Welcome to the Portfolio update of May 2020. A bit of recovery on all fronts, Net worth looks better again (partly because I adjusted the applied exchange rates for USD and EUR assets). And Savings Rate beyond 60% which is awesome as it was a regular income month.

Let’s see how the the P2P Portfolio performed.

First of all I have to apologize to my readers. I kind of broke the promise of providing weekly updates for the Technical Reviews. April was quite stressful at work and at home. I’m however optimistic that May will bring some more calmness. I even started to learn for a boat driving license 😀

I also switched my accounting from Google Sheets to beancount. I might write an in-depth article about this later on. It was a ton of work but I hope my accounting will be more precise and less time-consuming in the future.

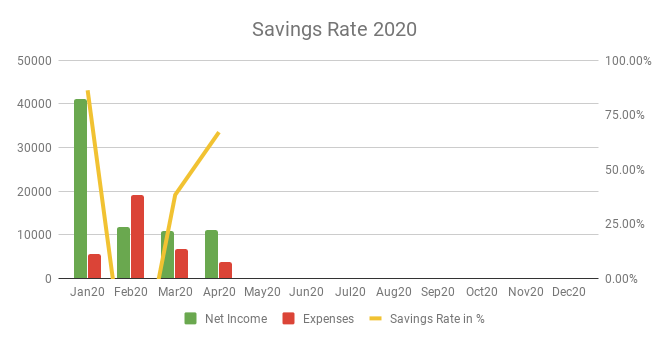

Savings Rate: April 2020

Total Income: 11’158 CHF – base salary plus two 200 CHF bonuses. Yay for awesome team mates which appreciate hard work.

Total Expenses: 3’680 CHF – It’s somewhat beyond my comprehension on how we managed to pull that off, lowest expense month ever! Despite the fact that we had the quarterly 854 CHF maintenance bill (got lowered this year from 1330 CHF in 2019 yay) and some 1’613 CHF in groceries (well that includes some delivery orders and take-away which I might account for separately in the future). There were also 724 CHF in gifts (two couples got babies in April and my sister turned 40) but also a refund of 572 CHF from booking.com due to my cancelled trip to Barcelona with my friends.

Savings Rate: 67.02% – Way over the yearly goal of 35%+ saving rate, maybe I should increase it?

Stocks: My SPXU bet is currently still at -16.7k CHF would be my worst loss in the stock market if I liquidate now. I strongly believe the stock market is overbought and doesn’t yet price in the consequences of Coronavirus. I will hold on to it a bit longer. My 3k CHF in VT so far have an unrealized profit of 666 CHF. And some 50k CHF still sitting around in IB, I should really invest them into something. Maybe Tesla stock? xD

All in all I face a Net Worth recovery of about 16k CHF back to 408k CHF see my portfolio page for details about the asset allocation.

P2P Portfolio

| Platform | Balance | Actual XIRR |

| Bondster | 4’792.83 EUR | 6.08% |

| Crowdestor | 4’736.00 EUR | 5.45% |

| DoFinance | 4’854.10 EUR | 10.22% |

| FastInvest | 3’684.61 EUR | 11.73% |

| Flender | 1’041.81 EUR | 18.75% |

| Grupeer | 4’755.00 EUR | 3.57% |

| IuvoGroup | 4’911.12 EUR | 14.17% |

| Mintos | 5’350.97 EUR | 10.42% |

| Monethera | 2’047.23 EUR | 4.90% |

| PeerBerry | 4’837.19 EUR | 9.07% |

| RoboCash | 4’817.46 EUR | 7.73% |

| Swaper | 5’096.31 EUR | 7.41% |

| Viventor | 4’778.32 EUR | 5.11% |

| Wisefund | 1’000.00 EUR | 11.32% |

| Total | 56’702.95 EUR | 8.99% |

April Income from P2P Portfolio: +327.64 EUR

Calculated XIRR (of the platforms that generated money): 8.99%

I’m trying withdrawals with several platforms. And most of them are delayed right now. Platforms which fullfilled my withdrawal requests:

- Swaper (one business day / requested 1st of May, on bank 5th of May)

- Crowdestor (one business day / requested 17th of April, on bank 20th of April)

- Wisefund (same or next day / requested 9th and 13th of April, on bank 9th and 14th of April)

Platforms for which I still wait:

- Grupeer (24.92 EUR requested on 17th of April)

- Monethera (32.79 EUR requested on 20th of March)

- FastInvest (978 EUR requested in three 320ish EUR on 1st of April, 17th of April, 1st of May)

I will stay away from these platforms for now.

Let’s dive into the detailed statistics and comments on each platform:

Bondster

Balance: 4’792.83 EUR

Income: 30.63 EUR

Platform XIRR: 13.03%

Calculated XIRR: 6.08 %

Corona is greeting, lower monthly income than last month despite being fully invested.

For Bondster I use the following AutoInvest settings: Minimum interest rate: 12.5%, maximum loan term: 12 months, buy-back guarantee: yes

I will try to lift the balance to 5000 EUR on this platform in the future.

| If you would like to try Bondster and get 1% cashback on all investments in the first 90 days, please use this link to register. |

Crowdestor

Balance: 4’758.52 EUR

Income: 0 EUR

Platform XIRR: 19.17 %

Calculated XIRR: 5.45 %

No payments this month. Crowdestor gave every project an optional grace period up to 3 months. My Fertilizer investment should however be fully paid back at the end of this month. They only asked for a 20 day delay.

| If you would like to try Crowdestor and get 1% cashback on all investments in the first 90 days, please use this link to register. |

DoFinance

Balance: 4’806.49 EUR

Income: 0.87 EUR

Platform XIRR: 12 %

Calculated XIRR: 10.22 %

Seemingly no payments this month. That pulls down the calculated XIRR.

They stopped accepting new investments due to the uncertainty of the markets. A very mature decision in my opinion.

| If you would like to try DoFinance yourself feel free to register thru this link. There is however no bonus nor support for my blog for using this link. |

FastInvest

Balance: 3’684.61 EUR

Income: 43.18 EUR

Platform XIRR: 12.99 %

Calculated XIRR: 11.73 %

My concerns keep increasing. I’m still waiting for the money I’ve withdrawn on the 1st of April. Since then I’ve withdrawn another 313 EUR and 289 EUR which are still pending. For one of them I got a date of 27th of April as payout date indicated but that money didn’t arrive yet.

I do NOT recommend to invest money in FastInvest at this point.

Flender

Balance: 1’041.81 EUR

Income: 3.33 EUR

Platform XIRR: 10.33 %

Calculated XIRR: 18.75 %

I’ve recalculated the actual XIRR and including their generous 5% cashback for all investments they actually reach a very nice 18.75%. Maybe I will reconsider the platform in the future.

I can still recommend the platform for People with less risk appetite for now.

| If you would like to try Flender and get 5% cashback on all your investments and 10% interest in the first 30 days, please use this link to register. |

Grupeer

Balance: 4’755 EUR

Income: 44.99 EUR

Platform XIRR: N/A (not available)

Calculated XIRR: 11.32 %

Concerns about Grupeer being another scam are increasing steeply. And my withdrawal request from 17th of April is still unhandled. They are probably gone.

I do therefore NOT recommend Grupeer at this point anymore.

IuvoGroup

Balance: 4’911.12 EUR

Income: 56.53 EUR

Platform XIRR: 13.93 %

Calculated XIRR: 14.17 %

A nice lady called me recently from IuvoGroup and asked if I have any concerns or questions regarding the current situation. I’ve just today started a withdrawal request of my available 7 EUR and if they process the withdrawals as promised I will increase my balance with the platform this month.

There are also several discounted loans available (at 2 – 4 %) which I might be able to scoop up.

My Autoinvest settings look like this: Maximum in one loan 10 EUR, min interest 12%, loan status current, all 3 buy-back options. No other limitations.

I will try to lift the balance to 5000 EUR on this platform.

| If you would like to try IuvoGroup yourself and get up to 90 EUR when you invest 2500 EUR, please use this link to register. |

Mintos

Balance: 5’350.97 EUR

Income: 78.57 EUR

Platform XIRR: 14.10 %

Calculated XIRR: 10.42 %

Still my personal favorite in my portfolio, the sheer amount of Loan originators allows for very nice diversification within the platform.

My Autoinvest settings look like this:

A high risk second market profile with all LOs with buy-back with 17%+ interest rate up to 12 months, no diversification across LOs, 5 – 25 EUR per loan.

A maximum interest profile with all LOs with buy-back with 16.5%+ interest rate up to 12 months terms, with diversification across LOs, 10 – 50 EUR per loan.

I will try to lift the balance to 6000 EUR on this platform.

| If you would like to try Mintos yourself and get 1% cashback of all invested capital in the first 30 days, please use this link to register. |

Monethera

Balance: 2047.23 EUR

Income: 32.63 EUR

Platform XIRR: 19.05 % (average from 20.1 % and 18 % projects)

Calculated XIRR: 6.57 %

I requested a withdrawal of 32.79 EUR on 20st of March which I didn’t receive so far. Red Flags intensifies. The technical review of Monethera showed clearly that this platform is a scam. Probably another write-off later this year.

I definitely do NOT recommend to invest in this platform at this point.

PeerBerry

Balance: 4’837.19 EUR

Income: 57.17 EUR

Platform XIRR: 13.43 %

Calculated XIRR: 9.07 %

Looks like my XIRR calculation last month was of this month my data indicates again a more realistic 9% of return. See updated AutoInvest settings below.

My Autoinvest settings have two profiles:

One for 15.0%+ loans with current status, buyback and any duration, max amount per loan 100 EUR.

One for 12%+ loans with current status but only 1 months remaining, max amount per loan 20 EUR.

I will try to lift the balance to 5000 EUR on this platform.

| If you would like to try PeerBerry and support the blog, please use this link to register. |

Robo.cash

Balance: 4’817.46 EUR

Income: 2.39 EUR

Platform XIRR: 12.33 %

Calculated XIRR: 7.73 %

Another seemingly hard hit platform by the Corona crisis. Only 2.39 EUR earned is very sad.

I will regardless try to lift the invested amount to 5’000 EUR.

| If you would like to try Robo.cash and support this blog, please use this link to register. |

Swaper

Balance: 5’096.31 EUR

Income: 61.25 EUR

Platform XIRR: 8.04 %

Calculated XIRR: 7.41 %

The Platform XIRR and actual XIRR slowly get closer to each other. I withdrew the 61 EUR of interest paid this month and they sent the money immediately, nice.

I will very likely add more money to my account in the future.

| If you would like to try Swaper and support this blog, please use this link to register. |

Viventor

Balance: 4778.32 EUR

Income: 4.48 EUR

Platform XIRR: 16.24 %

Calculated XIRR: 5.11 %

Viventor still can’t live up to the promised interest rates they state in the dashboard. I start to wonder how they calculate the XIRR or if I somehow managed to invest into bullet payment loans.

My Autoinvest settings are the following: max amount per loan 20 EUR, 15.9 – 16% loans only, up to 12 months term, all loan types, all countries, all LOs, buyback & payment guarantee.

I will regardless try to lift the invested amount to 5’000 EUR.

| If you would like to try Viventor and earn 1% cashback on all investments in the first 30 days, please use this link to register and the code: XE0180 during the registration. |

Wisefund

Balance: 1000.00 EUR

Income: 0 EUR

Platform XIRR: 17.4 %

Calculated XIRR: 11.32 %

After my Technical review of Wisefund I will definitely NOT invest more money in this platform. Too few employees, too many red flags from the owner. However the quick withdrawal processing gives me hope that I see my still invested 1000 EUR again at some point.

So we had 6 very nicely performing platforms yielding over 42 EUR each, with: Mintos, FastInvest, PeerBerry, Swaper, IuvoGroup, Grupeer (but those guys are probably scam)

With Grupeer, Monethera and FastInvest seemingly not able to process withdrawals I have some 11 415 EUR at risk of going down the drain. :'(

Blog statistics

Views: 620 (-293 from March) 🙁

Visitors: 173 (-57 from March) less bad than the Views count…

Followers: 8 (+3 from March) yay and welcome to the new people 🙂

I conclude that people have more important things in mind than to do high risk investments in the P2P world. Good news however are the 8 blog followers in total 😀

In April I added a Technical Review for Monethera and disqualified it as second platform.

I will try to add more Technical Reviews in the coming days and weeks. However with the picked up goal of getting the boat driving license I might fail my dear readers again :/

That’s it for this month. Like last month let me know if you like the style and the ordering of topics.

If you have any questions or comments, please leave a message below or contact me by email. I try to answer all comments and emails.

Woah! Congrats ont the savings rate…

Thanks I was astonished myself. I definitely try to keep it up. How is your saving rate?

This year until March I am at around 50% on average – but it’s highly skewed! I dumped a quite some cash in the market in February and March. I don’t have a good run rate – something to explore in a blog post though… 😉

3’680 CHF expenses made my heart lose some beats 😀

congrats Cheese!

Thanks, I was equally impressed. But I can say that May will quiet definitely be higher again, restaurants are open and we missed the Chinese food a lot 😀