Welcome to the Portfolio update of September 2020. I’m in the process of dissolving the P2P portfolio and making insane profits with Tesla stocks.

Personal update

I mentioned it last month and took consequences this month. I dissolve my whole P2P portfolio over the course of the next few months. tl;dr: different blog posts from Kristap Mors made me rethink if being one of the P2P investment blogger copycats is the way to go, and I said no. I therefore will focus on more traditional investments in the stock market for now.

2.5 weeks of vacation were very nice. Unfortunately coming back to work I was immediately confronted with an internal system that was left broken for 19 days. That killed a bit of my renewed motivation. We also couldn’t rent a boat during the vacation due to the high demand at the Lago Maggiore.

Also my new Monitor a Samsung Odessy G9 finally arrived (let me know if I should do a review about it, it will be mixed) and I’m playing the new Microsoft Flight Simulator pretty actively (with an Xbox Controller for now).

I also came to the conclusion that I will dissolve my side business in November of selling online storage as the underlying hardware (a self built Backblaze StoragePod 2.0) is getting a bit old by now (6+ years).

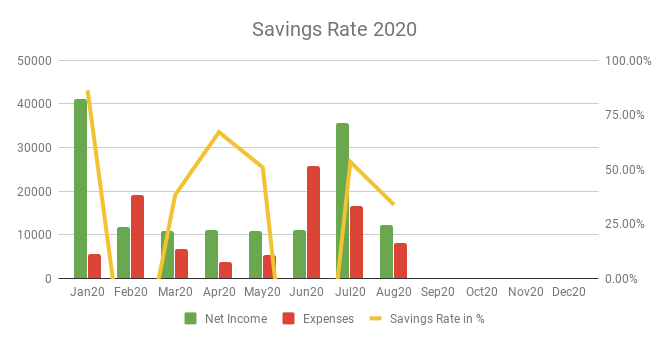

Savings Rate: August 2020

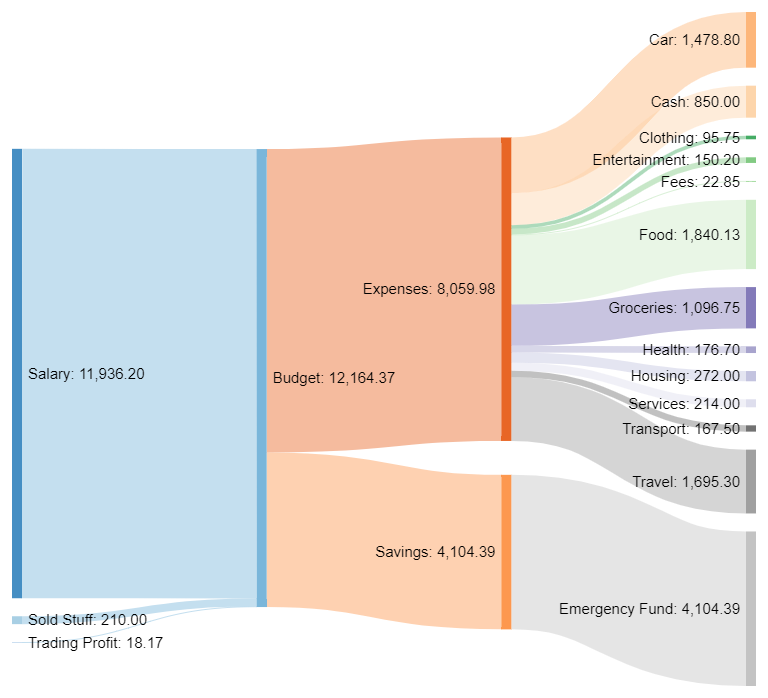

Cash flow: August 2020

Total Income: 12’164 CHF – base salary plus 210 CHF of sold stuff. I did cancel my parking spot at work at the end of July so that’s an extra 295 CHF of income, nice.

Total Expenses: 8’059 CHF – I had finally 2.5 weeks of vacation and we traveled for a few days around Switzerland. 4 days of Roadtrip and another 4 nights of staying in nice Hotels did cost a whopping 1’695 CHF. Totally worth it, we spent most of the time in the hotel pools at the different locations and eat deliciously. Food was with 1’840 CHF not exactly cheap either, but I invited the whole family of my side (10 people) once or twice during the vacation. On the plus side the groceries position with 1’096 CHF is the lowest in a long time. We also paid 100 CHF for 4 days of play group for my son which he hopefully can go to tomorrow. Also the yearly car insurance with 1’478 CHF was a rather big post in the expenses.

Savings Rate: 33.74% – Given the vacations, the spendings were rather high this month but those expenses were worth it to relax a bit from the stress at work.

Stocks: Remember those 10 TSLA stocks I bought last month? Well they’re now 50 thanks to the stock split this Monday and worth a whopping 21.7k CHF the gains in the last few weeks were rather surreal. Looks like my hopes from last months were confirmed.

Net Worth gained 17k CHF to 438k CHF see my portfolio page for details about the asset allocation. Mostly thanks to the 9k CHF unrealized profit from the Tesla shares. I will move more money from the P2P investments into my stocks portfolio and start experimenting with value investing with a part of it.

P2P Portfolio

| Platform | Value |

| Bondster | 6011.66 EUR |

| Crowdestor | 4744.12 EUR |

| DoFinance | 4854.96 EUR |

| FastInvest | 2911.9 EUR |

| Flender | 1444.3 EUR |

| Grupeer | 4787.29 EUR |

| IuvoGroup | 3058.5 EUR |

| Mintos | 6741.11 EUR |

| PeerBerry | 5601.37 EUR |

| RoboCash | 6363.38 EUR |

| Swaper | 6499.68 EUR |

| Viventor | 4532.24 EUR |

| Wisefund | 1000 EUR |

| Total | 58550 EUR |

August Income from P2P Portfolio: +384 EUR

Calculated XIRR (of the platforms that generated money): 12.54%

It feels a bit pointless to mention all the platforms individually here at this point. So I will just mention noteworthy updates:

- FastInvest paid 313 EUR from pending withdrawal from beginning of April on the 18th of August

- I so far dissolved: 7493.38 EUR from the portfolio

- IuvoGroup was the leader with 3671 EUR withdrawn because of the very active second market. Wohoo!

I didn’t get that much feedback if my decision to pull out of P2P investments was the right choice or not but I think it makes sense as outlined in the other blog post.

Blog statistics

Views: 1085 (+629 from July) wohoo, mostly because I shared my Tesla comparison on Reddit, that alone drove some 638 people to the blog.

Visitors: 700 (+548 from July) Welcome new readers

Followers: 10 (+0 from July) Plz like and subscribe ;D

I posted 3 blog posts in August. The monthly update, Pulling out of P2P Investing and the first Business Idea for a mobile-first restaurant.

That’s it for this month. Like last month let me know if you like the style and the ordering of topics.

If you have any questions or comments, please leave a message below or contact me by email. I try to answer all comments and emails.

You are big on P2P. It will take you some time to pull out, which is time you can use to meditate your new strategy.

I must say that I am reducing considerably my P2P stake, but I am not pulling out completely. My mistake was to allocate too much on risky investments, but once I feel comfortable with my allocation I’ll continue with it.

All the best mate.

That’s true, I tried to bet big in P2P but now have enough data points to see that these high returns come with a unjustifiable high risk. It would have been great to have a reliable source for 12% interest on my money but I’ll go the more conservative approach for now.

Salut Mr. Fondue,

Great post, thanks for sharing.

I particularly like the graphs you showed for your saving rate and cashflow. How do you keep track, and what support do you use (i.e excel, etc…)?

Looking forward to your input.

Thanks for your comment. By now I use beancount where I import my 3 different banking statements (Revolut, Neon & regular cantonal bank) plus Interactive Brokers and the Visa transactions. Then beancount allows to categorize all transactions in a semi automated way (e.g. recurring transactions at the same vendor). From there I take the numbers and put then in a Networth spreadsheet which I copied from Mr. RIP. And the cashflow I take from the fava (WebUI to visualize beancount entries) income statement.

I will eventually do a blog post about it. The initial setup took me half a day and I wouldn’t recommend it for people w/o python coding knowledge.

Kristap Mors brought me here. Luckily you were not in too deep into P2P and you have no substantial risks.

Don´t want to know how many people invested money they actually need.

I´ve been in P2P for 10 Years now and I´m probably also pulling the plug.

Greetings from Austria

Thanks for stopping by. Yeah in the total net worth picture the 70k were not too much but still a bit unnecessary. Good luck with taking your money out.

it´s all good as long as it is “play money”. I was in for 150k at start of the year and exited about the half.

By the way I thought I am an overpayed IT guy but your income is just insane 😉

Well my initial plan was too to get to 100k P2P portfolio this year but I guess I was very unlucky with my timing. Instead I will focus on the 100k Stocks portfolio so I can get rid of the Interactive Brokers inactivity fees.