Welcome to the Portfolio update of October 2020. I managed to dissolve 14k CHF of my P2P portfolio this month. Net worth didn’t grow much because of exchange rate and weak stock market.

Personal update

September… was ok. Went to the office for the second time since COVID-19 lock-downs started. I sent back my new Samsung Monitor because I couldn’t accept the build quality issues and it started to have burn-in/image retention, something that is technically not possible with VA LCD panels. Had barely time to play videogames and had a cold for a bit in the beginning of the month.

I started to do more regular exercises by buying back a Nintendo Switch which I sold to a friend last year. I got Nintendo Ring Fit Adventure for it and feel pretty fit now after working out for more than a week every day.

There was also the pre-order for the new GeForce RTX 3080 series GPUs and the PlayStation 5 console which I both ended up ordering… frugal is different. The GPU however was a pretty sweet deal for 689.- CHF (699.- minus 10.- CHF cashback), now it just needs to arrive.

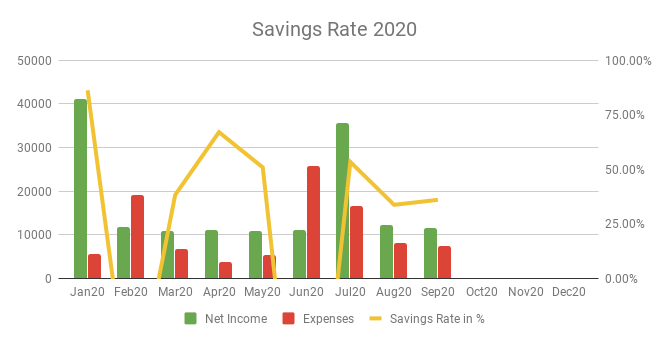

Savings Rate: September 2020

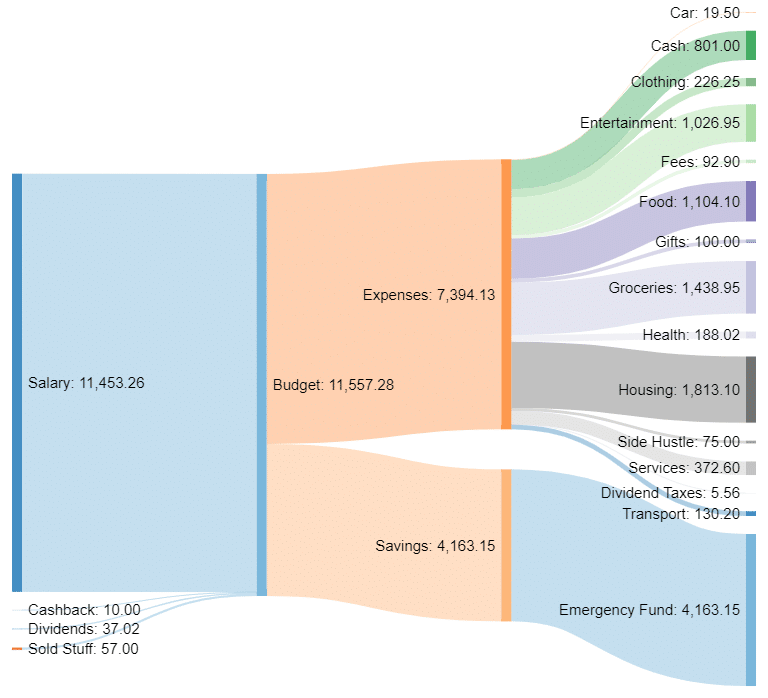

Cash flow: September 2020

Total Income: 11’557 CHF (-607 CHF vs. Aug) – base salary plus 57 CHF of sold stuff. There were also some dividend payments of 37 CHF and the previously mentioned cashback.

Total Expenses: 7’394 CHF (-666 CHF vs. Aug) – September is one of the Mortgage interest payment months. So housing was a significant post with 1’813 CHF. I also met friends for dinner almost every week where I usually spent some 150 CHF each on food and drinks. I also got new Pixel Buds which I highly recommend but they did cost 207 CHF. The 689 CHF for the GPU I compensated from my side hustle account which I don’t explicitly mention here in the blog. The income there is in the low 4 digit CHF area mainly from web hosting business and the online storage business which I will shutdown in November.

Savings Rate: 36.02% (+2.28% vs. Aug) – Lower income but also lower expenses than last month give us a net 3% higher savings rate for this month. The savings rate needs to raise much more. We only have 3 months to go this year.

Stocks: Since I will dissolve my P2P Portfolio I’ll add some more detail to my Stock portfolio in a new section below.

Net Worth gained 0k CHF… we’re still at 438k CHF see my portfolio page for details about the asset allocation. I’m slightly confused how there is no change in net worth at the end of the month despite having saved 4k CHF I assume currency fluctuations with my assets in EUR and USD slowly can be in this area. Or maybe I find the missing net worth later on, wouldn’t be the first time, lol.

Stock Portfolio

Stock Portfolio value: 87’239 CHF (+22’773 CHF vs. Sept)

| Stock Symbol | # Shares | Avg. price | Current price | Unrealized P/L |

| VT | 850 | 79.20 USD | 80.77 USD | 1.61k USD |

| ARKK | 150 | 88.76 USD | 92.54 USD | 558 USD |

| CSCO | 26 | 37.92 USD | 38.35 USD | 8.36 USD |

| UIS | 96 | 10.39 USD | 10.68 USD | 26.40 USD |

| SPXU | 1200 | 20.17 USD | 8.75 USD | -13.61k USD |

| Total | 2322 | N/A | N/A | -11.44k USD |

Yeah yeah, still holding on to my worst Stock gamble ever SPXU, stupid 3x inverse leveraged ETF of the S&P500. Let’s see if there will be a second market crash and I can get out of this terrible position without that amount of loss. I have some hopes up on todays news regarding a specific world leader and corona…

I timed the market quite often this month and got in and out of VT positions and then realized that timing the market is too stressful. Also not efficient. So I’ll stick to 80% VT and 20% ARKK for now. ARKK is an innovation ETF with focus on disruptive technology companies. It holds 10% TSLA hehe.

CSCO and UIS were added as a experiment for value investing according to Magic Formula Investing both companies share prices have a relatively low P/E ratio (Price vs. Earnings) and are therefore considered “cheap stocks”. The plan is to hold theses positions for either 12 months or sell at a 25% profit depending on what is reached first. I will probably add more of these in the future.

P2P Portfolio

| Platform | Value |

| Bondster | 5371.44 EUR |

| Crowdestor | 4547.6 EUR |

| DoFinance | 4857.91 EUR |

| FastInvest | 2914.28 EUR |

| Flender | 1365.78 EUR |

| Grupeer | 4787.29 EUR |

| IuvoGroup | 1441.99 EUR |

| Mintos | 2637.13 EUR |

| PeerBerry | 2750.2 EUR |

| RoboCash | 6169.14 EUR |

| Swaper | 2437.04 EUR |

| Viventor | 4092.8 EUR |

| Wisefund | 1018.73 EUR |

| Total | 44391 EUR |

August Income from P2P Portfolio: +373 EUR

Calculated XIRR (of the platforms that generated money): 12.45%

It feels a bit pointless to mention all the platforms individually here at this point. So I will just mention noteworthy updates:

- FastInvest paid another 130 EUR from pending withdrawal from middle of April on the 21st of September. Looks like they still find new victims who fall for their scam.

- I dissolved another: 14159.18 EUR from the portfolio

- My favorite platforms when it comes to liquidating your P2P portfolio: IuvoGroup, Swaper, PeerBerry and Mintos, most of the others didn’t pay much interest so there was not much to dissolve

- Crowdestor paid a whopping 196.52 EUR partly for the Fertilizer scam (150 EUR) and the rest is from the meat chef and volleyball projects.

I got some feedback about my P2P exit decision and most of the people were supportive of it. Thanks for the active feedback and comments people left. I’m not sure how my business ideas series is liked yet, please leave some feedback if I should keep going with them or not.

Blog statistics

Views: 906 (-179 from August) I didn’t do any additional marketing stunts this month. Well Kristaps Mors featured me in an little interview (thanks for that).

Visitors: 277 (-423 from August) Ouch, still more than in July tho, so looks like I slowly build up a set of regulars which is very nice.

Followers: 16 (+6 from August) Wow thanks for all the new subscriptions. I hope you like my content.

I posted 3 blog posts in September. The monthly update, Business Idea: Uber for restaurant staff and Business Idea: Social network app.

That’s it for this month. Like last month let me know if you like the style and the ordering of topics.

If you have any questions or comments, please leave a message below or contact me by email. I try to answer all comments and emails.

Welcome to the party ;-). I´m also in an leveraged inverse ETF SQQQ on Nasdaq, though my timing was a bit luckier.

What are you thoughts on your CISCO Invest ?

Regarding Arkk, “Active ETF of the Year”. Didn´t even know that such things exists.

Why don´t you invest into Tech Shares directly ?

Thanks for your comment. I’ve updated the post regarding CSCO and UIS, they are value investing experiments their P/E ratio is kind of low.

Regarding ARKK vs. Tech stock picking, I’m too lazy and for the long term I would like to just throw money at VT and ARKK to have enough diversity. ARKK performed amazingly over the last years but historic performance doesn’t guarantee future returns.