Welcome to the Portfolio update of May 2023. In April I’ve got laid off again, found a new job and broke my leg…

Personal update

April was rather eventful, early April it still sounded optimistic that the Series-A raise of the startup would be reasonably successful and we could hire more people. In the second week of April things changed a bit and people were asked if they’re willing to give up parts of their salaries a deal I couldn’t accept. And in the third week of April five people including me were laid off because the investors pressured the founders to cut salaries above 200k EUR/year. tl;dr: I got put on garden leave and will still receive my salary until the end of May.

So I’ve started to look around immediately and got an offer for a new job within 2 weeks. This time an insurance tech startup and no longer crypto. Doesn’t sound too bad to get a bit more job security/stability into my life. Pay will be at 210k CHF total comp, a 40k hit compared to the previous gig which I hopefully can compensate with my validator business or a new thing I’m trying.

As some readers might remember I’ve started bouldering regularly beginning in April 2022 and even increased the frequency to twice a week after I was put on garden leave. Unfortunately yesterday (2nd of May) I didn’t manage to climb down properly from one of the routes and instead fell down and while falling I’ve lost my balance and landed on my left leg.

Shinbone broken twice and left foot in a rubber cask now. Walking on crutches hurts w/o pain meds and all coming up events have been cancelled. The good news is that my family will return a week earlier on May 6th.

I certainly had enough life changing/impacting events for now in the last few months and wouldn’t mind if life gets a bit more boring again. And if there is a reader with a voodoo puppet that cursed me, please stop xD.

I’ve did trick a bit in the expenses, technically I’ve spent 134k CHF on the new Tesla in April but since that’s not a regular expense I’ve decided to not make it show up. It does impact the net worth negatively as if I spent the money (counting the car as an asset would be weird too).

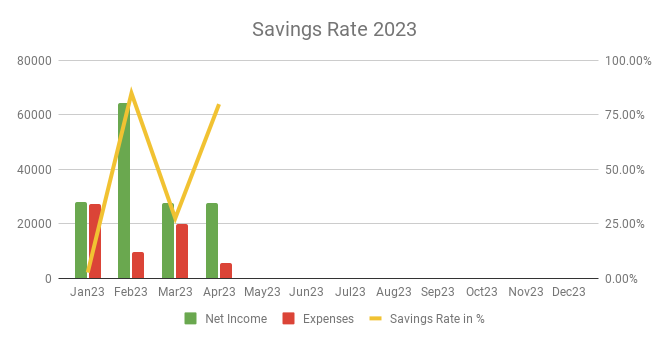

Savings Rate: April 2023

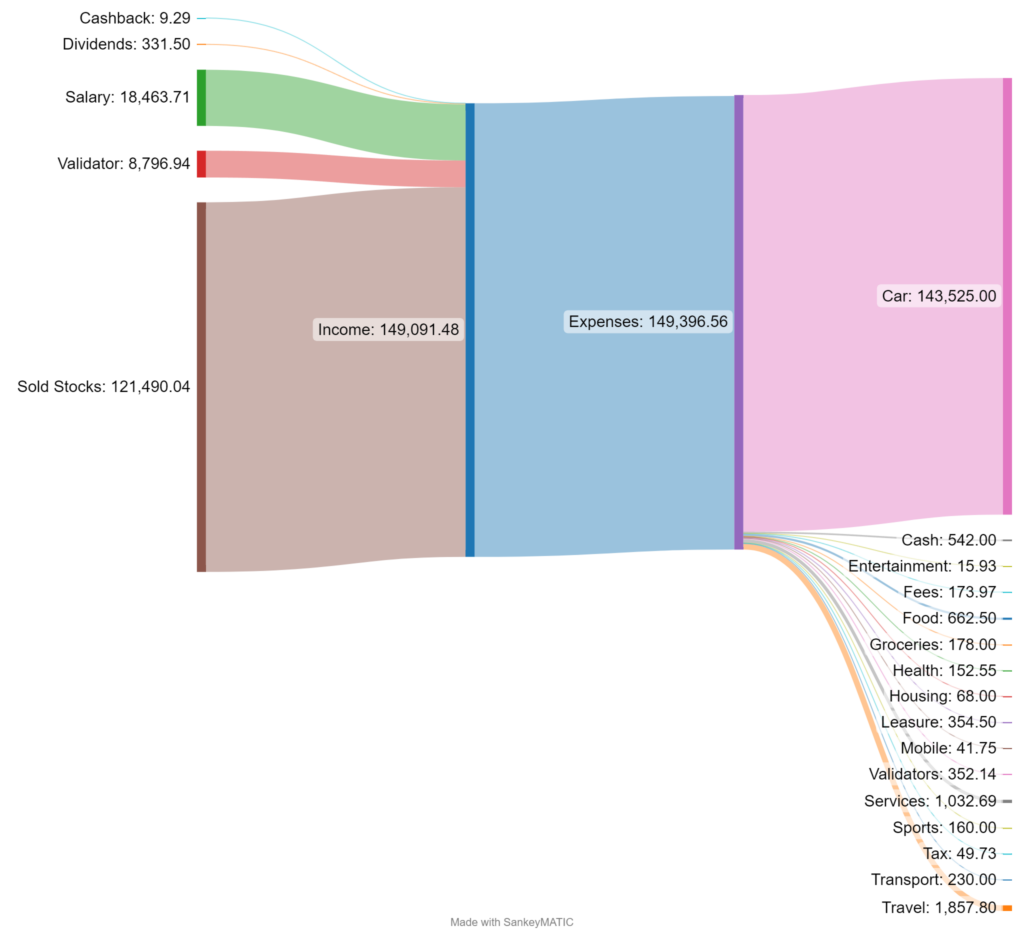

Cash flow: April 2023

Total Income: 27’601 CHF (+55 CHF vs. last month) – Regular salary (~18.5k CHF) plus validator income of ~8.7k CHF and 331.50 CHF in dividends from stocks.

Total Expenses: 5’571 CHF (-14’385 CHF vs. last month) well technically 149k CHF incl. car – Disregarding the car purchase April was rather affordable, I’ve only bought groceries for myself which accounted for 178 CHF, eating out at 662 CHF, money for my family 1.8k CHF and 1’032 CHF for services mainly for the play group for my son and some shipping fees for sending my company equipment back to France.

Savings Rate: 79.81% (vs. 27.55% last month) – As said a bit tricked with the car but otherwise a rather good month.

Net Worth: 921k CHF (-121k CHF vs. last month) – Not counting the car as an asset the difference pretty much makes up the car price.

Stock Portfolio

Stock Portfolio value: 34’028 CHF (-142’009 CHF vs. last month)

| Stock Symbols |

| AAP |

| ABBA |

| ABM |

| CMCSA |

| ELBM |

| GRNBF |

| MMM |

| MO |

| MPW |

| RF |

| SXOOF |

| WBA |

To pay back the margin loan (100k CHF) and have cash for the car I’ve liquidated my VT position of around 230k CHF. I will invest all future free money again in VT until I’m back at the 275k CHF all time high portfolio. What really hurt was the crappy USD -> CHF exchange rate of 1:0.89 (10% drop since beginning of the year, thanks FED!).

Crypto HODL Portfolio

Current HODL portfolio value: 232’111 CHF (~7.7 BTC / 248 KSM / 2852 DOT / 92100 CRO / 2.2k+ PHA) (+6’531 CHF vs. last month)

April was a bit of an up and downwards during April

Blog statistics

Views: 1610 (+648 vs. last month) – two posts, double the views?

Visitors: 514 (+114 vs. last month) – Nice growth.

Followers: 38 – not sure if that’s correct tho.

I posted 2 blog post last month, the monthly update and the sad news. If you have ideas or are interested in more details let me know in the comments.

That’s it for this month. Like last month let me know if you like the style and the ordering of topics.

If you have any questions or comments, please leave a message below or contact me by email. I try to answer all comments and emails.

Wishing you speedy recovery.

Thanks, the situation makes me appreciate the little things in life even more. The ability to carry stuff while walking for example w/o the need of some bag or backpack.

What is VT ? Would be cool if you could also state the name of the Company. Anoys me everytime when I have to search for it.

VT is Vanguard Total market. A low cost index fund that covers the total stock market.

What Validators are you running? And can you tell me more about your Jobsituation? What position are you in? What role do you have? Whats your background? Sorry that i ask so specific but i am working in IT by myself as a Freelancer on a hourly-base. But i never saw and dont know how to get these jobs with such a high salary as you had. Where do you find these gems? Can you provide some Information about this process since im am highly interested

For my background i have a BA in Computer Science and working now almost since 8 years as a Softwareengineer.

Thx for your response

Polkadot/Kusama & Phala, I’m mostly in Senior and Principal positions in the crypto space, I also only have a BSc in Computer Science but I know what’s the worth of my time and that I’m highly capable of learning new stuff quickly.

On a consulting basis you should be able to get 200-250k CHF gross salary if you purely go for project work. You might want to specialize in Rust and look at the crypto/web3 industry.

With my CV I mostly get head hunted thru recruiters in the crypto space that offer decent opportunities.

I guess, you need Cloud, Security, and Big Tech in your CV to get such jobs, even in Zürich.

Wow, brave move to liquidate VT and keep all this crypto…Even if I believed in crypto I probably wouldn’t sleep at night knowing that 30% of my NW is in crypto especially considering a big portion of the rest is locked in illiquid assets such as pension and RE.

But you do you 🙂

Looks like the new apartment will fall thru as the selling party already came up with an outrageous 50k CHF invoice for changes to the floorplan and the teardown of one wall. Given the new income the mortgage is also not as easily coverable as with the projected 400k EUR.

So the Car is more important than the flat? Why Not go for a Model Y and save the Money there

The total mortgage interest load & amortization would have led to roughly 6k CHF/month of fixed costs, something that’s ok with a 35k EUR/month income but not with 15k CHF/month. So no it’s not about importance but rather fixed costs.

OK but then it’s Not about the 50k more…