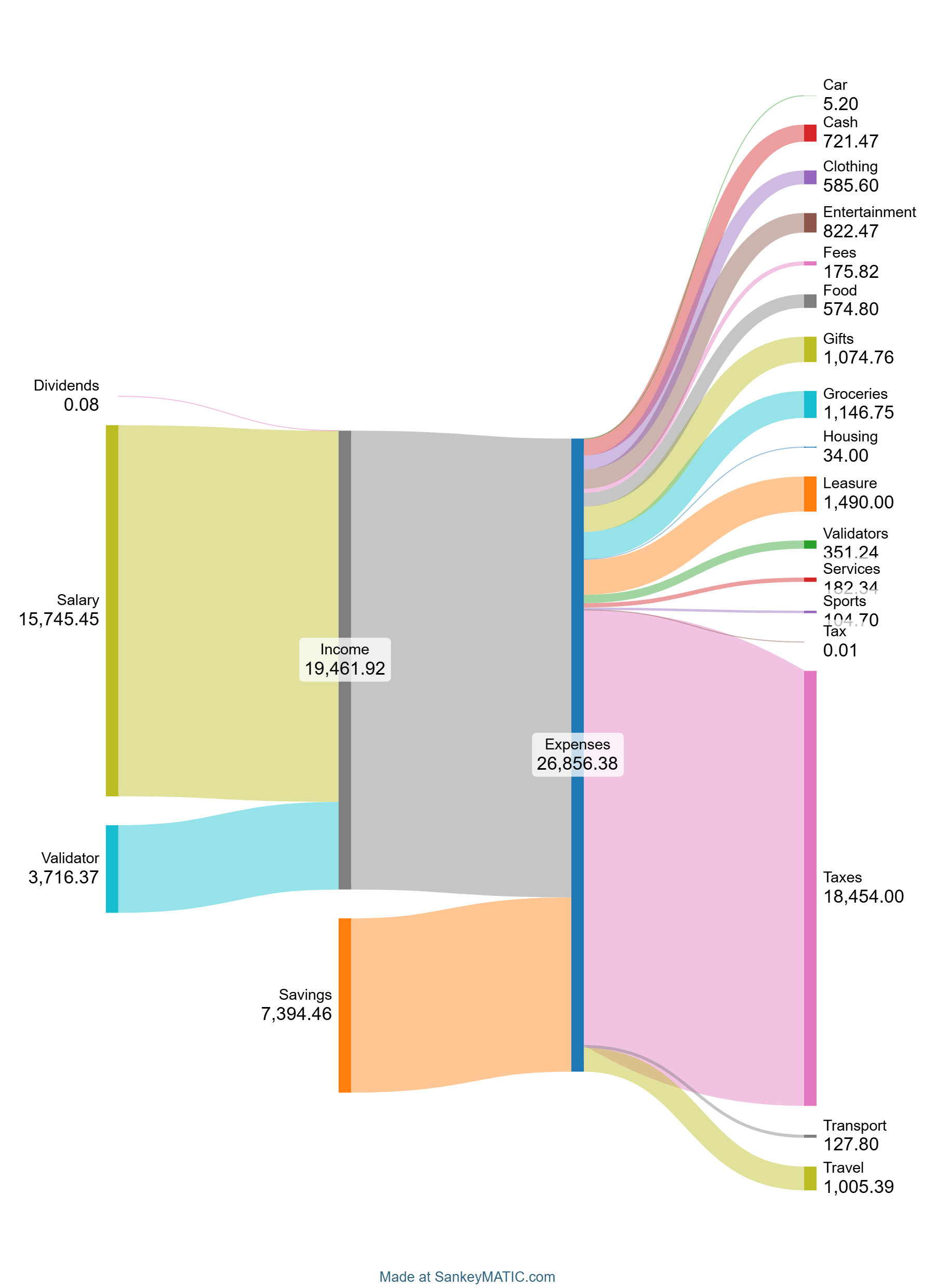

Total Income: 19’461 CHF

Total Expenses: 8’402 CHF (26’856 CHF incl. Taxes)

Savings Rate: 56.83%

Net Worth: 2.0M CHF (-109k CHF vs. last month)

Stock Portfolio

Stock Portfolio value: 153’728 CHF

| Stock Symbols |

| ABBA |

| AMZN |

| CMCSA |

| EBAY |

| ELBM |

| MMM |

| MO |

| MPW |

| MRK |

| PATH (UI Path) |

| SSTK (Shutterstock) |

| WBA |

| VT |

Equity Portfolio

Equity Portfolio value: 80’070 CHF (+0 CHF vs. last month)

Nothing changed on that front. This position will be growing by ~30k CHF/year around March.

Crypto HODL Portfolio

Current HODL portfolio value: 671’620 CHF (~8.37 BTC / 674 KSM / 9449 DOT) (+85k CHF vs. last month)

One huge dump 🙁 makes me sad.

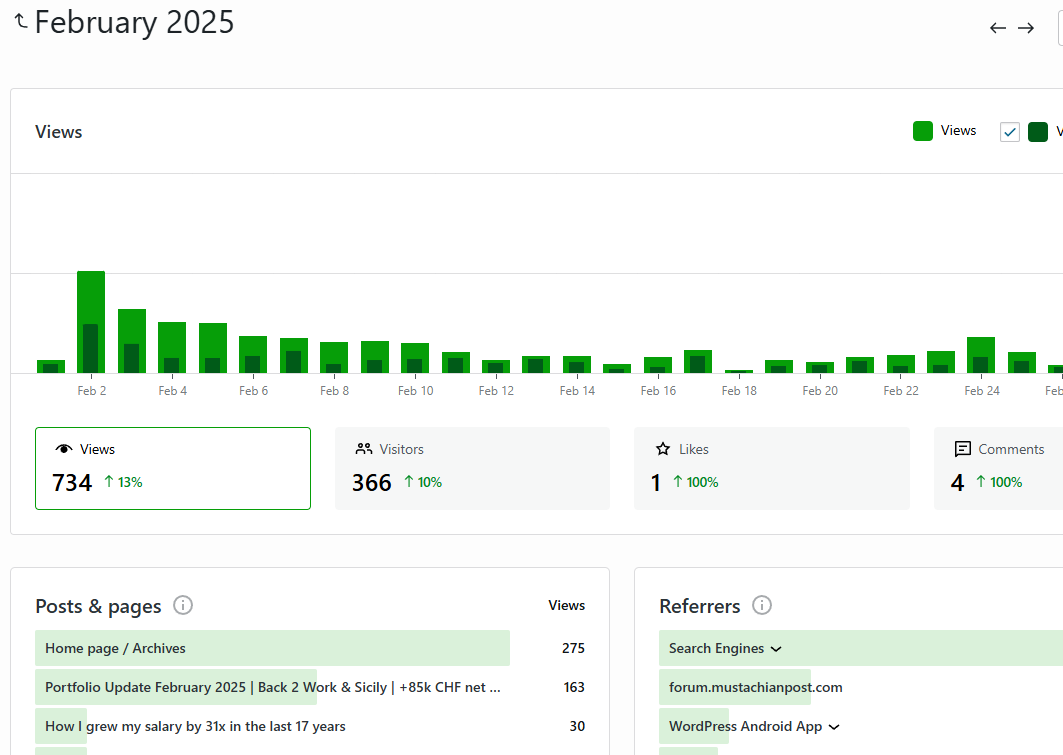

Blog statistics

I posted 1 blog post last month, the monthly update. If you have ideas or are interested in more details let me know in the comments.

That’s it for this month. Like last month let me know if you like the style and the ordering of topics.

If you have any questions or comments, please leave a message below or contact me by email. I try to answer all comments and emails.

Thanks for this short update. A bit lean in content, but ok.

One suggestion: Half of your net worth is driven by your Real Estate, which seems to nicely increase over time. Would include a sections similar to Stock, Crypto or Equity Portfolio highlighting the increases. On Equity nothing moved in a year, but the Real Estate value grew nicely, so more interesting to look at this then at a constant Equity value.

Yeah sorry for the short one this time. Was in a rush to leave for an event.

Hi,

I am struggling with your cash flow chart, you have an income of 19.5K and you have expenses 28.8K how can you save 7.4k?

This month cashflow shows the 7k CHF flowing from Savings into expenses. Check other month where the excess income flows into the savings