Welcome to the Portfolio update of May 2021. Sorry for the rather late post, looks like working for a Startup that is about to launch a product is a somewhat stressful and exhausting experience. Find out more in this monthly portfolio update.

Personal update

I’ve started my new job and immediately got several launch critical projects assigned. Looks like I’m the monitoring expert/owner now (I’m glad that Grafana and Prometheus were systems similar to the proprietary ones in my previous job). Also preparing and shipping equipment for 4 datacenters in EU were part of my first tasks. Official training: not much.

The good thing is that time flies very quickly, the bad thing is that I spent several weekend days and long extra hours working. Mrs. Cheese is not super happy about it. (Had to work and bring up a new datacenter at her birthday day 🙁 Sorry again baby). Coworkers are super awesome and borderline workaholics, fortunately the whole political correctness craze didn’t reach that startup yet, we can joke around and have a good time.

My little YouTube channel about daily Crypto Token prices now has over 1000 subscribers. I hope I can eventually start to monetize it a bit.

Not much else on the personal side going on, there is clearly a lack of free time due to the amounts of working hours. Well I managed to meet former coworkers in a rainy outdoor drinking event and the guy that brought me to the startup (technically also a former coworker), going to an actual restaurant felt very nice.

The FTTH offer got voted on and I managed to get support from all other owners. It’s ordered now and should arrive within the next 3 months or so. That will cost me an installation price of 8’422 CHF :-/ So any further watch collection additions are postponed for now.

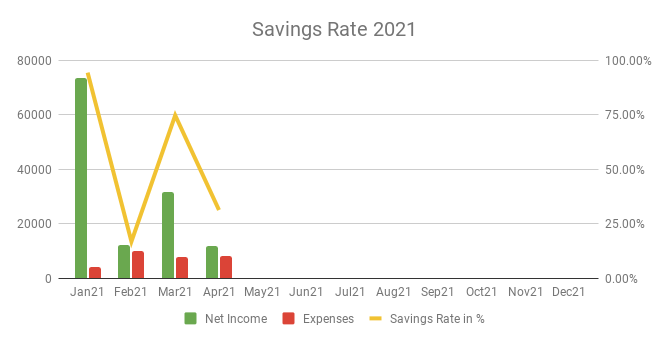

Savings Rate: April 2021

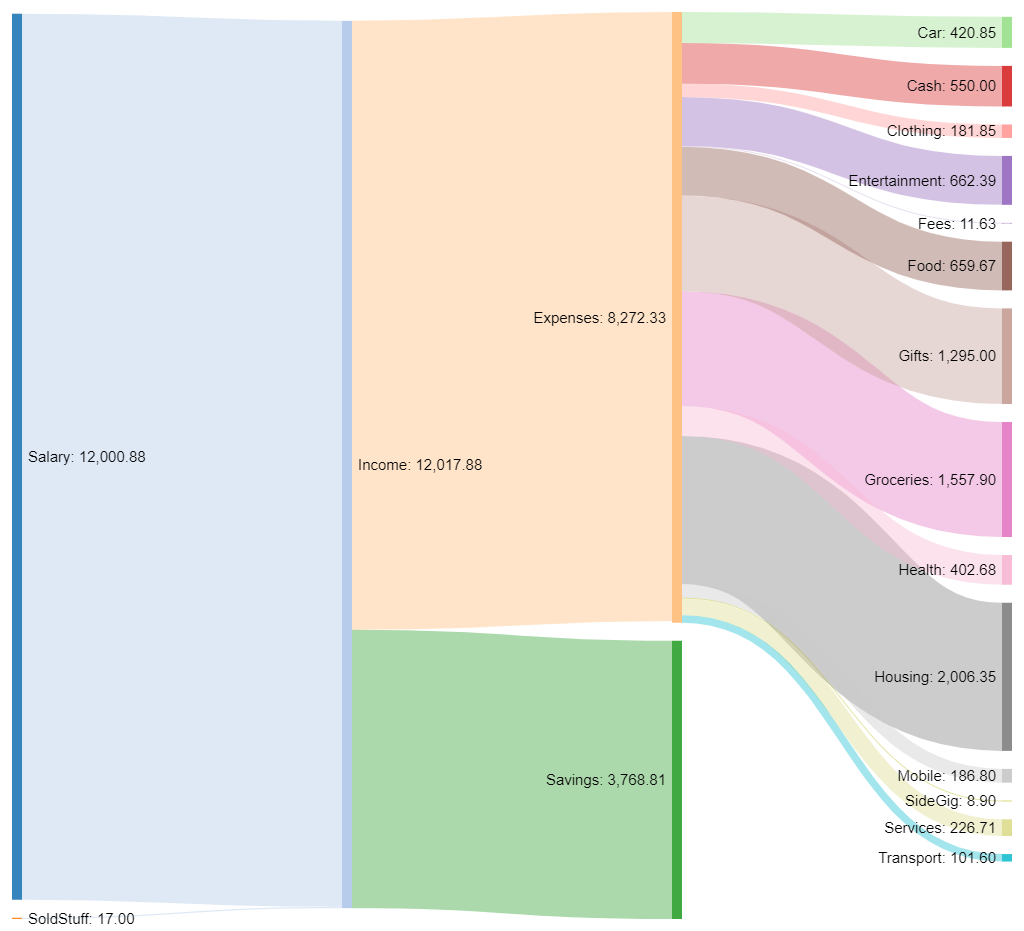

Cash flow: April 2021

Total Income: 12’017 CHF (-19’741 CHF vs. Mar) – That will be very likely my salary for the next 11 months. If the tokens are still worth something this should increase massively in March 2022 (looking forward to it). Also some 17 CHF of sold stuff.

Total Expenses: 8’249 CHF (+221 CHF vs. Mar) – Some more extra ordinary expenses: A gift for my mom’s 60th birthday that was deferred until now costing 1’250 CHF (new chairs), a new grill (aka BBQ for the american readers) costing 797 CHF (at least was discounted from 899 CHF), car service and tire change for 420 CHF, new headphones (BeyerDynamics DT-1990 Pro) & USB DAC (FiiO K5 Pro) for work for 625 CHF (should get a 300 CHF reimbursement), and mobile phone costs of 186 CHF (100 CHF yearly top-up of my wifes and 86 CHF of March&April with some premium call costs due to Baby Cheese being feverish for 3 days). I’m btw now using Wingo Swiss (for 24 instead of 58 CHF/month). Few trips to the office did cost 101 CHF in train tickets.

Savings Rate: 31.36% (-43.36% vs. Mar) – Definitely too high expenses this month, let’s hope next month is more affordable. No big spendings plans currently but there’s a small chance that the FTTH invoice will already arrive tho.

Net Worth: 1.09M CHF (-9’263k CHF vs. Mar) – Bitcoin dropped again and the stocks only appreciated by some 400 CHF (thanks to a weak USD). Combined with high expenses resulted in a net loss.

Stock Portfolio

Stock Portfolio value: 231’513 CHF (+396 CHF vs. Mar)

| Stock Symbol | # Shares | Avg. price | Current price | Unrealized P/L |

| VT | 1444 | 85.18 USD | 101.31 USD | 23’291 USD |

| ARKK | 324 | 110.12 USD | 120.77 USD | 3’450 USD |

| AVUV | 452 | 71.88 USD | 73.90 USD | 913 USD |

| AVDV | 372 | 62.34 USD | 64.69 USD | 874 USD |

| SPXU | 240 | 100.87 USD | 20.13 USD | -19’377 USD |

| ABBA | 48 | 10.14 CHF | 23.04 CHF | 619 USD |

| Total | 2880 | N/A | N/A | 9’770 USD |

Due to the busy month I kind of forgot to invest the automatically transferred 5’000 CHF into stocks. However my target allocation is still the same:

| Stock | Allocation % |

| VT | 60 |

| AVDV | 10 |

| AVUV | 15 |

| ARKK | 15 |

ABBA seemingly had a 1:6 stock split, since I have now 48 pieces of this title.

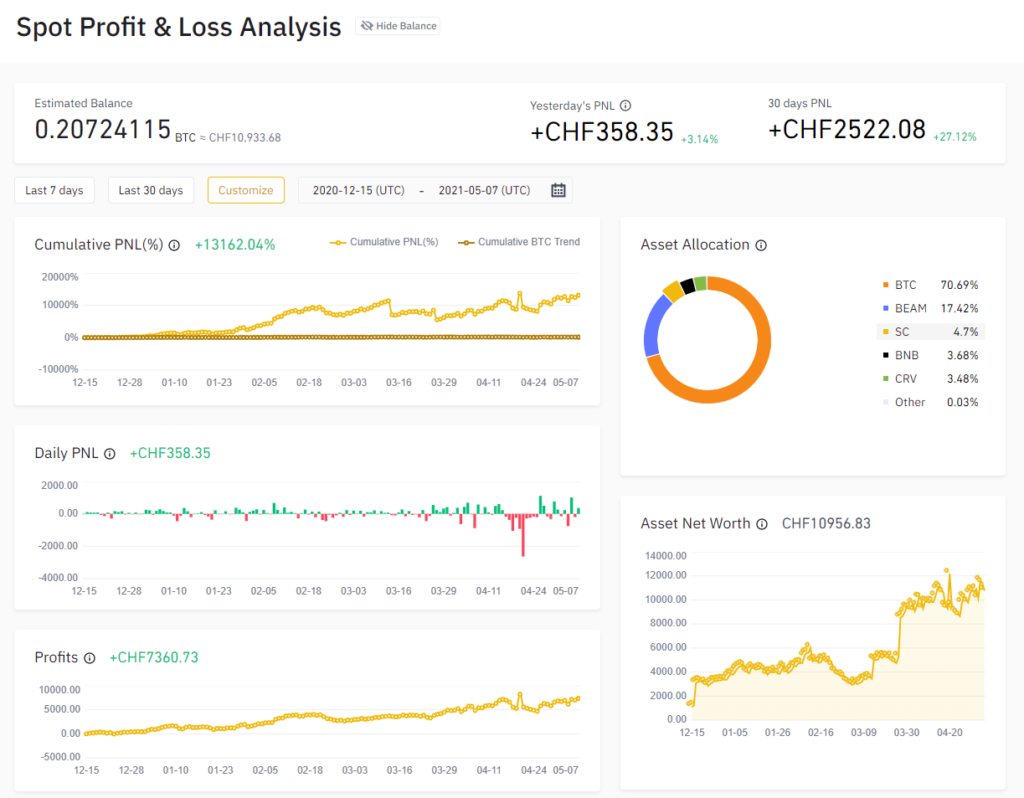

Crypto Gambling Portfolio

Since the P2P stuff is no longer interesting I’ve decided to share some more details of my crypto gambling portfolio. I’m in a paid subscription membership that regularly posts calls about tokens that look interesting and might gain money. I had pretty good returns so far fully covering the membership fees and more.

Gains/Losses in April: +1’765 CHF (vs. +2194 CHF in March)

I’ll just post my Binance portfolio picture here:

Please note the gambling portfolio is not actively tracked in my net worth, I should probably change that since it now surpassed 10k CHF. I will post the monthly screenshot in the future.

I also started experimenting with Cash & Carry trades, not too excited about the returns so far tho.

P2P Portfolio

| Platform | Value |

| Bondster | 1241 EUR |

| Crowdestor | 823 EUR |

| DoFinance | 4186 EUR |

| FastInvest | 1394 EUR |

| Flender | 1616 EUR |

| Grupeer | 4787 EUR (more likely 0) |

| IuvoGroup | 1315 EUR |

| Mintos | 2083 EUR |

| PeerBerry | 1123 EUR |

| RoboCash | 2776 EUR |

| Swaper | 9.84 EUR |

| Viventor | 3339 EUR |

| Wisefund | 1000 EUR |

| Total | 25’698 EUR |

April Income from P2P Portfolio: +465 EUR

Noteworthy updates:

I liquidated a total of 1177 EUR of my P2P Portfolio in April.

- Bondster paid a huge junk of 410 EUR (I must somehow have had 12 months long loans that got repaid)

- I sold all pending loans on FastInvest but withdrawal is very limited due to their intransparent withdrawal restrictions. I also didn’t see any money from FastInvest since last November…

Blog statistics

Views: 1435 (-590 vs. Mar) Less posts == less views 🙁

Visitors: 459 (-209 vs. Mar) same as above.

Followers: 39 (+2 vs. Mar) Yay at least one number going up. Welcome new subscribers!

I posted 1 blog posts in April. the monthly update and that’s it. The crazy working hours and stress didn’t leave a lot of room and energy to post more. Mea culpa. If you have ideas or are interested in more details let me know in the comments.

That’s it for this month. Like last month let me know if you like the style and the ordering of topics.

If you have any questions or comments, please leave a message below or contact me by email. I try to answer all comments and emails.

Start up Life doesn´t sound like fun, Do you get our weekend hours rewarded or is anything Allin on that level ?

Are somehow familliar with Asset Taxes in Switzerland, is your portfolio also effected by it ?

Cheers Matthias

Well while it is certainly the most demanding job I’ve had so far it’s also very rewarding as every hour worked can have an positive impact on the product. No extra comp so far.

Taxing is the same as for the stocks in the previous company, when they vest they’re being valued and get taxed as income.

Thanks for sharing!

Can you disclose the startup name ? Or the coin associated ?

Alors regarding your waterfall expense, I was curious, what do you use ? Excel?

I prefer not to disclose the startup name at this point.

For the sankey diagrams, check out this article of mine: https://fondue.blog/how-to-create-beautiful-sankey-diagrams/

Sorry for the unclear question. Is there a Capital Tax in Switzerland ? Hence if you buy stocks and sell them with a upside ?

That would be capital gains, and no Switzerland doesn’t tax those. However if you get stocks from your employer these are taxed as income at assignment date.